On March 2, 2017, the value of Bitcoin exceeded for the first time that of an ounce of gold ($ 1268 for a bitcoin against $ 1233 for an ounce of gold). It is good to remember this event (historical?!) that we would have almost forgotten as the courses flew afterwards.

As of July 29, 2018, an ounce of gold is trading for $ 1228 (after reaching its lowest level in a year, flirting with $ 1218), against $ 8,190 for a bitcoin (after recovering 40% of its value since its lowest on June 24 at $ 5835).

Gold: it's THE safe haven par excellence. Its main use remains the hoarding because the precious metal is a shelter in times of crisis and pleases to those who have the will to keep their money out of the economic circuit. This is what gives gold its function as a store of value.

We could say the same about bitcoin. It is common to hear about Bitcoin as digital gold because it shares similarities:

- Gold like bitcoin, are rare assets and of limited quantity: the gold represents 5.5 trillion ounces in circulation, against a maximum of 21 million bitcoin in circulation

- Each is obtained by mining, one physical, the other mathematical / computer

- Experts estimate that about 77% of the world's gold reserves have been extracted, knowing that at the current rate of production, reserves should be exhausted in 20 to 25 years. For Bitcoin, 17 million out of 21 (about 80%) have already been mined, and it is planned to pass the bar of 20.99 million by 2044.

- This supply limit is actually a tangible store of value over time, some even speak of deflationary assets.

- Gold and bitcoin are both acephalic currencies, there is no state or institution that controls them, it is to the community that this power belongs (although in both cases there is has limits to the decentralization of power)

But could digital gold become more practical than physical gold?

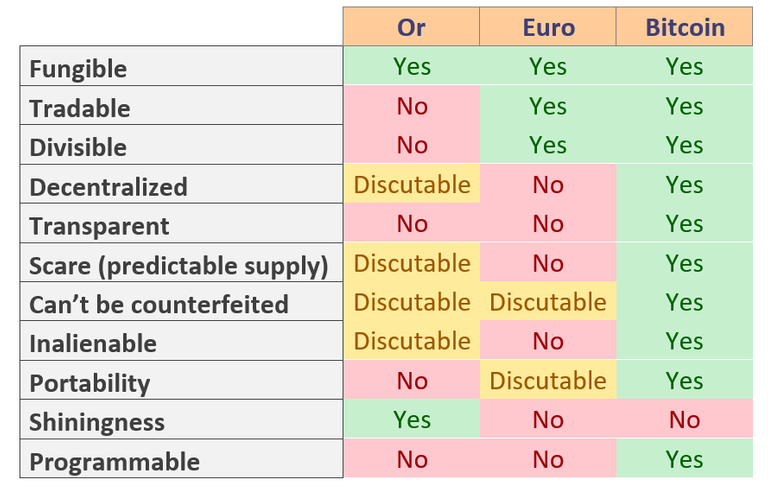

Coin Capital has summarized for you the characteristics of gold, the euro and bitcoin in one table:

On August 15, 1971, President Richard Nixon suspends the convertibility of the dollar into gold and so the Bretton Woods agreements, and since then gold prices have exploded as you can see below:

Although prices have exploded for 15 years, gold is known for its relative stability, which contrasts with the instability of its digital competitor. Yet, the change in the price of gold over time is far from being a quiet river! Many still have in mind the incredible rise of the yellow metal that peaked at $ 1900 in September 2011, before plunging to a low of $ 1000 in December 2015, to finally recover gradually and reach $ 1228 today.

However, this volatility is perceived especially over time, while that of bitcoin can lose 10% and recover 8% in the same day. Gold has been used for more than 3000 years as a store of value while Bitcoin is only 9 years behind him. What will happen to its volatility and price if it is ever used by a large part of the monetary system as an alternative value reserve? There is good reason to remain optimistic about the future of the crypto ecosystem that only needs to get out there and whose flagship remains bitcoin!

By the way, did you notice that if you change the scale of the bitcoin price, it almost perfectly follows the price of gold between 1970 and 1991? As you can see below (bitcoin price in dark blue and gold price in light blue).

But it is not the most interesting, which especially marked the price of gold is the arrival in March 2003 of the first ETF on gold. If you take the measure of what the arrival of the ETFs on gold has allowed in terms of democratization, or at least accessibility to investment on gold for Mr. Everybody, then you will understand why the recent demand ETF on bitcoin by the CBOE caused a runaway on the market of crypto-currencies and especially bitcoin.

As this ETF is physically replicating, for the CBOE to be able to sell bitcoin ETFs, it should first buy bitcoins, thus increasing liquidity in the market. Without going into detail but for simplicity, if the application was accepted, it would mean that Mr Everybody could have on his savings in action plan a UCITS (portfolio) of the top 10 cryptocurrencies.

To return to gold, the total capitalization of gold on the world market amounts to $ 7,521 billion, far from the $ 140 billion total capitalization for Bitcoin (as of July 26, 2018). But for several months, the gold depreciates or stagnates for various reasons (http://bourse.lefigaro.fr/devises-matieres-premieres/actu-conseils/pourquoi-l-or-ne-fait-plus-recette-6505496 / https://www.capital.fr/votre-argent/lor-tombe-a-un-plus-bas-dun-an-comment-expliquer-sa-chute-1299444), and investors seem not to be very attracted by this metal: "Why buy precious metals, which do not yield, when we can have shares ", Questioned recently the specialists of BNP Paribas.

Note that it is much more complicated for an individual to invest in physical gold because of the many constraints (the choice of material support -pieces or ingots? -, the refining quality -LBMA, ... - the place home storage, bank, private company? -), while investing in bitcoin is accessible to all via the internet (and potentially soon via conventional institutional channels).

This article is not intended to be taken as a buying tip but truly as a step back on a technology still young and in full development but which is already stirring fantasies and misunderstandings.

This article have been written by Marius Campos, Business Developer for Coin Capital (https://coincapital.fr), with the help of Adrien Hubert.

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

Congratulations @faucheur! You received a personal award!

Click here to view your Board