Hi steemians!

Feel free to comment if you have different ( or the same) opinions on the subject!

Where does the value of bitcoin comes from ? How is It possible that a multi-billion dollar currency comes out of nowhere and becomes a candidate to be a world currency? This article will explain what the value-proposition of bitcoin really is.

First of all Bitcoin was created as an experiment to create a new payment system that is decentralized and open source. This means that this system does not need a central entity to keep the whole system running smoothly. Instead a network is operated by “miners”, who keep the network running and get rewarded by doing so. So what is the value of such a decentralized currency?

This question is still difficult to answer because a lot of people use or invest in cryptocurrency through central entities like coinbase, exchanges, investment instruments,… These central entities are in my opinion hiding the real original value proposition of bitcoin. These entities can stop payments, block funds, close accounts, etc whereas bitcoin was originally designed to be a product of the people. A network runned by millions of people so large that no government or any other entity can close, hack or block the network.

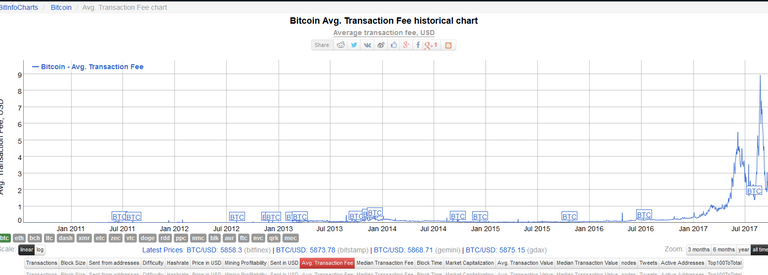

“Low transaction fees” were originally part of the value-proposition of Bitcoin. However Bitcoin transaction fees have been increasing due to limited block size and an increasing amount of transactions. Miners are rational and with limited block size miners will prioritize payments with the highest fees. To tackle this problem a hard fork was executed on august,1. Bitcoin splitted into bitcoin and Bitcoin Cash. The main difference between BCC and BTC is the block size. BCC has a block size of 8Mb and Bitcoin still 1Mb. This makes BCC sometimes more lucrative to mine than Bitcoin. This is why miners still switch between one and another. This is not good news for Bitcoin. A few dollars per transaction is not a big deal if you are an investor but if Bitcoin wants to become a payment system like it was originally designed for it sure has some technical issues to resolve first.

The graph above shows clearly the increase in transaction fees on the Bitcoin network. The increase occurred right around the time Bitcoin became very popular beginning around January 2017.

The recent Segwit update of the bitcoin software has improved the situation a bit. This update has paved the way towards a lightning network for Bitcoin. This is still a technology that is being developed but once implemented transaction fees should reduce a lot and the transaction speed should also increase. Another fork will occur in November. Segwit2X will increase the block size of bitcoin to 2 Mb.

Bitcoin has a solid first-mover advantage in the crypto-space. All other coins have often to be bought with bitcoin. This increases demand for bitcoin because if someone wants to buy an alt-coin this person will have to buy bitcoin first.

A huge factor in any price determination of anything are demand and supply. Knowing that the supply does not change by much with bitcoin we can assume that the price is hugely determined by demand. Demand for a currency can have 3 motives. Speculative for investors who think bitcoin will go up in price, transactive motive for people who actually use is for transactions and thirdly as a store of value.

Bitcoin’s adoption has increased in speed since the beginning of this year. In a lot of places you can use bitcoin now instead of a credit card. Every day there are new use cases that are being developed. The more useful bitcoin becomes the more demand will increase and with it the value.

Let’s take a look at the data on coinmarketcap.com

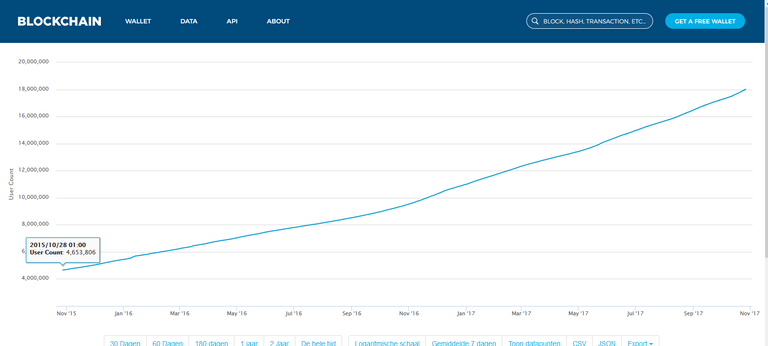

The chart shows a parabolic increase in value. This is typical with networks. The more users, the more valuable the network becomes. This effect is called the network effect. It is an economic theory developed to describe the increase in value of an invention due to the increase in users. An example is Facebook. If there are only 10 users on the facebook platform it will be worthless, but with almost half of the world population having a facebook account it will be immensely valuable. A lot of the value of networks come from it’s users. So it is you, I and every other bitcoin user that give Bitcoin Its current value ( At the time of writing 5940$)

The more users the more valuable Bitcoin will become. It is difficult to determine how adopted bitcoin really is. Due to the anonymity it is difficult to calculate how many different users are using the bitcoin network. On the graph below you can see the increase different bitcoin wallets registered on the blockchain. As long as more users join the network the value will increase.

https://blockchain.info/charts/my-wallet-n-users?timespan=2years

A lot of people see more value in the blockchain than in bitcoin. The technology behind bitcoin is what makes it special. A lot of things can be done better and more efficiently by using a block chain. But being the first one to have implemented this technology Bitcoin has put itself in the center of this whole crypto revolution. Sure a lot of adjustments will have to be done and a lot of obstacles will have to be surpassed butBitcoin will remain the face of cryptocurrency. At least for the coming years.

FIAT comparison

“Bitoin is the scarcest, most divisable, most transportable, most verifiable, most recognizable form of money humanity has ever used”.

What gives fiat it’s value? Before 1971 the US dollar was pegged to the amount of gold there was in reserve. The more gold there was the more paper bills could be printed to keep the value of each dollar the same. So for all US dollars in circulation there was the equivalent of value in gold in the reserve. After 1971 US government abolished this pegging of the dollar against gold. Instead we now rely purely on government policy to decide how much paper bills can be printed.

This printing of paper bills leads to inflation. Inflation is the general increase in price level of a certain country. In other words by printing more and more paper bills they become less and less valuable. This gives people the incentive to spend their money before it’s worth less. Many economies maintain a certain level of inflation to guarantee economic growth.

GOLD comparison

The circulating supply is at the time of writing equal to 16.648.312 Bitcoins with a total maximum supply of 21.000.000 BTC. The creation of new bitcoins is a slow process. There is a lot of scarcity in bitcoins.

Having a fixed supply is a characteristic that set it apart from any other currency. Bitcoin in that optic has been often compared to gold. Indeed, bitcoin and gold have both limited supply. Also the analogy with gold mining and digital mining is astonishing.

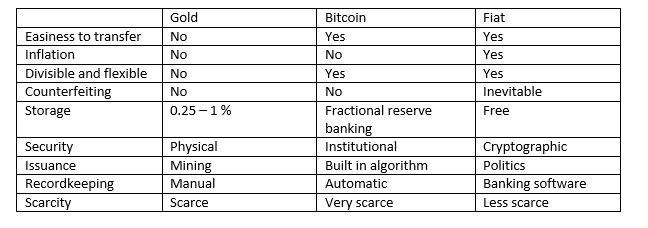

Therefore I present to you a comparative table between bitcoin, gold and FIAT currency to determine whether the comparison is justified.

In certain aspects you can say that bitcoin has more characteristics of gold than those of fiat currency. But there are some differences none the less. Bitcoin is in many optics even better than gold. It is more transportable, easier to verify, even more scarce, record keeping occurs automatically.

Gold has the advantage to have been a store of value for over more than 5000 years. It won’t be easy for humanity to switch from gold to bitcoin. But if this occurs, this could be the biggest wealth transfer humanity has ever witnessed.

Conclusion

A lot of the original value proposition are slowly disappearing. However due to the scarcity and the increasing usefulness the price keeps on increasing. A lot of adjustments will have to be done to keep the parabolic increase in value going.

Keep in mind that the value and the price are not always synonymous. Certainly not is such volatile markets such as crypto currency markets.

https://bitinfocharts.com/comparison/bitcoin-transactionfees.html

http://www.bitcoinedu.co/why-choose-bitcoin.php

https://www.luno.com/blog/en/post/how-bitcoin-price-determined

https://blockchain.info/charts/my-wallet-n-users?timespan=2years

http://www.thrivenotes.com/the-7-network-effects-of-bitcoin/

https://coinmarketcap.com/currencies/bitcoin/

https://www.quora.com/How-does-supply-and-demand-work-in-Bitcoin

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!