Financial technologists worldwide have been trying to define and differentiate among cryptocurrency, digital currency and virtual currency. A consensus seems to have emerged among various stakeholders that a currency, which can’t be produced in a physical form, is a virtual currency like Bitcoin etc. Since the virtual currency can only be stored and transferred electronically, it also becomes a kind of digital currency.

Sometimes this type of currency is called cryptocurrencies, other times virtual currency and sometimes digital money. However, the three terms are not interchangeable. On the other hand, all real or physical currencies that can exist in digital form become digital currencies. Some experts call them real digital currencies. So, all virtual currencies are digital. However, the converse is incorrect.

One can transfer dollar or any other currency for that matter from his account to someone else’s through the internet, debit card, mobile phone, etc. which is in digital form and the same can be done in the physical form too. So the two types of currencies can be broadly divided into virtual digital currency and real digital currency. While the former is virtual, however, digital and the latter is real but digital.

This can generate quite serious confusion as when a medium said that the Bank of England was preparing a cryptocurrency, when in reality it is a virtual currency. On other occasions we are not wrong, since Venezuela actually prepares its cryptocurrency. Venezuela is forced to create a cryptocurrency backed by oil

Another differentiator between digital and virtual is that digital currencies are based on two digits 1’s and 0’s. However, virtual currencies are created through cryptographic algorithms, and that’s why they are also known as Cryptocurrencies.

Digital is (practically) everything

Digital money is, in general, any means of monetary exchange made by electronic means. When a money transfer is made from one bank account to another, digital money is being used. When paying with a card in a store, too.

That is, when a payment or sending of money is made without physically exchanging coins or bills, digital money is being used. Virtually all the money in the world is digital, since cash only represents approximately 8% of the money in circulation.

Therefore when someone refers to digital money should be talking, simply, money. The money of the day to day is digital. The vast majority of wage earners in the world charge and pay in digital money. Digital money is money.

Virtual, there are some

Now, sometimes we talk about virtual currency. Virtual money is money that only exists in its digital format. For example, in many video games there is internally a currency with which you can buy objects. This money that is used within the game is virtual.

There may also be virtual money that is not the protagonist of a videogame, for example, a currency created by companies or fans that intended to substitute the current physical money for a new currency away from the control of central banks. An example could be E-gold, which ended up closing due to legal problems.

By definition, virtual currencies are all digital. As they do not physically exist, there is no paper money of them, they have to be 100% digital. Therefore all virtual currencies are digital, but not all digital currencies are virtual (an example is a bank account in euros, it is digital but not virtual).

Cryptocurrencies, a subgroup of the above

Digital and virtual money have been with us for decades, but cryptocurrencies are more recent. Cryptocurrencies, like Bitcoin, are a type of virtual currency that does not have a specific issuer, which are protected by cryptography and that in principle its coherence can be protected by a massive and distributed user verification of its users.

Therefore, cryptocurrencies are virtual and digital money. But unlike other virtual currencies, they do not have a centralized control, but are distributed and based on cryptography to avoid the manipulation of any of its members.

It can be concluded that all cryptocurrencies are virtual currency and digital money, but not vice versa. When talking about digital money you can be talking about any currency in the world (the euro and the dollar too), and when you talk about virtual currency it may not be a cryptocurrency, but a currency with a specific issuer. We hope that the terms are used correctly in the future and there are no misunderstandings.

Conclusion

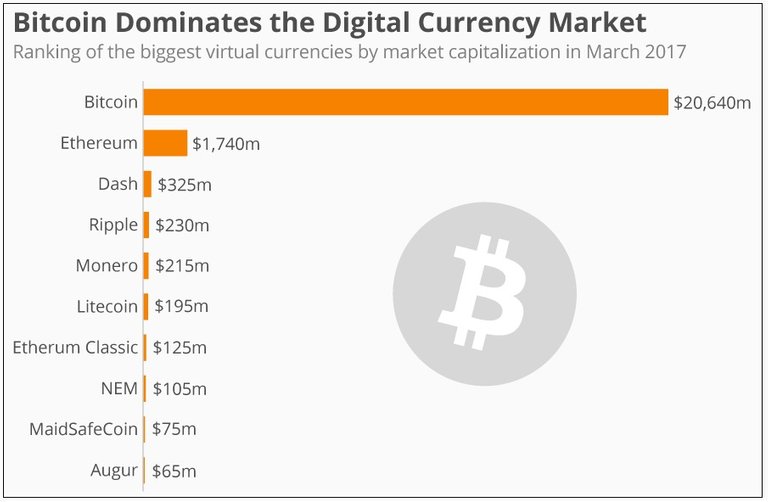

Barring a few developing countries, which have banned the use of Bitcoin, the use and popularity of the virtual currency, is growing around the world. The majority of the authorities, which regulate money in various countries, have accepted that they can’t turn their eye from the new technology.

These countries might not have regulated the currency, but the majority of them haven’t termed it illegal thus allowing private parties to trade if they want. Even the European Union has recognised it as a currency rather than a commodity. Experts believe that in coming few years, virtual currencies will take the financial system by storm and governments will have to recognise it as a legal tender sooner or later.

Nice post!

hello dear already i follow you, I hope you also follow me

Thank you.

thanks for comment I will follow the same for possible publications

good post I congratulate you