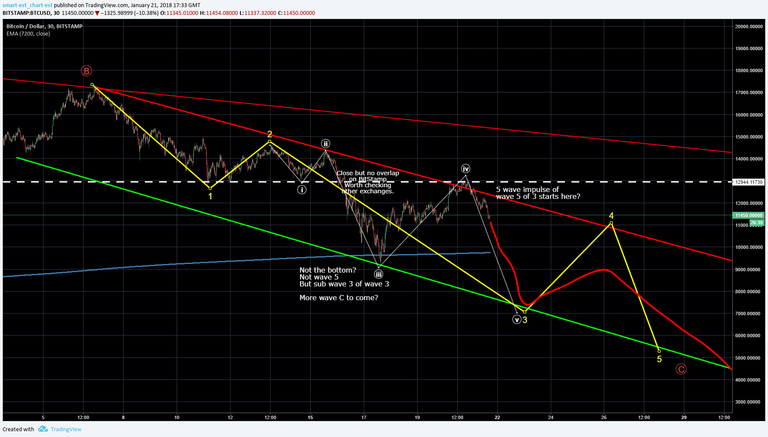

Not sure if I read you wrong but afaik it was not the ABC that was negated but the wave 3 of C count. For some reason lots of people are calling the awkward five wave count to 9200 as the potential bottom C when there is a much simpler explanation. 3 needs to drop below 9200 prior to putting in 4.

Illustrative only. scribbles, no price targets.Wave 3 target = 1.6 of 1 here so it does fit technically

Just dumped 4 and 5 on the channel.

That's why I didn't FOMO in. Too many possibilities now ...I literally have now idea which way will the price go short term. I am inclined to believe (just a little bit , NOT SURE) that we are going to enter the Capitulation phase pretty soon if the price doesn't go above 14k.

However looking at your chart ...could you show me how you read subwaves of wave 3 ? :)

Cause if you think we just started subwave 3 of wave 3 ......then wave 3 is going to be a big ass wave down.

Yes totally agree, the possibilities are myriad and we just have to discount the options as the price evolves.

I tried making a chart to illustrate how I think the chart might count but realised that wave A in this correction is the perfect example of why it looks awkward.

Wave A has a messy count with a 1-4 overlap that needs to be skipped and I'd expect to see the same form develop again.

Please understand I am a rank amateur at this and do it for the fascination, learning and experience. Frog-odds sake don't trade my TA!

You don't necessarily count the whole spike up or down, as it could be one

sale or buy doing it. We are looking for the overall market sentiment, not the lone panic or fomo trader. So moving your wave 1 a little bit up is not really bad. Then this count is valid.

I did this in the post Will BITCOIN continue the PARABOLIC TREND? Up, up and.. as my primary count, but just now it seems a bit too bearish, this might either not hold true, and the pink wave up may be an abc correction in the 5 wave down.

The only way to learn this properly is to study, practice and put your charts in the crowd to get rect or praised, again and again :)

Right, this is something that has been bothering me and where long term charting experience is missing.

For Alts with wild spiky charts I tend to go with the candle bodies and ignore the wicks. For BTC on a big exchange I try to stay true to the extremes for Elliot and knock them out for triangles and trend-lines. I'm guessing experience on each asset will improve judgement there.

I would comment on your chart though that the aesthetic form of the 5 wave impulse just does not present well and leads me to look for a better looking solution. I guess time will tell.

The aesthetic form is just as much shaped by time as price, and I don't predict time :)

You have wave 3 as shortest price travel.

That doesn't make your bullish impulse wrong of course, just makes me question the completion of the overall form. It seems to be a really awkward count. But I'm convinced we will look back on this and see it clearly for what it is.

Damn, you are right :/

Realised I put the 2 in the wrong place in the first big picture chart . needs to be one minor peak to the left. The count will then make sense. Thanks for the vote :)

FWIW I watched the touch at 9200 150 day EMA and didn't feel it had quite done the job yet either.

I look at EWs a lot when they can be easily discerned, and that's often possible even on the 1 minute scale. But sometimes EWs are not ideal, there will be interruptions in waves, there will be crippled ones, and to try and still count them as valid while refusing to use other methods and general market mood is a bit autistic and sometimes bizarre.

So I use a mix of Fibonacci, Gann and trend line, and comparison with what happened in a similar wave pattern maybe a year ago. It's enlightening what limits and patterns crypto price development follows once you try all of these, and just keep the ones that work in a special situation.

Haejin just uploadad his morning update and he's haaving the same wet dream we're having ;)

Agree. At times like this you gotta dig to the bottom of the tool box. Find you might not have the right spanner and figure on a new tool or getting creative.