In my last post I explored the history of one of the founding members of Tether, Brock Pierce. In that post I speculate as to whether or not Pierce was being controlled by his past, and placed into the crypto world as an asset by the CIA. Whilst researching for that post I came across some very troubling issues surrounding Tether.

First off, I'd just like to say that I think Tether is actually a great idea. It's a currency that's pegged to the US dollar which allows you you cash in and out of cryptocurrencies quick, easily, and relatively cost free, all without the hassle of jumping through banking regulation hoops.

With the ever increasing number of Tether being released into the market each day, along with their lack of banking facilities, I wonder whether Tether has been creating and issuing their currency illegally and then lying about it.

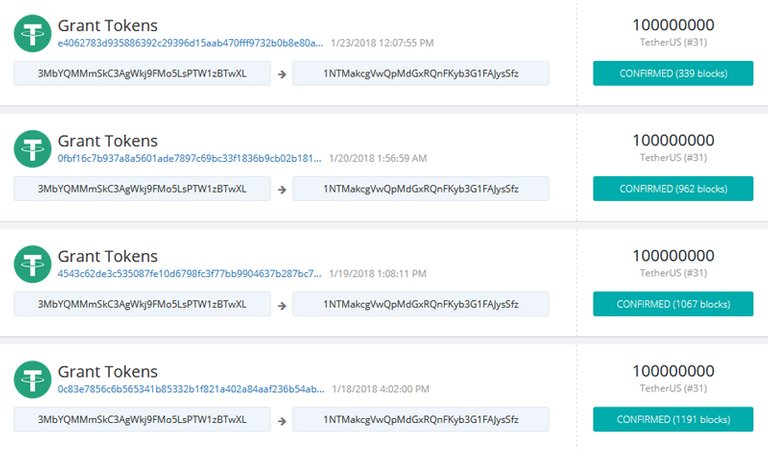

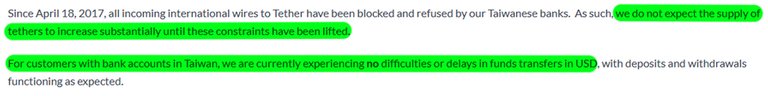

Originally, the only way for Tether to be issued into the system was if people first bought them with US$, via a verified Tether wallet. Once someone purchases Tether via the wallet, they are then free to send it to an exchange to buy other cryptocurrencies. Unfortunately, in April 2017 Tether announced that their US banking payment partner, Wells Fargo, had blocked international money transfers to their bank in Taiwan. This effectively left Tether without a bank to facilitate international money transfers to and from Tethers Taiwanese bank. After this event, you'd assume that the amount of Tether entering the system would decline dramatically. Instead, the opposite happened. Since April, Tether's issued over 1.5 billion Tethers bringing their total market cap to over US$ 1.6 billion. The correlation between the issuing of new Tether, and the price rise in Bitcoin, seems highly suspicious.

According to Tethers Terms of Service they'll buy and sell you Tether for US$ if you register your Tether wallet with them. Unfortunately though, they haven't had a functional wallet since they were hacked in late November last year.

Hackers steal $30 million worth of cryptocurrency in Tether hack | Hack Read - 11/21/2017

Tether, a start-up firm known for offering dollar-backed cryptocurrency has announced that hackers have breached their security and stole a whopping $30 million worth of tokens. The breach took place on 19th November 2017 while the news of it was announced earlier today.

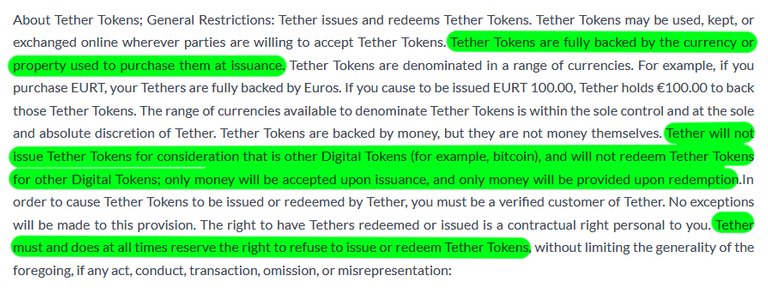

The question I'm stuck on is, if there has been no bank to send US$ to, and no Tether wallet to receive them in, then how were Tethers entering the market? One thing that stood out to me in their ToS was the word property. "Tether Tokens are fully backed by the currency or property used to purchase them at issuance."

Source

So, how would you go about buying Tether with property? Does this mean that people have been selling their houses for a ton of Tether? No. In fact, the IRS classified BTC as property back in 2014. This makes me wonder whether it's actually Bitcoin that is the property backing Tether? I suspect, yes.

Bitcoins are property, not currency, IRS says regarding taxes | Reuters - 03/25/2014

Wading into a murky tax question for the digital age, the U.S. Internal Revenue Service said on Tuesday that bitcoins and other virtual currencies are to be treated, for tax purposes, as property and not as currency.

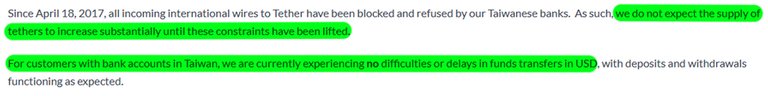

Coin Market Cap shows us that on the day the banking blockade began the market cap for Tether was at US$60,720,500. Given that a Tether is worth around $1, this works out to be about 60,720,500 total tethers in circulation. In an announcement on their site Tether even states that they "do not expect the supply of Tethers to increase until constraints have been lifted."

Source

As they had no way of processing payments due to the banking blockade it would make sense that they wouldn't be issuing any more Tethers. But this wasn't the case. Instead, the amount of Tethers in circulation went up dramatically throughout 2017. The issue some people have with Tether is compounded further by the fact that they continue to put off releasing a full audit of their US$ accounts.

What could be happening?

I see a few things that could be happening here. Firstly, because their bank in Taiwan continued to except direct US$ deposits after the blockade by Wells Fargo, Tether may have been buying up Tethers using their own US$ and then trading them for BTC on Bitfinex and other exchanges. A second theory is that they could have been issuing Tethers that weren't actually backed by any US$ at all, awhich they were using to buy BTC on Bitfinex and other exchanges. Or, they were buying Tether with Bitcoin and then issuing them into the market. Whatever happened did seem to have an effect on the price of BTC.

I feel there has definitely been some kind of scam going on with Tether over the last year. In all honesty though, after looking at all the evidence I could find I feel like this isn't a scam in the sense that Tether plans to run off with everyone's money. I do think however that it it's a creative tactic used by Tether to introduce a much needed stable coin into the cryptocurrency space. If this is the case then it's a very risky tactic. Not only because nearly 2 billion $ would get wiped from the total market cap if they were ever found out and shut down, but it would also have a massive effect on the confidence of new people entering the crypto-markets.

Sounds like BCash propaganda to me.

Great research as always mate.

It does sound very shonky and BTC manipulation is a meme that is getting more traction in the past few weeks.

I've always been suspicious of pre-mined coins so naturally I avoided this one.

Do you think Tether is basically being was used as a BTC pump and dump?

If that is the case could Tether be used to manipulate any cryptocurrency?

I wonder if it is being used to control the price down as expiration of CME BTC futures contracts is tomorrow?

Just trying to get my head around it buddy, apologies for all the questions 😉

Hey.

Yes. But instead of a small group of people making gains it's all of us. I saw an interview with Brock Peirce the other day and he said that Bitcoin is like the sea and the other cryptocurrencies are like the boats in the sea. So if the tide goes up all the boats in the sea go up with it.

If you manipulate BTC you inevitably manipulate all the others. I could be wrong but potentially the easiest cryptocurrencies to manipulate with Tether would be the ones that have a trading pair with Tether. Which there are quite a lot of as USDT is a base pair on a lot of markets these days.

The futures contract definitely had a negative effect on the price of BTC but I don't think Tether and the CME BTC futures contracts are connected in this manipulation of the markets.

Basically it seems very unlikely that people around the world bought up 1.6 billion Tethers in under a year without Tether having either a working bank account or working wallet. So the question remains, where did they all come from?

Thanks for the reply buddy.

Where did they all come from indeed? Doesn't feel right.

I await the next update mate.

Cheers.

Ong, what is happening? This is how companies are exploiting the opportunity and if they kept doing that then this bubble gonna burst.

Great Update.

I think Tether is useful to some to manipulate.

But like XRP, I want nothing to do with it.

I think good Cryptos REPLACE money...

Instead of becoming instruments for money.

Highly rEsteemed!

You know whats up haha 👍

Well said Franky!

Same. I'm just focusing on eos.

Hey man please help me out resteem my best stuff bro

I hate how widely used Tether is..cant we all just agree to ditch this scamcoin????

Me to. I stay well clear even though it looks useful.

The U.S. Dollar is worse than Bitconnect Coin. Why not "tether" a coin to gold, silver, or pizza; anything if real value. The USD is not stable, and not a store.of value (money.)

Yes. The whole point of cryptocurrencies is to move away from USD all together. Not include it like some government Trojan horse.

I convert all my bitcoin into cheese so I'm Ok.

Tether is now not usable by American traders. They changed their terms of service to attempt to limit their exposure to US interference. They are attempting to be their own central bank and other exchanges play along because it helps to prop up prices and keep people from leaving the crypto ecosystem. Feed them some tether, push up the prices, let them play with funny money and they keep their coins and money at the big exchanges that use tether instead of wising up when prices drop back down to natural levels and cashing out.

The issue will only truly present itself when many people try to cash out quickly, exchanges themselves sit on their hands with some and fully block others leaving leaving the room, and people don't believe it can happen to them and continue to gamble.

It does feel like it's setting itself up to fail dramatically.

This chart from Coinmarketcap proves that Tether has been artificially pumping the market:

This one as well:

Hmm .. its a very good post so first of all thx :)

I dont think too that this is a scam but you shouldnt always criticize everything

I would like to love € with cryptocoins too

Keep up the work :D

And Steemit witnessses are advocating for a SBD pegged to the dollar. This would create a Tether like currency and be bad for the platform. Check out my blog about it:

https://steemit.com/steemit/@ginquitti/high-sbd-or-usd1-sbd-putting-greed-aside-high-sbd-is-still-best

Thanks. Jsut did. Left a reply. Good post.

Cryptocurrency is the enemy of banking sector. Because of which the government is running anti-currency campaign.

Indeed. The banks are scared of crypto.

I agree too. Because the crypto service from the bank is a lot better.

I hope they haven't been printing money. that will not end well for the market

I love the concept of tether, but don't trust them for shit.

Same.

I've seen a lot of chatter in crypto groups of this idea, but you presented it very well! Thank you!

Respect

I read about this a while back. I think all of these "fiat" crypto's are just alt coins designed to get your BTC and ETH. I also saw this medium post that talks about the same thing.

Thanks. Yeah Ive been following bitfinexed work for a while. Definitely need to stay away from USDT.

As a trader, in the now, Tether has its uses, however - i question its end game, and for that reason would rather weather the storm of the dips and pullbacks rather than safe haven in their ledger.

Something just seems off to me.

If your in the mood for something a bit out of the ordinary, check out my latest post on The Man from Taured and hey follow back if you get a chance.

Exactly, the whole point of cryptocurrencies is to move away from the US$. Tether just brings them closer together. The end of Tether could be catastrophic for the markets. I hope they sort their shit out and show us an audit at the least.

Thanks will check it out.

Well written, I’ve seen other content investigating tether, I’m suspicious for sure, who wouldn’t be tempted to “print money” I know we’re all angels here but...

Interesting. Yeah, we have to keep our eyes open on this situation.

I like your post, I find this topic interesting, you won my vote, I follow you, I invite you to see my last post if you like help me with a vote

https://steemit.com/venezuela/@palmidrummer/severe-currency-devaluation

nice pos

It is 100% scam, but not in the same way as Bitconnect, Davor etc are, totally agree. The effect on the market will be long-lasting after today.

good post

Please don't spam.

gt!