ETC

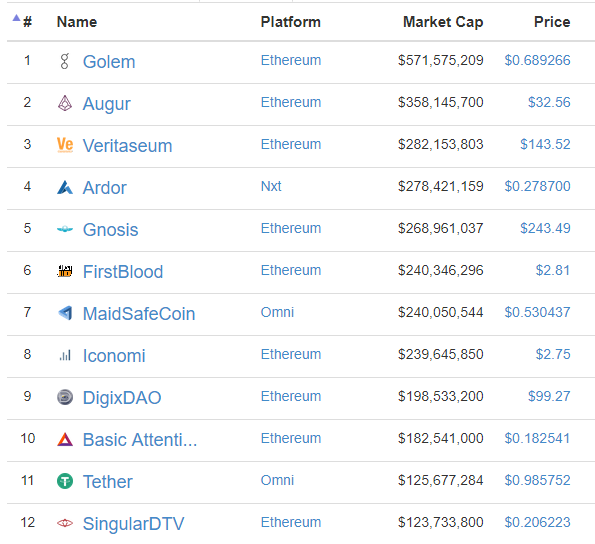

We’ve all read the articles that tell us that ETH is a bubble about to burst. Its bring driven by ICO many of which don’t have many lines of code written. These ICO’s are far from generating any form of profit and could have a hard time maintaining astronomical market caps. As we all saw in the early days of altcoins, traders get impatient and pull their BTC from projects to chase the hot markets. As we can see from the image below, ETH has a huge lead as far as development goes. The ICO craze crates demand for ETH, driving up the price.

We have to go all the way down to #72 to find an ETC dapp.

Yet despite this the price of ETC has been in bull mode for this entire year. Why is this happening if there are no ICO’s? ETC has regularly achieved volumes of 200-400 million dollars. Where is this money coming from? And why ?

One of the reasons is most certainly Greyscale Investments. A hedge fund founded in 2013 centered around digital currency investing. Their Ethereum Classic Investment Trust is one of the instruments attracting large amounts of fiat investment. Using their global reach they are most likely attracting investors from Asia to ETC.

Is Greyscale the beginning of a new trend of hedge funds adding cryptcurrency as an asset? If so we could see more speculative money join the space as other hedge funds discover this lucrative space. In the absence of ICO’s on the classic blockchain, we can only conclude that traders and investors are speculating that this is inevitable. While ETH has a large lead, it is only a matter of time before developers turn their attention to classic as it is a comparable blockchain. If blockchain tech becomes ubiquitous, like so many expect then there will be room for more than one force in the platform space.

Thank you for sharing this, following you