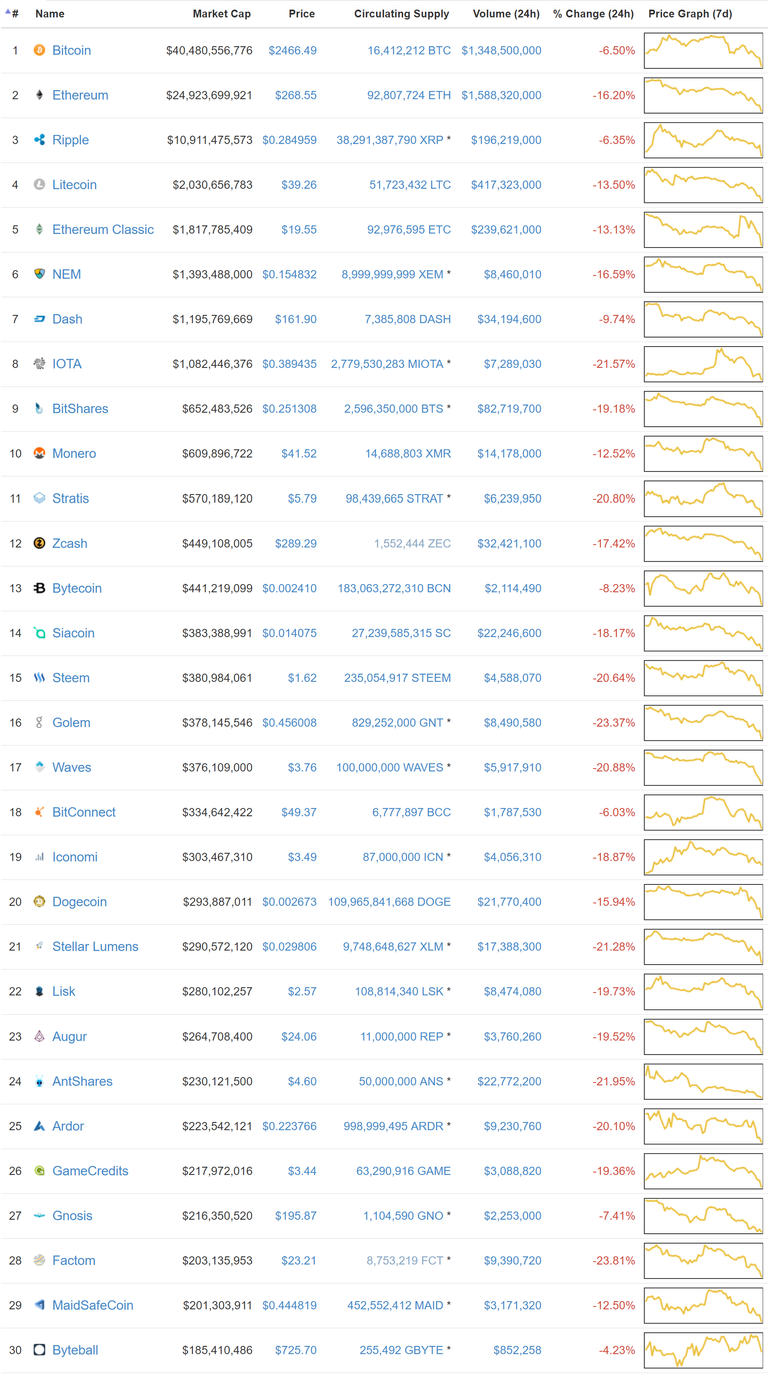

Monday, bloody Monday. Everyone is taking a beating today.

his author has a private speculation on the matter: the decongestion of the Bitcoin network enabled quicker movement of coins, and panic selling as a result of recent decrescendo created a downward wave. Or something along those lines.

But let’s look at the bright side, shall we? There are many of you reading this who didn’t lose anything. Think about it, unless you need the full sum of your coins to spend today on something, and were planning on a figure 7% higher, you are still whole, so relax. One Bitcoin still equals one Bitcoin today. One Eth = one Eth. And so forth. You still own those tokens. They’re not IOU tokens like your fiat dollars. You can panic with the rest or you can hold. Over the long-term, those who’ve held through the worst of the Bitcoin price panics have profited the most handsomely.

If you didn’t lose anything because you didn’t have any of these coins, then today, they’re all on sale. If you want to partake in future profit-taking, now is a good chance to get started. A dip in the price of Ethereum is a quickly accessible way into the crypto economy – it’s very easy to buy Ethereum from Coinbase through the official wallet, with a debit card. Duly note there is a foreign transaction fee, probably having to do with whoever is settling the credit network transactions for Coinbase.

This is not bad. It takes a lot for veteran cryptonaughts to really get doom and gloomy. This correction was coming because the price of at least two of the tokens on this list far outpaced its actual readiness for mass adoption. You’re not going to continue to find people to pay higher prices if you have ongoing existential crises, myopic developers sounding off, and tit-for-tat ripples of discordance throughout your network. You’re going to reach the a wall of interest until you resolve those issues. This is to say, no matter what anyone else is saying, this author places the blame for faltering confidence squarely where it belongs: the many global participants in the whole blocksize nonsense. It’s so tiresome at this point that we don’t even need explain what it means.

Many of the newcomers were wholly unaware of all the drama. When they began to learn of it through hearsay and low-information articles, how do you think they reacted? “It’s just what I feared!”

In much the same way that Mitch McConnell recently requested that Donald Trump’s White House produce less drama moving forward, this author humbly requests that the Bitcoin Core team get their proverbial crap together and muzzle anyone still needlessly flaming those who disagree with them. Call out their own sycophants, too.

But-ya-know… the alternative is fine too. Not having to review another drawn-out forum argument or tweet boxing match regarding Bitcoin ever again would be fine – it’s perfectly fine if you just want to let things get to the point where no one cares anymore. Network effect is a social concept and construct. The more toxicity you allow to pervade from your own ship, the more toxic oceans you are navigating, until you are a friendless minority with nothing left to do but kill each other. No amount of meaningless affirmations will change this reality: Bitcoin big wigs are increasingly looking like bullies on the playground in their reaction to other cryptocurrencies as well as user sentiment, and their biggest supporters are increasingly looking like sycophantic small people with no ability for independent thought. Once an hour (facetious), one side or the other makes a huge dramatic proclamation regarding the evil of the other. Bitcoin proper, itself, is the victim, and if this snake actually gets a taste of its own tail, then this author’s perspective is simple. In the words of Jim Morrison: