The January breakdown in cryptocurrencies continues. There was a lot of talk in the industry that the first month of the year brought market turmoil. And so it happens. Bitcoin only in 1.5 hours lost 1.3 thousand dol, i.e. over 10 percent. Ethereum, the second largest cryptocurrency in the world, has slipped by around 21 per cent within 24 hours. The lion's share of the market shines red. What's happening?

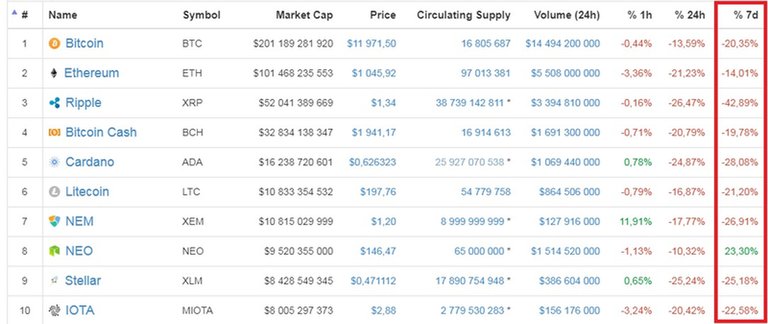

First, check the state of the game. It does not look good. The capitalization of the cryptocurrency market at the time of writing this article is about $ 530 billion, or $ 300 billion. less than at the peak of 7 January this year (then it amounted to just over $ 830 billion). And that means that a significant portion of tokens have been lit red for a long time.

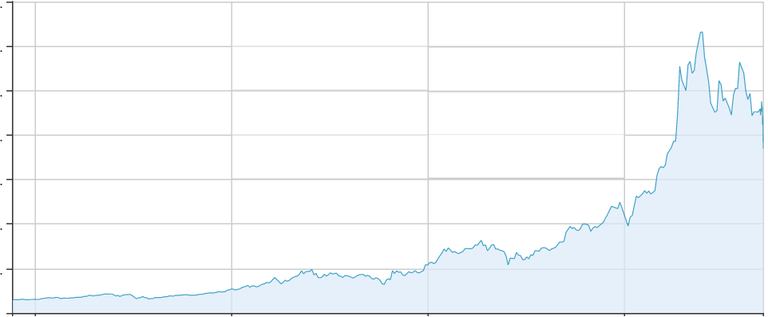

Bitcoin costs about 12 thousand before Tuesday afternoon. dollars. Within 24 hours, the world's largest cryptocurrency lost over 15 percent. From the summit of December 16, when bitcoin cost about 20,000 down, the decline is even deeper and already exceeds 40 percent. To even more vividly present the sale dynamics, just look at what happened on Tuesday between the hours. 8.00 and 9.30. In just 1.5 hours "virtual" money lost 1.3 thousand dol., or about 10 percent.

For cyberspace players on the cryptocurrency market, the current breakdown is also not new. Mid-January was usually a sell-out for the industry. A similar scenario was repeated a year ago, in 2016, 2015 and 2014.

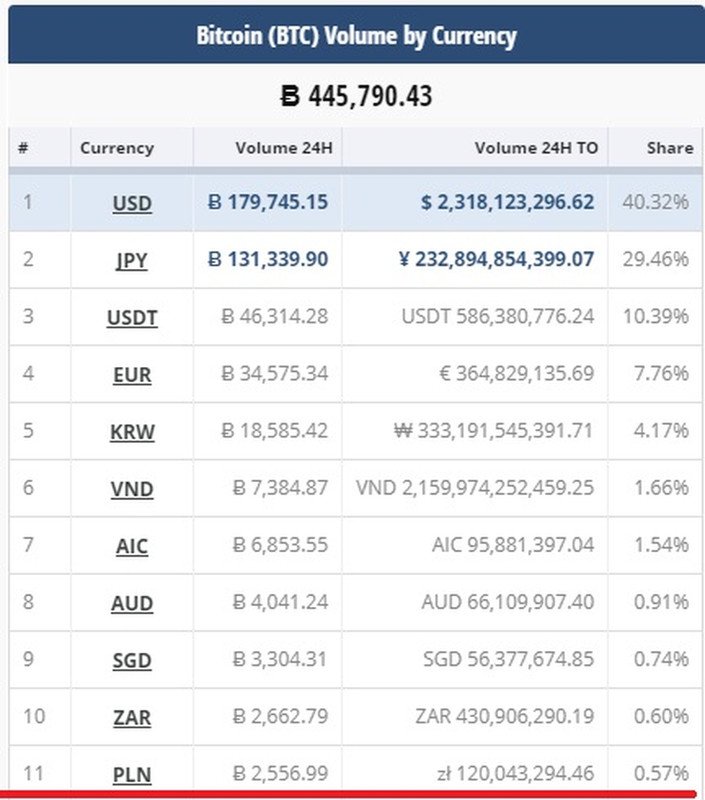

What's more, we can also answer the question who is responsible for these declines. Among the dominant currencies fiat in bitcoin turnover will find the US dollar (40% of total trade in the last 24 hours), the Japanese yen (29%), another crypto-currency USDT and the euro. An interesting fact is that our zloty is on the 11th place. He is responsible for 0.6 percent. world trade in this cryptocurrency.

Bitcoin rate sharply down. The collapse on cryptocurrencies continues

The collapse did not miss the rest of the crypts of the top ten in terms of capitalization. During the day:

ethereum lost about 21 percent

ripple around 26 percent

bitcoin cash approx. 21 percent

cardano 25 percent

Litecoin 17%

In turn, taking a little longer perspective, the last week is under the sign of mass sale of the king of recent increases - Ripple (about which we wrote a lot here). The cryptocurrency valuation for ultrafast bank transfers has decreased by over 42%.

The cryptocurrency market shines on Tuesday in red

A sharp cryptocurrency exit. What's happening?

Why the advantage of bears at the beginning of the year? This is the result of several factors. Firstly, on Monday Bloomberg announced that the Chinese authorities are planning to block fully national access to cryptocurrency exchange platforms, including those registered in other countries. As Daniel Schittek of XTB explains, people associated with the topic indicate that Chinese supervision is also targeted at individuals and companies that organize market-making and clearing services for centralized trade:

China's actions go hand in hand with the efforts of this country to discourage Bitcoin diggers, which is to help solve the problem of high consumption of electricity through their increased activity.

How do these activities read players? - This means that there will be no trade in tokens in China. Up to now it was a very strong market. Therefore, the lack of buyers in Asia deepens today's declines - Matti Greenspan, a cryptocurrency expert from eToro, says in an interview with Business Insider Polska.

Secondly, Steven Maijoor, head of the European Securities and Markets Authority, the regulator in the EU, also threw his three groszy. He said that people who have invested their money in ICO (cryptocurrency fundraising for blockchain projects) should be aware of the loss of all capital. - You do not have any regulatory protection in ICO. You must be aware of losing all of the money invested - he argued.

And finally, thirdly, they are still unmoving after last week's news that the South Korean government will ban digital currency trading through stock exchanges. It is one of the largest "virtual" money markets in the world. At the end of December, the Reuters agency reported that South Korea would ban the opening of anonymous accounts on cryptocurrency exchanges, and in exceptional cases it would be able to close them.

At the beginning of January 2017, we learned that the Ministry of Justice was preparing a draft law prohibiting trade. As reported by Reuters, the reason for this decision is the fight against tax evasion. The local control authorities are raiding local exchanges regarding the alleged evasion of paying Korean tributes to the Korean tax authorities.