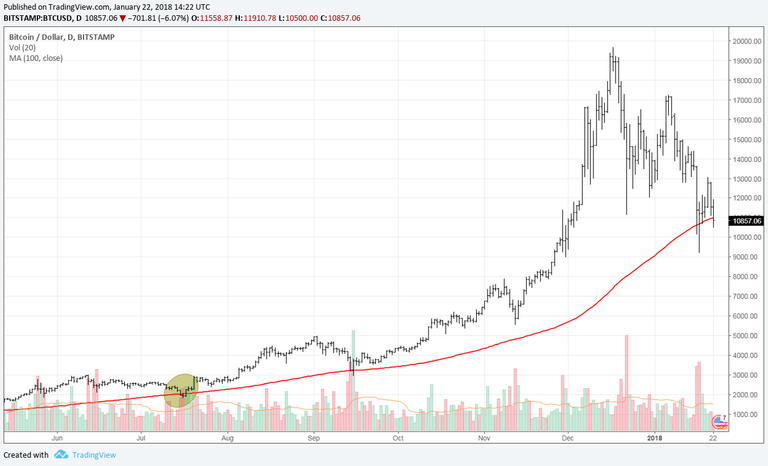

Cryptocurrency prices opened Monday on the back foot as heightened regulatory concerns continue to weigh on sentiment. Over the weekend, some of India's largest banks, including the State Bank of India, suspended accounts of prominent bitcoin exchanges, and requested greater collateral on others, according to The Economic Times of India. This comes on the back of concerns out of South Korea, where talks the government could draft a bill to ban trading of virtual currencies on local exchanges. Monday's slide saw prices of bitcoin dip below $10,500, down as much as 8.5% while Ethereum prices fell back below $1000. The move lower in bitcoin saw it tumble below its 100-day moving average ($10,990), which it has not closed below since July 2015. A close below this level could set up further weakness as skeptics continue to come out of the woodwork.

Source: Trading ViewThe latest bitcoin bear is Peter Boockvar, chief investment officer at Bleakley Advisory Group, who said bitcoin prices could fall by as much as 90%, wiping out most of the 2017 gains. "When something goes parabolic like this, it typically ends up to where the parabola began," Boockvar told CNBC Monday. "I wouldn't be surprised it over the next year it's down to $1,000 to $3,000."Boockvar added that there is a risk a collapse in bitcoin prices could add to overall market sentiment, dragging equity markets down.

Potential targets

A close below its 100-day moving average could open up room for further weakness with the next significant level being the $9,000 support. After breaking above $9,000 on November 26, bitcoin recorded five consecutive up weeks, reaching an all-time high of $19,670. The $9,000 support level was further validated last week when prices plunged more than 30% in two trading session, reaching a low of $9,200 before reversing sharply back above $12,000. Furthermore, a close below $9,000 will also put it below the 61.8% Fibonacci retracement from the beginning of its bull run in September of last year to its all-time high.

The Bottom Line

After a succession of weekly gains, bitcoin has fallen the past two weeks and has begun the week on the back foot. Should it put in a third consecutive weekly fall, drums from the bears may begin to beat a little louder as important levels begin to crack. Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns no cryptocurrency.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/news/bitcoin-price-tumbles-set-close-below-100day-ma/

Congratulations @futuredreamer! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @futuredreamer! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!