I don't know about y'all, but I sense something's changed over the weekend. There's a bull in the china shop at the moment. The question is whether the bull will leap out of the shop with little damage to show for it.

I've seen a few things that makes me think beyond the pure technical that we may at last be coming to the end of the current bear run.

The dark pool, low volume, mostly consolidating activity across nearly all ALT coin charts has come alive with volume and sharp upticks abound. In short, the High Frequency Trading bots have kicked into at least second gear. With climbing volumes and climbing prices, we can start to snip off profits a little easier. And we all know little things can lead to bigger things.

I'm hearing rumblings of many who entered the market in November and December calling it quits over the weekend. They've thrown the towel in and swallowed their losses and glad to be done with it. This to me is one of the biggest signals that the bulls are likely back for a real charge. When the shoeshine boy stops talking cryptos, that's when it's time to seriously consider the market once again.

Something weird going on with news. A sea of nothing but negative news pieces suddenly evaporates and is replaced with a sea of mostly positive news. Not just Bitcoin news, but various alt coin news pieces are suddenly flooding the space. Where's all the negativity? One simply does not turn that off like a water spigot. Or do we? Inquiring Minds Want to Know!

The German research about Bitcoin's blockchain containing child abuse material on the blockchain and making anyone possessing entire blockchain on their hard drive criminals did not stop the spike we see in the chart below and it's now gone on to break above the wedge anyway. How is it such major news hardly affects BTC's price? How is it a lame G20 report with a hint of positivity blow the doors of the bear trend? I don't know about you, but that's got to be a debilitating blow if I ever heard one that's far more lethal than, oh, say, U.S. subpoenaing Bitfinex and Tether. This one will require a fork of Bitcoin just to remove incriminating blockchain content.

I have ditched the down trend channel from my Bitcoin chart that has been in place since the first week of February. Just like that, no more downtrend channel, no more bear market. It couldn't be any simpler. Right?

Ok, all kidding aside on that last point, it does lead me to technical analysis of the Bitcoin/USD chart. As you can see above on the 1H chart, we've broken out of a bull flag/pennant and now seem to be testing next level in another potentially forming bull flag. The Kumo has twisted to green and we have climbed from below the cloud to above both the cloud and the indicators. The 50 EMA is on it's way to catching the 200 EMA and a cross soon will form the golden cross on the 1H timeframe if things continue like they have.

Meanwhile, on the 4H timeframe, I've zoomed out a bit to show you a pitchfork channel riding along a major bull wedge:

This is the wedge that has convinced me to toss out the long-running bear channel and call it done for. So what's going on inside the pitchfork? Zooming in, we can see we're bouncing back and forth between top and bottom of the green area.

What this is telling me is that we're well on the way to consolidating and building up for a major break out of the wedge as we draw closer to the apex.

While it's early to be calling for the return of the bulls, I can't help but wonder if they're standing around in the china shop as we speak and getting ready for a stampede, which we're all looking forward to. I'm not overly optimistic, yet, but there's definitely a whiff of change in the air.

Anybody else seeing a change as well?

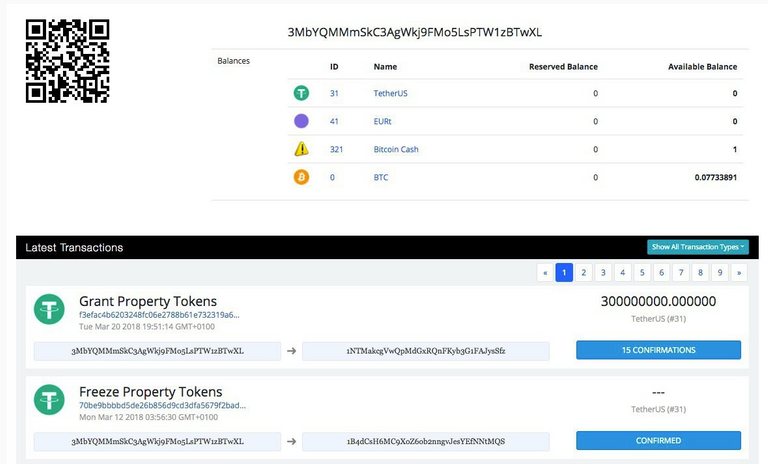

P.S. I just learned that Tether just printed 300 million USD. How is that for icing on the cake?