There has been a lot of fear, doubt, and panic sweeping through the cryptocurrency world the last few days. Many people made doom and gloom bitcoin price predictions, especially this last Sunday when the price went into a bomb-propelled plunge. People and media sources said this could herald the end of bitcoin or suggest the”bubble” had popped. However, just a few days later, the price started to skyrocket again, vexing naysayers and overturning shortsighted predictions. Looks like they ate their words.

Bloody Sunday Price Analysis

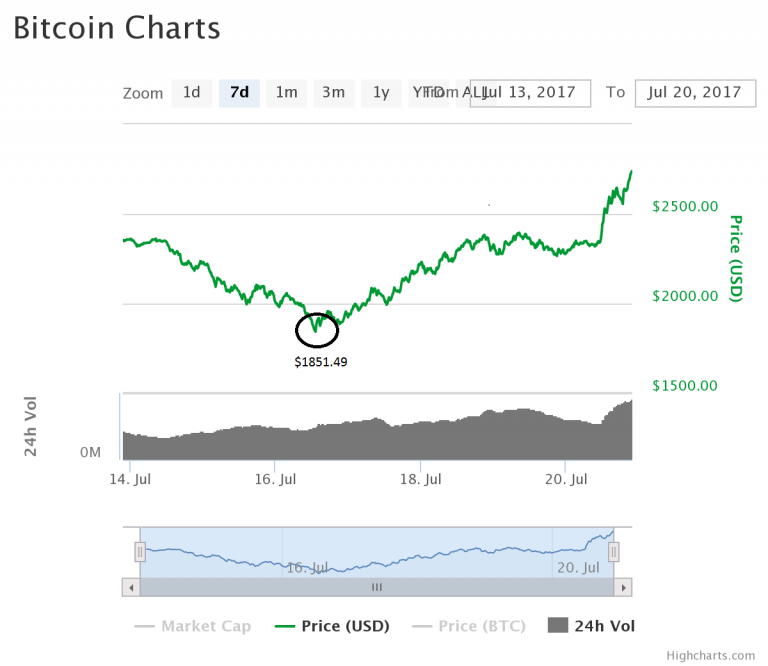

For perspective, lets analyze recent price movement in greater detail. Prior to last weekend, the price was hovering healthily in the upper $2,000 range and flirting with a $3,000 peak. As the weekend rolled around, the price began to plummet. This occurred in lockstep with fearful signals that the bitcoin community would not be able to reach consensus on the scaling debate. So during the wee hours of Sunday, the price dropped roughly 10% to a devastating $1851.49, a record low in recent weeks.

Catastrophic Media Headlines and Price Predictions

During the price downturn, media sources exacerbated fear by writing clickbait headlines to scare people into a panicked frenzy. CBS news wrote on July 14, “Did a Bitcoin Bubble just Burst”? On July 17 Fortune wrote “Wipeout: Bitcoin and Other Digital Currencies in Price Collapse.”

Along with a slew of provocative — yet preemptive — media posts about bitcoin’s imminent collapse or demise…individual users on Facebook and elsewhere spoke of selling their coin and panicking. They embraced the panic and met it with equal parts fear and uncertainty. Here are a few quotes from my personal Facebook feed:

Wow! Bitcoin is crashing. I lost $100 before I saw it is tanking and transferred it to my PayPal. I left it in thinking oh yes it’ll gain money! Nope :'( If you have Bitcoin be careful-you might want to watch how it’s dropping and you might want to pull your funds from it

One user even misinterpreted bitcoin as fiat currency during the price movement: “bitcoin is crashing, lol. fiat currency is no good, even digital ones. gold is the standard.”

There were many other posts about bitcoin collapsing or dying, but as everyone witnessed, the price made a significant turn and started an upward trend. As of writing this, Bitcoin just surpassed the $2,750 mark with a high of around $2,900. It looks like the ecosystem could be making a recovery.

Do Not Make Predictions, Lest You Eat Your Words

As a result of this staggering change in price, I urge people not to listen to FUD predictions, unless they know factually that something has broken bitcoin or harmed its infrastructure. If they do make these FUD predictions, and the opposite comes true, they may have the unsavory task of eating their words.

Do Not Make Bitcoin Price Predictions Lest You Eat Your Words

Here is why: people cannot accurately predict markets anymore than they can accurately predict the path of a tornado. Cryptocurrency markets are notoriously more difficult to guess at than other markets as well, because the constant fluctuation of price points and random behavior of market actors can cause the price to shift on a dime.

To wit, I am not making a prediction myself. I am not saying without doubt bitcoin will win or end up at $500,000 mark, like John McAfee predicted. I have utmost faith in bitcoin and its diligent community, even regarding technical and political challenges; however, I know enough about markets to realize they are basically unpredictable. Not even astute technical analysis leveraging Fibonacci retracement can always provide accurate analysis for investors.

Self-Fulfilling Prophecies and FUD-Based Panic Selling

I admit, I made predictions in the past. Some came true and some did not. I realized Do Not Make Bitcoin Price Predictions Lest You Eat Your Wordsapplying arbitrary, subjective guesswork to crypto markets is likely doomed to failure. I usually just end up wrong or dumbstruck. Worst case scenario is a FUD prediction could precipitate a temporary panic sell. In psychology, this panic sell would result in a domino effect predicated on a self-fulfilling prophecy.

A self-fulfilling prophecy is a prediction that directly or indirectly causes itself to become true due to positive feedback between belief and behavior. On the market, a catastrophic prediction by various organizations or individuals could elicit a panic sell that results in the expected belief of the actors.

This is probably what happened on bloody Sunday as media sources yipped and howled about bitcoin crashing. It didn’t of course, but bitcoin could eventually undergo serious problems. The digital currency is not guaranteed to win, but predictions are oftentimes wrong. They do not really do justice to all market variables. Try to withhold making predictions unless there are solid facts to support them. Otherwise, loose predictions could provide false market signals and exacerbate panics. Do not be part of that. Do not have to eat your words.

Do you believe making cryptocurrency predictions is a good thing? Are they ever accurate? Let us know in the comments below.

Images via Shutterstock

Whether you’re a beginner or a long-time bitcoin player, there’s always something interesting going on in the bitcoin.com Forums. We are proud free speech advocates, and no matter what your opinion on bitcoin we guarantee it’ll be seen and heard here.

bitcoin.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/predicting-bitcoin-markets-is-near-impossible/