Goldman Sachs is out with a call on bitcoin, and chart analyst Sheba Jafari expects the digital currency could rise as high as $3,915.

That would be 52 percent above Monday's price of about $2,567.

"The market is in wave [four] of a sequence that started in the late-'10/early-'11 lows," Jafari wrote in a Sunday report on charts for the week ahead. We are "eventually expecting one more leg higher; a 5th wave."

"From current levels, this has a minimum target that goes out to 3,212 (if equal to the length of wave I)," Jafari said. "There's potential to extend as far as 3,915 (if 1.618 times the length of wave I). It just might take time to get there."

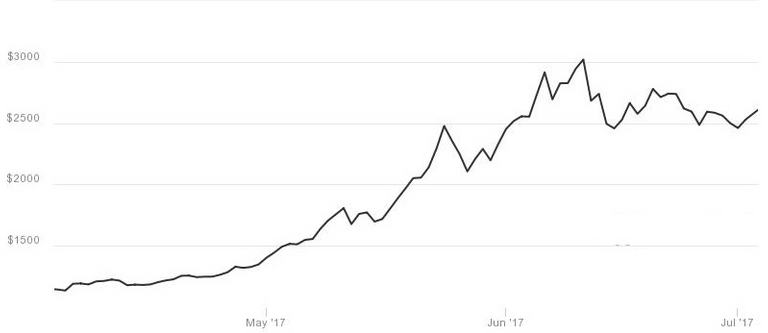

Bitcoin three-month performance:

Bitcoin has traded in a range between about $2,100 and $3,000 ever since hitting a record high of $3,025.47 on June 11, according to CoinDesk.

Uncertainty about the future of bitcoin itself has kept prices in check lately. Updates to the bitcoin network scheduled for release in the next several weeks could split the digital currency in two if developers don't agree on how to make the updates compatible with each other.

To be sure, Jafari said, "fourth waves tend to be messy/complex," meaning bitcoin could continue trading in a range and potentially fall close to $1,857 before recovering. On June 12, Jafari said in a note — written "due to popular demand" — that she was "wary of a near-term top ahead of $3,134." She said traders should "consider re-establishing bullish exposure between $2,330 and no lower than $1,915."

After topping $3,000 for the first time on June 11, bitcoin prices fell more than $800 to a low of $2,185.96 less than a week later. However, bitcoin recovered to end the month at $2,499.98, up 7.2 percent for June and having risen 158 percent for the year so far.

The Goldman reports illustrate how mainstream Wall Street is paying much closer attention to bitcoin, despite high volatility and lack of regulation in the digital currency world. This week, bitcoin and the blockchain technology behind it made the cover of a well-respected investing magazine, Barron's.

I am sure I am not the only one who is worried that Wall Street is interested in Bitcoin.

Definitely a fear of of a lot of us. It'll be interesting to see how the working class bitcoiners react if Wall Street comes in big.

you are not the only one, absolutely!

nevertheless, there are a lot of other promising currencies.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.cnbc.com/2017/07/03/goldman-sachs-says-bitcoin-could-rise-another-50-percent.html