Logic and Math?

When I see all of the Technical Analysis that goes on in the markets... either the stock market or the cryptocurrency market I feel there is a conundrum.

Charts with all of the indicators based on mathematical probabilities are great and they seem to be successful in predicting the action of the crypto markets. At least sometimes. There are indicators for bull markets and indicators for bear markets. Hmmm...

They seem to make sense. Then there are ways to trade based on support and resistance.

Also... hmmm...

What I find amazing is that all these things seem to work... sometimes.

There are traders who choose an assortment of the different indicators and succeed ... there are others who choose a different assortment and lose... bigtime.

What is the right Thinking when it comes to Predicting Price Action?

Ultimately the markets must have a correct method of prediction... right? Is it a totally mathematical structure based on "Logic"? Or is it a human structure based on "Emotion"?

Funny thing is that maybe we should think about who powers any free and open market?

Is it run by logic or human emotions?

I decided to start with an actual definition of each side.

Logic

"reasoning conducted or assessed according to strict principles of validity"

Emotion

"instinctive or intuitive feeling as distinguished from reasoning or knowledge"

These are definitely opposite sides of the situation when watching the markets.

My Conclusion... Emotions Run The Markets

First of all I love the Technical Analysis people do... so interesting and seems to have some "validity". However, I would argue (please keep in mind - just putting this out there for debate) that the legacy markets of Wall Street, after decades of experience, have developed a theory (with an actual picture) that has won over my belief.

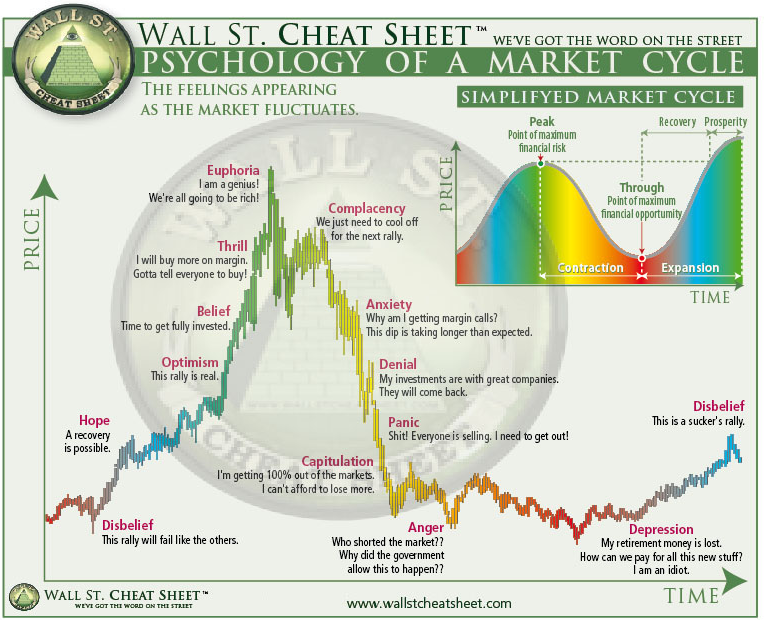

Image Called the Wall Street Cheat Sheet

Please read over the corresponding emotions and see whether this isn't exactly what we have been through with Bitcoin and cryptos overall. This is what Wall Street considers to be a "Cycle".

So... do we go through cycles? Look at these pics and consider.

Current State of Bitcoin vs the U.S. Dollar as of June 2, 2018.

Please look closely at these two images

I don't know but I gotta say there is a real life correspondence between these two charts.

I also can say upon looking at these charts I am predicting another dip before a true building and running of the bull market we are all waiting for.

We might be entering the "depression" phase.

If so, the key in the next few weeks and months is to not get depressed, go against what the population as a whole in the crypto community are going to start feeling. Do the opposite of what everyone else is doing. Buy when there is blood in the streets. The great investors of the markets of the past have all kinds of sayings to instruct us.

Are these sayings just cliches?

Or... are they the truth?

If we look at another dip as an opportunity for buying... we could succeed big time.

I can't believe I am making a prediction, and I am not an expert in anyway. I am an artist and a grandma. However, I have jumped into this crypto world and focused and learned for the last year. Yep started in May 2017. That might be considered a bit of time in this new world.

So... put it out there for discussion.

Very well written post @granblock

Math and emotions need to be always taken into consideration while investing.

Good to see that you're still active. Post is a bit to old to upvote :(

Yours,

Piotr

Congratulations @granblock! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!