Forget about boring stocks. Bitcoin is where it's at these days for investors.

The virtual currency is now trading at a record high above $8,200 -- just a little more than a month after bitcoin first passed the $5,000 level. If this keeps up, bitcoin could be trading at $10,000 before the end of the year.

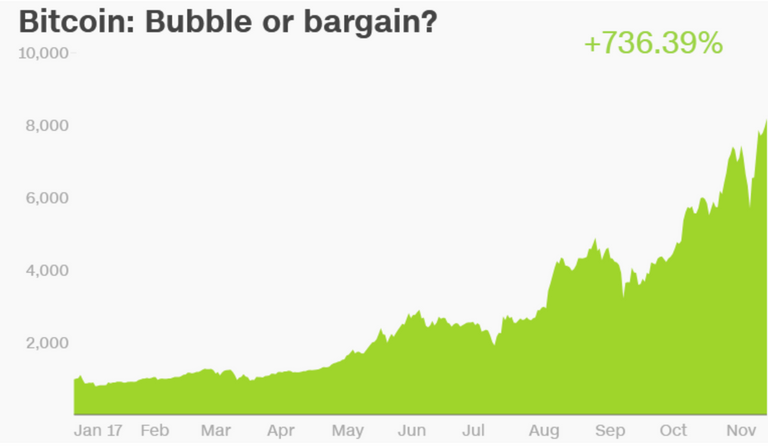

The price of one bitcoin (XBT) has surged more than 735% this year alone and have skyrocketed nearly 40,000 % in the past five years.

Of course, bitcoin's meteoric rise has led to some skepticism. JPMorgan Chase (JPM) CEO Jamie Dimon has bashed it on numerous occasions, calling it a "fraud" that's better off being used by drug dealers and North Korea.

And Saudi Prince Alwaleed, a billionaire whose Kingdom Holding Company owns stakes in Apple (AAPL, Tech30) and Citigroup (C), told CNBC before he was arrested in a sweeping anti-corruption probe that he thought bitcoin was an "Enron in the making" that will implode.

But while some see a bubble about to burst, others see opportunity. Lloyd Blankfein, the CEO of JPMorgan Chase rival Goldman Sachs (GS), took issue with bitcoin critics.

Blankfein tweeted last month that "folks also were skeptical when paper money displaced gold." Interestingly, technical analysts at Goldman also correctly predicted earlier this month that bitcoin prices would soon top $8,000.

Blankfein raises an interesting point though. Sure, some investors are likely flocking to bitcoin as a speculative bet because they've watched the price climb higher and higher.

But there's also a legitimate case to be made that bitcoin, ethereum, litecoin and other cryptocurrencies are the future of money and that more and more people will conduct actual transactions using these currencies.

To that end, Square -- the popular mobile payment service run by Twitter (TWTR, Tech30) CEO Jack Dorsey -- recently announced a trial that will let some users of its Cash app purchase bitcoin.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://money.cnn.com/2017/11/20/investing/bitcoin-prices/index.html