Let us first determine what a pyramid scheme is, also known as the Ponzi scheme. Investopedia gives it the following definition:

Fraud in the field of investment; investors are promised big profits with little risk. Income under this scheme is received only by early investors through the attraction of new ones. This is a classic pyramid scheme as both are based on the use of new investors ' funds to pay early investors. Under such schemes, the money eventually is not enough and the scheme collapse.

Against the background of the astronomical growth and rapid decline in the cost of bitcoin, it became popular to believe that the cryptocurrency market and bitcoin in particular is a financial pyramid, or Ponzi scheme. But if you study the principles of bitcoin and the reasons why it was invented, you will see that it is actually the complete opposite. Let's review the above definition to understand: it has nothing to do with bitcoin.

Investors are promised big profits with little risk.

If you still haven't read Satoshi Nakamoto's original bitcoin article published at the end of 2008, read it. This is eight pages of technical description of the principles of the bitcoin network, which is quite difficult to immediately learn. You will note that this article does not mention any income from "investing" in bitcoin anywhere. It doesn't even mention the price of bitcoin. The article describes the solution of one of the long — standing problems of cryptology-the problem of Byzantine generals. This was the original value of bitcoin, which did not imply any profit: in the early years of its existence, it was a "toy for geeks" or "magic Internet money".

There is nothing secret about bitcoin: it is one of the most open technologies in the world. Open source allows anyone to use it or contribute to the development of a technology in which the entire history of all transactions is visible to absolutely everyone in the world. This significant departure from the paradigm of any financial system is the exact opposite of a fraudulent scheme shrouded in vague promises of high returns with capital inflows, which are always kept secret.

Income under this scheme is received only by early investors through the attraction of new.

Bitcoin does not generate profit. It's just software. The price of bitcoin directly correlates with the demand for it. Bitcoin does not impose anything, no one knocks at the door and does not agitate to invest in bitcoin. New users that join the bitcoin network, not funded by old members with new money. Quite.

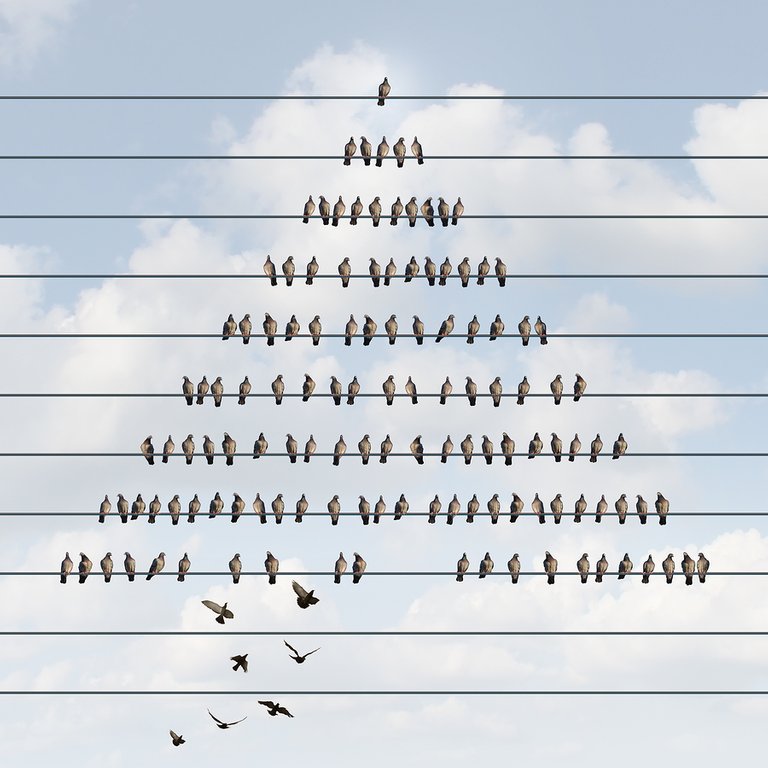

In a typical pyramid the founders are guaranteed to be the richest. The more people join, the more founders will earn, as all the money flows to the top. They make initial investments, and then agitate others to invest, which they then put in their pockets. The pyramid relies solely on new members coming in with fresh capital, which is the new income.

Bitcoin works on the contrary. Yes, many people who bought bitcoin in the beginning, today would have made a profit of more than 50 000%. But a huge number of them spent their bitcoins a few years earlier on pizza, mining farms, gambling or drugs. For many, bitcoin was not an investment at all, but only a convenient, safe and global payment system — in fact, only it was in the understanding of Satoshi Nakamoto.

On the other hand, the old "hontarov there is very little. Some of them today are insanely rich due to the market price of bitcoin, but their condition is not implemented in currency terms. They measure it by the number of bitcoins that they hold, and not a fixed rate currency.

Hodlers did not sell bitcoins — and that's why they are rich. And the hodlers will never sell them. Perhaps some of them will sell a small part of their assets, but without withdrawing money to Fiat, and only to those who need bitcoins for a new home or car. Most people do not want to so easily part with their bidone, because people tend to spend first, bad money, and good to save for the future. Bitcoin today is much better suited to the role of good money than any Fiat currency.

If other financial systems are driven by a thirst for profit, then some of the early bitcoin investors are among the most generous people on earth. Recently, one of them donated more than $1 million to Andreas Antonopoulos (first 37 BTC and then another 42 BTC). Andreas, one of the most important figures in the bitcoin community, recently said that despite being "in bitcoin" since 2012, activities to popularize cryptocurrency around the world have forced him to spend most of his savings, so he has received no profit from the growth in 2017. Another early bitcoin investor is actively donating millions of dollars to charity.

In a pyramid, or Ponzi scheme, old investors sell everything, leaving the new to their fate. In the bitcoin system, new investors panic and sell their coins at the slightest sign of a collapse in value.

Those who really understand the true value of bitcoin will never withdraw it to Fiat. They don't need dollars, they need bitcoin. After all, why sell the final, scarce and valuable asset for a bunch of papers?

introduction post

Check out the great posts I already resteemed.Resteemed by @resteembot! Good Luck! Curious? Read @resteembot's

RESTEEMBOT IS LOOKING FOR A NEW OWNER

Very insightful thanks for a great read.

Think that this is a misunderstood aspect of cryptocurrencies...

People always wanna know where the money comes from... thanks for giving the public some insight on this..

A very good article!!! Thanks, i resteem it and upvoted and expecting more articles from you, wish you to have a nice creative day!!! Followed you also!

Your post get free resteem service from @kabibitak.

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly � Featured Posts are voted every 2.4hrs

Join the Curation Team Here | Vote Resteemable for Witness