SUMMARY

I had introduced about a MASSIVE PROFIT generating ETF strategy which I still think many have not paid much attention to. That's unfortunate. For those who have interest in growing their wealth, please consider reading the linked blog and observe the below:

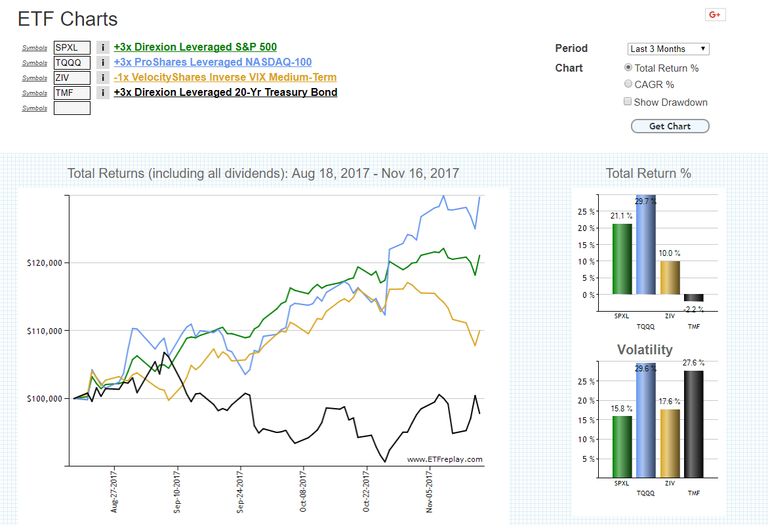

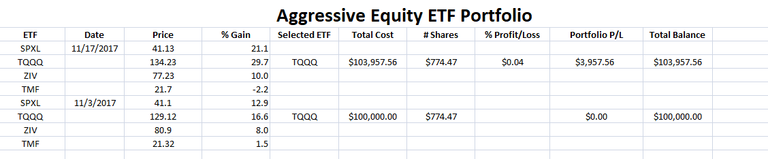

The four ETFs selected are SPXL, TQQQ, ZIV, TMF. These are biweekly charted like below for a 3 month running % performance. The highest % gaining ETF is selected and 100% of funds are put into that ETF. Two Fridays ago, TQQQ was the top performing ETF and my $100,000 was used to purchase 774.47 shares.

Today, two Fridays later, the below shows the % Performance of the four ETFs. Which is the winning ETF? It's still TQQQ, so I leave the money in TQQQ. Easy! Zero STRESS! But PROFITS and soon to be MASSIVE PROFITS of about 47% to 79% Annual Return!

Now, let's look at the performance of the portfolio. In two weeks, this ETF strategy has gained 4%, handsomely beating most mutual funds already!. I believe within 6 months to a year, this strategy will outperform just about every mutual fund and hedge fund! In two weeks, Dec. 1st, we shall reveiw the ETF % gains and see if we have new winner or not.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

These Technical Analysis Books: Elliott Wave Priniciple & Technical Analysis of Stock Trends are highly recommended

Follow me on Twitter for Real Time Alerts!!

--

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTS Wallet - haejin1970

BTC Wallet - 15ugC4U4k3qsxEXT5YF7ukz3pjtnw2im8B

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LecCNCzkt4vjVq2i3bgYiebmr9GbYo6FQf

Legal Mumbo Jumbo: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.**

Hey does anyone have 1 billion dollars I can borrow?

Ill pay it back in 70 years, with interest of course.

Ty in advance

Good job!

What I do know about investing is purely in the cryptosphere. Can you recommend a reputable place/website to purchase the ETFs? Also is there a minimum amount you would recommend to get started with? Anytime I have looked into buying this type of thing the fees for account maintenance & execution of trades etc are a bit much compared to the amounts I'd be thinking about.

You can start with $500 or $1,000....doesn't matter.

I use TD Ameritrade but you can open an account with $500 with Etrade or Fidelity or any other brokerage.

The fees are negligble given the returns.

Thanks for the info. Their fees look a lot more reasonable and TD Ameritrade at least will deal with non-US citizens (aliens...seriously? I'm Irish not ET).

I'll see if I can find somewhere more local but so far the only places that seem to offer these services charge about 5 times more per trade on top of a quarterly fee for the privilege of doing business with them.

Thank you for the reminder. I have been so deep in cryptoland, I had forgotten.

Bitcoin Evening Update is up and live!

@alchemage has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

To receive an upvote send 0.25 SBD to @minnowpond with your posts url as the memo To receive an reSteem send 0.75 SBD to @minnowpond with your posts url as the memo To receive an upvote and a reSteem send 1.00SBD to @minnowpond with your posts url as the memoHoly Shit! That's AWESOME! I love this project! and skin in the game to prove it!

I thought you only invested crypto. Lol!

No. Equities too!

Nice

I wish I had that much to invest

Thank you- trying to learn and appreciate your sharing with evryone

Sweet! Thanks for sharing

Thank you!

I like this strategy because it's simple and low-maintenance, yet very methodical. Analyzing markets is like putting together pieces of a puzzle. It's important to remember that no individual asset exists in a vacuum, and it is useful to gauge the performance of an instrument in relation to other correlated markets giving you confidence that you're on the right side of momentum. Don't take Haejin's word for it; test it for yourself. Good luck!