The Old lady always looks for cheap prices in crypto, she starts buying at the 0.618 Fibonacci level, 0.786, and at the 0.886 level. She never invests more than 5% in any one coin, expecting to lose the investment. Positions of 0.3% are not uncommon.

The old lady also looks for an asset that has flattened out and is on the floor preferably without a new bottom in the price. But she has been surprised lately as coins are rallying of their lows, just like XVG making a bottom then a few weeks later a pump starts. She looks for coins that have bottomed and are forming large W patterns on the chart. She pulls up her Fibonacci retracement tool from the weekly low to the recent high. So she can buy in at her retracement levels.

She calls her "broker" and places an order for an amount @ Ƀ 0,00000048 Satoshi's between the 0.618 and 0.786 Fib levels buy when the market comes to her. When she gets a fill she places her sell orders, and forgets, every time the coin doubles, half her holding gets sold. The first double was at At Ƀ 0,00000096 she then sold half, and at Ƀ 0,00000192 she will sell half again, etc. If the position is still less than 5% she can pull up her fib from the bottom to the recent blow-off top. And reinvest what she sold at the 0.618 or 0.786 fib zones.

If the weekly goes higher, you have to pull up the fib tool and grad it from the bottom to the new high and buy-in at the relevant levels.

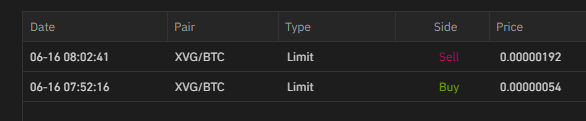

This is what my current open orders look like:

The buyback between the 786 & 618 level or @ 54 satoshi's and the next sell orders when it doubles again @192 sats.

This is not to be taken as investment advice! This is an investment strategy by @davincij15 at www.thedavincicodes.net And there are many more layers than discussed here.

Also @bbeamish at the rationalinvestor.com this is their strategy and you should get a course from them.

These are my ideas only. Chart: https://www.tradingview.com/chart/SGdopyFx/