Cryptocurrencies are up across the board Friday, with solid gains in bitcoin, Ethereum, and Bitcoin Cash. However, Ripple has been the real story of the week, and is continuing its impressive climb.

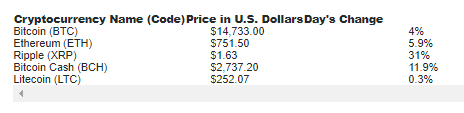

Here's a look at the five largest cryptocurrencies by market capitalization, and how much each has changed over the past 24 hours:

Data source: www.investing.com. Prices and daily changes as of noon EST on Dec. 29, 2017; prices are rounded to the nearest cent.

As you can see, Ripple is the clear winner today, and this has been the case throughout most of this week. Here's why Ripple's week was so good, as well as some cautionary advice about a popular bitcoin-based investment.

Ripple continues its rapid rise

Not only is Ripple up by 31% today, but the cryptocurrency is up by more than 75% over the past week. Ripple started the week as the fourth-largest cryptocurrency by market cap, and now is within striking distance of surpassing Ethereum for the No. 2 spot. In fact, at its $1.90 peak today it briefly did just that.

Ripple has attracted lots of attention from financial institutions all over the world recently, including a project with American Express in the U.S. and partnerships with several banks in South Korea and Japan, the latter of which was announced just this week. Ripple has a four-second transaction settlement time, which is dramatically lower than either bitcoin (about an hour) or Ethereum (two minutes). Therefore, banks have begun to test its potential to complete real-time payments, especially across international borders.

Want to own bitcoins through the stock market? It'll cost you

There are several "bitcoin stocks" that investors should be wary of, and that includes the Bitcoin Investment Trust (NASDAQOTH: GBTC). On the surface, the trust may seem like a pretty direct way to own bitcoin without actually buying the digital currency. After all, the basic idea is that the fund takes investor money and pools it to buy bitcoin.

While this is true, the problem that investors should be aware of is that the fund's shares trade at a massive premium to the value of the underlying bitcoins. As my colleague Dan Caplinger recently wrote, the Bitcoin Investment Trust trades for roughly 35% more than the value of the bitcoins it owns.

To be fair, there's a reason for the premium: convenience. Many investors who want to get involved with bitcoin don't have the time, knowledge, or desire to by actual bitcoins and prefer to own them indirectly. As of this writing, the Bitcoin Investment Trust is the only exchange-traded way to do this.

However, at some point there will be bitcoin ETFs and other investment vehicles that allow people to own bitcoin directly, and once these hit the market, the premium could collapse fast. In addition, Grayscale, the management company that runs the fund, charges a 2% annual management fee.

To sum it up, while I don't suggest that anyone put money into bitcoin or other cryptocurrencies that they can't afford to lose, the mathematics currently favor owning bitcoins directly instead of through the trust.

Source > [ https://finance.yahoo.com/news/bitcoin-may-rising-today-ripple-182500833.html ]

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://finance.yahoo.com/news/bitcoin-may-rising-today-ripple-182500833.html

riple cant be high bitcoin will be a the top as always etherium is looking good

All those who are buying bitcoins may ruin themselves. But still stories are there that bc will prove its worth in 18.