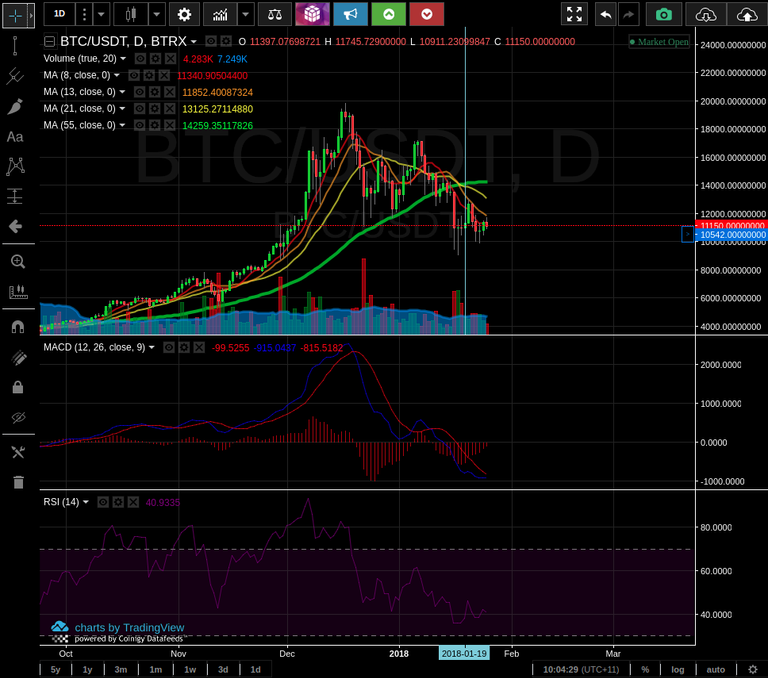

On the daily scale the 8 13 and 21 exponential moving averages have breached the 55 exponential moving average and are all decisively bellow the 8 13 and 21 EMA. The doji candles have not been confirmed by volume instead we have formed several no demand candles. The MACD and RSI has begun to curl up however the RSI still has further down to move as it can still breach the lower dotted line.

( )

)

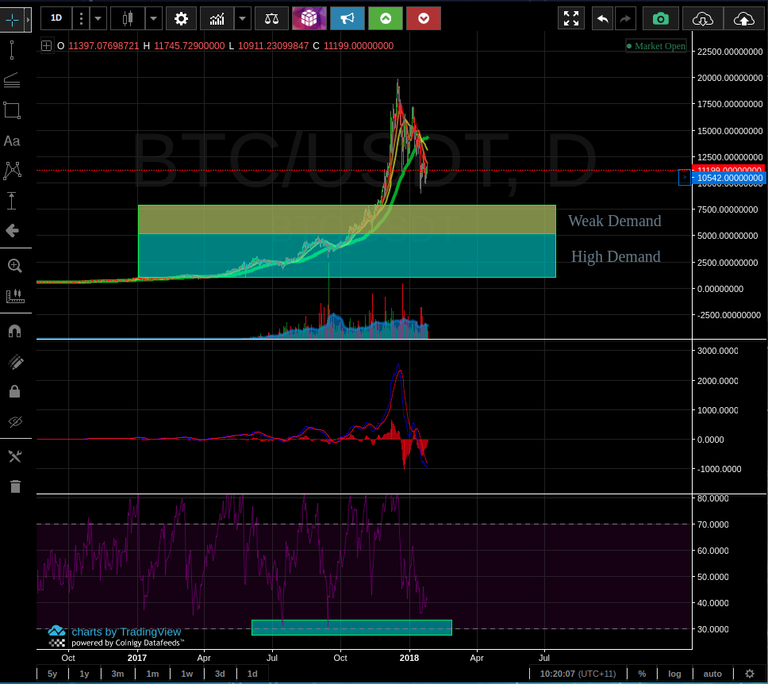

The safest time to buy is a break of prior support within regions of past consolidation. Our first demand region lies between 5000 and 8000 dollars which is what the price should fall to given the 9000 dollar support is broken. At this point bitcoin should be very oversold on the daily scale.

there is still a bullish scenario however it becomes less and less likely as time passes. This is because as time passes and retail investors who bought at the top become less confident in the consumable it lowers their propensity to buy. Eventually demand decreases to the point where "big money" decide to close off the rest of their position. At that point there is no more support for the stock and we see a rapid collapse in price. The only way that bitcoin prices can increase is if we get a massive influx of interest. Looking at the run we have just had we might need further correction and consolidation before prices become acceptable for new buyers to enter the market

A further bearish Scenario

hola! I like your post! Thanks for it! I went to jail because of cryptos... lets make steemit together to a better place with our content! I would like to read a bit more about you and maybe do you have some more pictures? I also just wrote a introduce yourself. Maybe you upvote me and follow me swell as I do? https://busy.org/introduceyourself/@mykarma/1-jail-review-bitcoins-3-years-ago