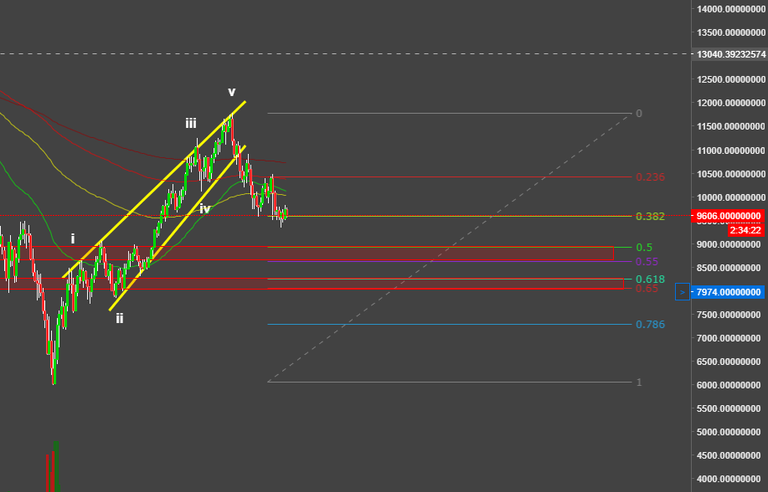

The bullish scenario has occured and the upper target was hit however it was not hit in the desired fashion

I can count the following waves

Becasue of this as well as a clear failure to break the overarching downtrend the possibilities are now quite confusing and a number of things can happen.

Let us view the bullish possibility.

There is a possibility we have had a completed 5 wave

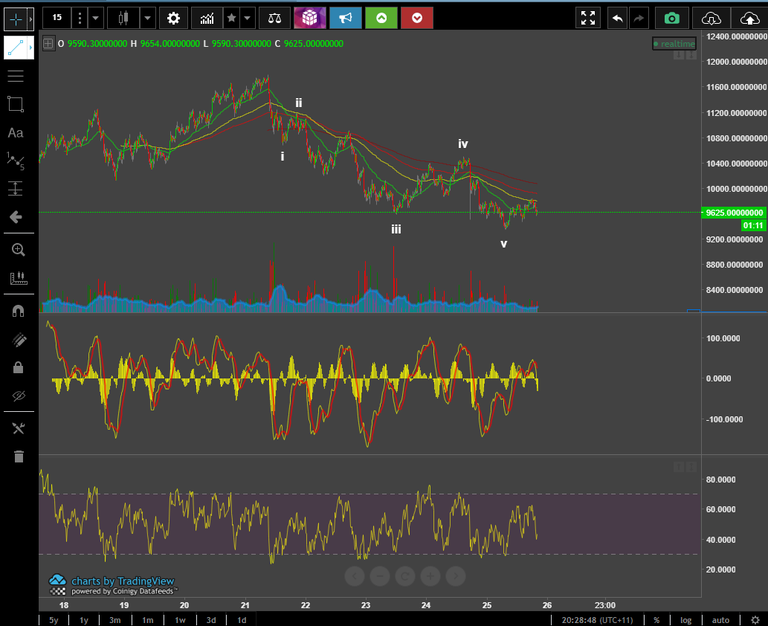

at the moment there is no clear entry signs on the 4 hr charts as we have not entered into oversold territory on a higher time frame such as the 4hr. However currently there is a minor bullish divergence so we may expect a bounce. We mayb also look to enter small positions if the MACD is able to cross

there is a potential impulsive count completing though it is quite rough. This makes us suspect that even if there is a bounce we should expect a lower low which can retrace upwards of 99% of the move. To enter we must wait for 5 waves down and a form of bullish confirmation like RSI divergeance or long wicking candles etc.

The bearish scenario

The bearish scenario is still on the table as there is an hidden divergence on the daily which implies trend continuation to the next cluster of support from 3000-5000. There is also potential for the MACD to cross as well as the contraction then downward cross of the EMAS . This combined with the decrease in volume does not necessarily mean we collapse however it lowers the chance of upside in the near term and we may be entering into a sideways market for the next couple of weeks