Good evening, everyone,

Here is an analysis concerning Bitcoin 3.08%. Whether you are in the crypto bubble or not, you know that for more than a week now the Bitcoin 3.08% has been falling, and does not stop.

Since the historic peak at a few hundred dollars of the $20,000, Bitcoin 3.08% has led to a rather logical correction after a (too) fast rise. While remaining calmly in its descending triangle, the Bitcoin 3.08% has returned to stabilize around 6500-8000$, but a week ago a new significant drop of several tens of percent made the happiness of the "shorteurs" and the misfortune and the "longueur?

Enough jokes, how far Bitoinc will go in this correction.

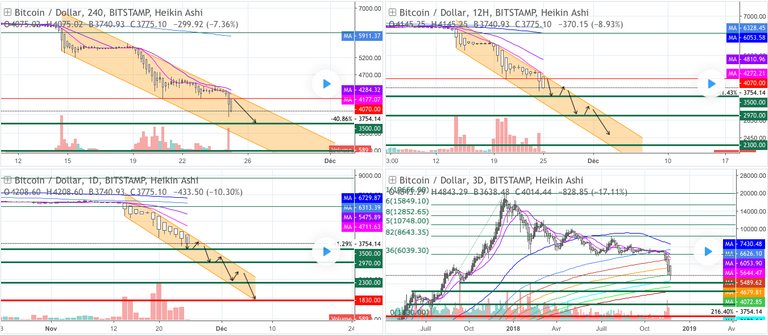

First of all, I plotted on all the graphs a retracement of Fibonacci from $1,830 to $19,666. Looking closer, this retracement corresponds perfectly to the supports and resistances that occurred during this fall.

Indeed, since the 23.6% support, the last support before a 100% retracement was broken, the fall is accelerating and the price of a Bitcoin 3.08% is now 3750$.

On the D3 graph, I plotted a lot of moving averages, namely: 10, 20, 100, 200, 250, 300, 300, 350, 400, 450 ,500. The price is currently supported on the MB -0.31% 350, after rebounding on the MB -0.31% 400.

I think that these moving averages will now serve as new supports (and) resistance in case of a small correction in this bearish channel.

That's it, my price target before a significant rebound is 1900-1850 which could be a very good entry for new investors.

Thank you all!