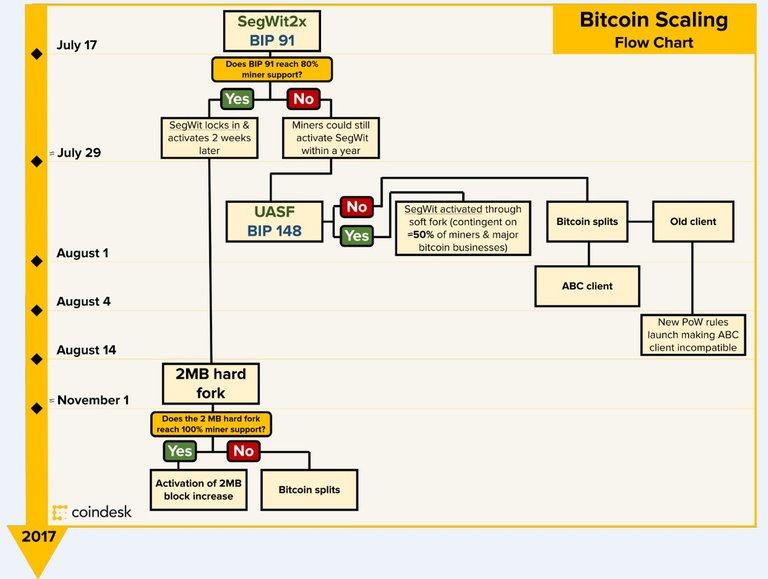

If you held onto your Bitcoins, congratulations! If you sold them in a frenzied panic when it bottomed out then I feel sorry for you but completely understand. Markets DO NOT LIKE UNCERTAINTY, that's for sure. The last week has been a tumultuous rollercoaster of emotions for people who do not know the crypto world like us seasoned veterans. There were mass sell-offs across the board with nowhere to hide (except USDT or a handful of ICOs). In case you haven't heard the news yet there is a semi-defined path that Bitcoin is now venturing down:

(source: reposted from @redlebik on Twitter)

It appears that we have already reached a "lock-in" status for BIP91 (https://www.xbt.eu/) and it will activate SegWit within two weeks. When this happens we can expect a serious rally up until the end of the month with one or two minor corrections. It looks like we have a market trend reversal underway here people!

Yes there is still a very real possibility of a coin split BUT I believe that it is very unlikely for many reasons that I will get into on my next article.

REMEMBER TO FOLLOW, UPVOTE, AND LEAVE A COMMENT DOWN BELOW :-) HAVE A FANTASTIC DAY!

To the Moon!!! $5,000 HERE WE COME!!!

First pro bitcoin UASF post i have seen. Way to swim upstream Hot Sauce

I wonder, instead of the hard fork or soft split, just increase the gas...and do a reverse bitcoin split or some may call a bitcoin merge. In this approach, shares or bit slices of bitcoin are effectively merged to form a smaller number of proportionally more valuable shares or bit slices...and thereby achieving a more valuable bitcoin. I like to compare this conundrum to my trading of stocks [although applicability is far and few between]. But for argument sake, I looked at Zacks and found this at: http://finance.zacks.com/reverse-stock-split-good-bad-2298.html

Now, in comparison and substitution, you could hypothesize the following:

In Applying “The Mechanics:

In a [coin] reverse split, an ICO cancels all of its outstanding coins and distributes new coins to its bitcoinholders. The number of new coins you get is in direct proportion to how many you owned before, but the number itself will be smaller. For example, in a 1-for-2 reverse split, you would come out of the split owning one share for every two you owned previously. And if you owned 1,200 shares, then you would wind up with 600 shares. And In a 1-for-3 split, you end up with one share for every three you owned, and thus so you would emerge from the reverse split with 400 shares if you started with 1,200.

In Regards to the Bitcoin Pricing:

The ICO's coin market capitalization -- the total value of all its coins -- stays the same before and after the reverse split. Let's conjecture Bitcoin has 21 million outstanding coins, a market cap at $37,508,913,830, a circulating supply at 16,455,825 give or take, and a coin price of $2,280 a coin. An execution of a 1-for-4 reverse split, reducing the circulating supply to 4,113,706.25 million. The coin's value remains the same, at $1,460,460 million, so now each coin is worth $9,120. So, if you owned 100 coins at $2,280 ea before, now you own 25 coins worth $9,120 ea. The total value of your investment remains the same: $228,000. Nothing about the ICO's bitcoin has changed except the number of coins available, and that by itself has increased the stock price fourfold...FOOD FOR THOUGHT! Root for a reverse-split...”//medianation

Was about time we would get to see the tides turning

Coincidentally the miners decided to signal for SegWit early THE DAY AFTER BTC BOTTOMS OUT :-/ Market manipulation at play? In my article yesterday I described how the BTC issue may come to an end very soon and predicted that BIP91 would take effect... It locked in overnight :-D!

Well whatever the case, the markets are responding in green so there is some trust being restored