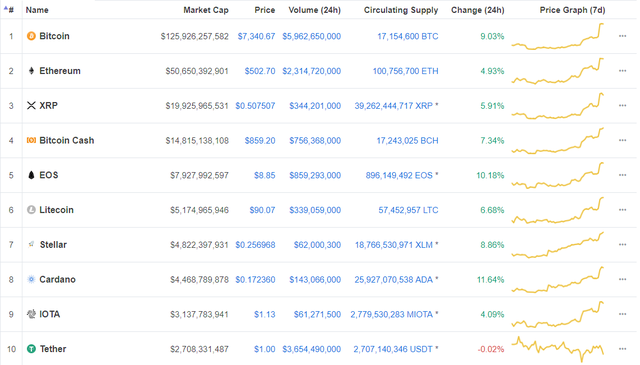

Bitcoin has gained 10% in the past 24 hours, according to Coinmarketcap, which topped $ 7.536, the highest level in five weeks.

The value of the Copper bitcoin continued to soar yesterday, widening its upside over the previous days. The most feasible news is that the giant asset management firm BlackRock has set up a working group to review cryptanalysis and blockchain, along with technologies to strengthen them.

Financial News is the first newspaper to report on BlackRock's move. BlackRock CEO Larry Fink later confirmed the information in an interview with Reuters. "We are deeply researching the blockchain," Fink said. However, he added that "there is no big demand for electronic money."

Fink also told Bloomberg that BlackRock is not buying into bitcoin because customers are not interested in this type of asset. That means that none of the $ 6.3 trillion of BlackRock's assets are invested in Bitcoin, Ethereum or any other currency. At the present time, BlackRock is just researching how the money works and to predict when the money can become a legitimate alternative to cash.

In addition, the following reasons caused Bitcoin prices to skyrocket:

Yesterday, Coinbase announced that US regulators would approve the listing of digital assets classified as securities.

Last week, Coinbase also announced that they are learning more about Cardano, Basic Attention Token, Stellar Lumens, Zcash and 0x.

At Goldman Sachs, the current COO David Solomon will move to the CEO role. Solomon is quite open minded with electronic money.

Line Japan will launch its electronic money trading platform called BitBox this month, however, it will not support the conversion from tokens to tokens in the US and Japan.

SBI Holdings, the Japanese financial giant, has opened its doors to traders in the nation's e-currency trading platform.