.png)

Bitcoin Reaches $5000, Testing New Heights

On April 4, CME Bitcoin futures had a record trading day (with 22.5K contracts volume). Google Trends also show a surge in interest in Bitcoin on April 2, when the price of currency began to move to upper mid-term values. This growth of Bitcoin also hooked up a large number of small investors. Typically, 40-50% of the wallets in the Bitcoin network are inactive, but this time, according to Bloomberg, since March 15, only 10% of wallets were inactive.

Another statistical note is the increase in average number of transactions per Bitcoin block. Trading volume also increased proportionately in the period under review. It looks like a duck, swims like a duck and quacks like a duck, so that all indicators uniquely describe increase in the price of the first cryptocurrency.

A representative of one of the most successful enterprises in this bear market, CZ, gave a positive outlook:

I guess this was true. Plenty of money ready to jump in, and in full FOMO mode.

CZ Binance (@cz_binance) April 2, 2019

Everyone will be in Crypto. Don't get left behind! https://t.co/rfvRS7uhGK

In general, growth is what we have at the moment. In addition to the market mechanisms designed to fool the trader aimed to pump/dump schemes, there are several semi-fundamental factors that can be listed - namely, the IEO hype (which is likely to last until a major lawsuit or question from regulators/or wave that will fade in a natural way), the ghosts of institutionals for which many exchanges are developing infrastructure (regardless of whether they want to go openly or quietly).

According to Oliver von Landsberg-Sadie (CEO of BCB group), the rise in the asset price was consistent with the algorithmic outlier:

’There has been a single order that has been algorithmically-managed across these three venues, of around 20,000 BTC. If you look at the volumes on each of those three exchanges—they were in-concert, synchronized, units of volume of around 7,000 BTC in an hour.’

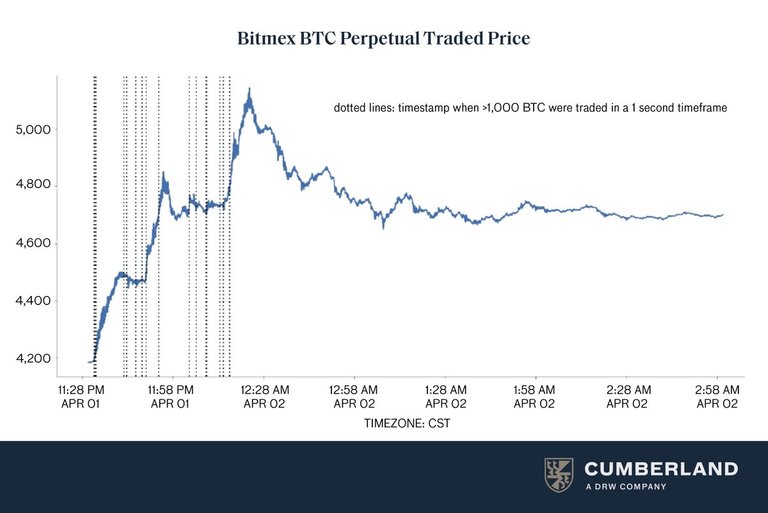

Spoofing or Reality? Cumberland OTC Reported on a Series of Large Bids (>1,000 BTC per order)

OTC trades remain a blind spot of the cryptocurrency market, however, this is a good place where whales can swim. So this time, probably, on the Cumberland OTC platform, the demand for Bitcoin among major investors has increased.

The exchange reported this on its Twitter account:

Desk Update: The post-trade analysis of Monday evening’s price action revealed a series of large bids (>1,000 BTC per order) within a 1 hour span, which appear to be actual buyers vs. forced liquidations. pic.twitter.com/UiuHLoCbPr

April 4, 2019 Cumberland (@CumberlandSays)

According to representatives of the platform, the next Bitcoin jump can occur at $5500 - $5800.

Some users also remembered such a phenomenon as spoofing. Spoofing on the exchange is the intentional placing of a big order on at a price definitely lower or higher than the value of the asset. OTC can also be used in the spoofing scheme. However, now there is no clear evidence to this effect. It is also unknown whether this market or any other platform is taking part in a spoofing at this particular moment.

China is Also in Trend: Bitcoin Tops Baidu Hottest Emerging Keywords

Here we have already written about the fact that Bitcoin has become the subject of interest for many Google users. The same thing happened in Asia: the number of search phrases containing ’Bitcoin’ in China increased just at the time when the price of the first cryptocurrency rushed up.

Thus, despite the regulatory restrictions, China, one of the most populated countries, is quite actively responding to news related to the growth of cryptocurrency. Slightly less active trend shows such countries as India and the United States. According to the latest data, investors from Nigeria, the Netherlands, Austria, South Africa and Switzerland could form part of the recent bullish trend. This is also reflected in non-market indicators like Google Trends.

Is Google Trends an effective indicator in crypto space? Typically, Trends are used to assess brand awareness, and, moreover, it can be quite effective: Google Trends indicators can be viewed even in the last hour. You can also determine how the dynamics of the popularity of ’branded’ queries that relate to products, product groups and brands.

Google Trends also reflect the interest in buying Bitcoin among retail investors. At the same time, it is not possible to make a clear correlation between the rates of currency growth and how often it was searched for.

Coinbase Is Preparing For ‘the Next Super Major Run-Up’

Coinbase is preparing infrastructure for a new bullish self-fulfilling prophecy: according to Paul Bauerschmidt, product manager for Coinbase Markets, the company is currently improving its matching engines, what can be interpreted as preparing a platform for better interaction with cryptocurrency assets while its prices and trading volumes will be increased.

’And I want to be able to do that at scale. From my perspective when I was at CME Group, whenever we would reduce latency, or increase the determinism of the underlying platform then we would see customers responding quickly and you could observe it in the way the market was quoted, the numbers of trades that occurred, and the numbers of traders'

Improvements, especially technical ones, are very good for cryptocurrency trading infrastructure. It is also likely that companies will increasingly be reminded of their brand, mentioning the growth of Bitcoin. If one wants company's name to be seen again, one can use 'Bitcoin growth' as an argument as to why the changes are being made. It can be worrying if companies will do this more often, and where such a media paradigm may lead.

US Congress Releases Anti-Manipulation Cryptocurrency Legislation

Representatives of the largest regulatory US institutions will soon come to a conclusion on two new bills relating to the cryptocurrency market.

- The 1st bill — H.R. 922 – Virtual Currency Consumer Protection Act of 2019, considers the manipulation of cryptocurrency prices.

- The 2nd bill — H.R 923. – U.S. Virtual Currency Market and Regulatory Competitiveness Act of 2019, It is based on the international and local experience of the United States in relation to the regulation of digital assets, and will mostly concern everything that is close to crypto exchanges, licensing and so on.

In the event that bills are fully incorporated into the existing asset oversight system, the rules of the game will change somewhat in US markets. At the same time, it is worth expecting that the discussed practices and analysis capabilities of crypto market/assets are still too new to be included in official legislation. This also applies to the section of market ’manipulations’ that are difficult to determine unambiguously.

CZ: the Launch of Binance DEX Mainnet Will Happen This Month

As announced by Binance CEO Changpeng Zhao during his speech at the Deconomy conference, the launch of Binance DEX may take place this month. In the same month, the launch of another cryptocurrency exchange Binance Singapore will take place.

The Binance Chain test network was launched back in February. Then the announcement aroused interest among the followers of the exchange.

Centralized and decentralized exchanges are often compared. Supporters of decentralization stay at their own view, while the largest centralized exchanges are trying to create new platforms where users could not transfer their funds to an outside agent, as Binance and others do.

Decentralized exchange does not require that users trust it with their money, and this is a plus. At the same time, trading on the blockchain has its own problems. Since so far little is known about the infrastructure of Binance DEX, it is difficult to clearly identify possible problems.

Ethereum Classic (ETC) Increased in Price due to Recent Details of the Upcoming Hard Fork

Ecosystem development coordinator of Ethereum Classic Donald McIntyre has published details on developers discussion timed to upcoming ETC hard fork Atlantis. The main idea of the Atlantis fork is that the Ethereum Classic blockchain will finally separated from the Ethereum's blockchain. Due to the fork, the team will develop PoW, but the transition to PoS will not happen. The described changes will not affect the amount of miners rewards, which, by the way, have already supported fork (2Miners and Ethernode are the largest mining pools).

’The proposed changes discussed were:

Spurious Dragon state-trie clearing.

Spurious Dragon contract-code size limit.

Byzantium EVM opcodes, namely REVERT, RETURNDATASIZE, RETURNDATACOPY, and STATICCALL.

Byzantium EVM precompiled contracts, namely addition and scalar multiplication on the elliptic curve alt_bn128, optimal ate pairing check on the elliptic curve alt_bn128, and BIGINT modular exponentiation.

Replacing the intermediate state root field in transaction receipts with the contract return status.

Change difficulty adjustment to target mean block time including uncle.’

PoW -> PoS transit is the far-reaching goal of the parent project. PoW does not require much computing power; to recieve reward, it is enough to have a large share in the PoS-system. At the same time, Ethereum Classic currently refuses such a vision, saving PoW.

Barclays, RBS Joined Blockchain Property Sales Test

The real estate sales sector is being revived thanks to new technological solutions. Thus, the Instant Property Network developed a platform based on the blockchain Corda, which allows to accelerate the process of selling housing, which will occur directly.

The test of the new solution attracted such major participants as Barclays and the Royal Bank of Scotland. Other participants, such as construction companies and representatives of the legal sector, also familiarized themselves with how the blockchain can be used in this industry.

’Property is an industry that is ripe for this, where a complex difficult process for customers could be made cheaper and more transparent.’

Being 'Amazon for properties', Instant Property Network can be used to capture a significant property market share, which requires improvements of technical and business processes.

We do not give investment, life or cooking tips. All investments must be carefully considered.

🏛 About 100 companies (including public favorites) joined INATBA to develop DLT-frameworks | US SEC posted framework that helps to find if coin/token is a digital asset or a security

💱 The maximum potential profit will be returned to BitMEX users suffered losses as the result of recent auto-deleveraging | Binance will open exchanges only in regions with clear and positive crypto regulation, for example in Singapore

💸 Users were indignant at the silent launch of VeriBlock trading on Bittrex International | MultiVAC IEO on KuCoin Spotlight completed in 7 seconds, rising $3.6 million total | Huobi Global will launch the 2nd Prime Trading on April 16, 2019 (attention - rules have been changed)

🛠 PayPal invested in blockchain startup: '(it) could benefit financial services companies including PayPal' | Bosch releases blockchain-powered refrigerator

📢 Elon Musk: 'Dogecoin might be my fav cryptocurrency' | Weekly Tom Lee: 'The fair value of Bitcoin right now is $14,000'

Congratulations @icotelegraph! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!