Sunny DecreeVincent Briatore on Youtube) both recently made videos talking about their negative feelings about technical analysis, going as far to say as it was essentially useless. Long story short, I've been on their case a little bit about how strongly I disagree(Vincent favorited the tweet), and today Sunny made a video giving TA a bit of a chance. This was my reply said video. I know my time spent writing it on his YouTube channel is mostly wasted, but perhaps less-so if I post it here too...@foodnature ( on Youtube) and @vincentb (

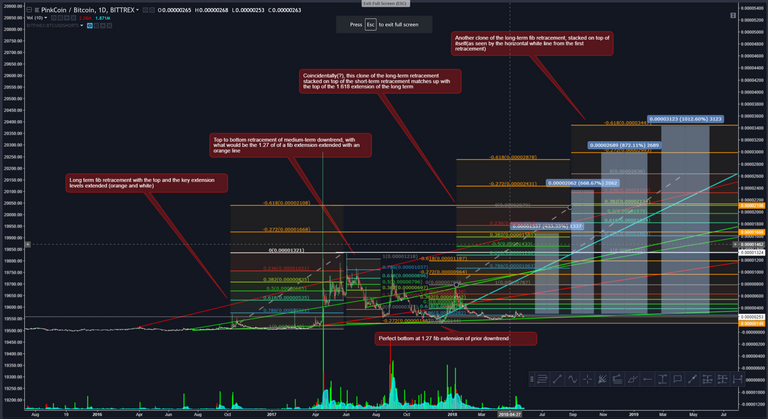

If you were to really start playing around with fib retracements and extensions you would start to be more of a believer as far as that goes, almost instantly. Of course no one can predict the future to a large degree of certainty, but if you choose the right impulse legs to look at, SO OFTEN price will reverse at the 1.27 or 1.618 extensions. And in the shorter term, there will be opportunities to sell at certain fib retracement levels/trend lines and buy back at certain fib retracements levels/trend lines on the way to your ultimate target(s) at one or both of the fib extension levels. Patterns like the Gartley pattern and the Cypher pattern can be very significant indicators too(with probable and sensible targets), which can only be determined by using fibonacci as there are certain conditions that must be met for the patterns to be legit, as well as the targets being set based on fib retracement/extension levels. http://stockcharts.com/school/doku.php?id=chart_school:trading_harmonic_patterns has some pretty good information about the conditions of the patterns and their respective targets.

In my ~1 year of using technical analysis quite successfully, I've also found crosses of LONG-term trend trends and LONG-term fibonacci levels to be EXTREMELY significant. If the price is significantly down from a cross with support building, often price will just rocket right up to it, and the same in reverse. If it's a "cluterfuck" of lines crossing, it acts as more of a magnet.

By the way, I've been watching BTCUSDLONGS and BTCUSDSHORTS very closely for months, of course using TA on the charts. TA on those charts are likely the best indicators for BTCUSD for me. Giving me confidence when BTC looks like crap(such as ~36 hours ago when I tweeted I thought we may have found the bottom of this correction around $7,400, partly thanks to those charts), and seeing BTCUSDSHORTS break a bunch of resistance lines would have the opposite effect. As only a small percentage of people bother to look at those charts, and the action in those charts seems to happen there BEFORE the action really happens in the BTCUSD chart(as opposed to the MACD and RSI which are lagging indicators), you have an advantage if you keep a close eye on them. Of course I like the RSI and MACD too, especially on the BTCUSDLONGS and BTCUSDSSHORTS charts, giving even more of an idea of exactly what's goin on. Trend lines drawn within the indicators(long-term, mostly), also A-OK :)

Glad to see you're starting to give TA more of a chance in your world. If you can get better than Tone(his methods are horrible, so that's not hard), and you were to show your success on your channel, your subscriber count would skyrocket even faster than it's going to anyway once crypto is all the hype again.

Of course the usefulness of technical analysis goes way beyond what I highlighted in the comment, but it's a start. The most useful thing about it for me, is having some idea of whether or not I should remain bullish or bearish on a certain certain asset, not necessarily(but definitely not fully excluding) predicting any certain high/low.

My tradingiview page for examples of price reacting to lines derived from TA)-@MyEmpireOfShit (

I agree on the usefulness of technical analysis to limit open and close windows for investments, make models to track your investment performance and other alike activities, but in the crypto realm I have to say that is not as important as you will take it in normal financial markets. Mainly because we have 1500+ coins that essentially performs according to whatever happens to the Bitcoin, and Bitcoin is not a fundamental stable standard to start from. Highly speculative and volatile, that has even more volatile consequences on all the other players in the market, which is mainly pump by not technical people, this is a market that is determined more by behavioral social economics and psychology than anything else.

I agree with almost everything you said, but most of the time if you really look close enough, especially in hindsight, it's easy to see the technical analysis signals that would have brought the particular coin to a particular level regardless of how much it is affected by the price of bitcoin. Alts have definitely been unfairly hammered on due to wall street, and their paths would likely have been much different if had bitcoin's growth in 2017 been more organic, but the situation has made the technical analysis stars line up for mind-blowingly extraordinary gains in the near future for so many of them.

Hey man, can you recommend any good technical analysis books to read? I’m still not convinced it works well in the crypto sphere, however, I would like to educate myself on the process to be able to test it for myself

High Altitude Investing on YouTube). I believe he took down a lot of his older instructional videos, but I believe it's still possible to learn most of the basics for free from his channel. Node Investor is another good one. Carl "The Moon" is pretty new but his videos are informative(especially for someone who knows nothing about T.A.) and he has been right more often than wrong from what I've seen. In general, I agree with his views of the world economy and cryptocurrencies, however some things I'm forced to take with a grain of salt in his case due to his apparent lack of experience and certain things I disagree about("Bcash is scam," namely). There's several more good ones I haven't mentioned, and I left out Tone Vays for a reason... other than that you can search YouTube/google for "fibonacci retracements/extensions," "chart patterns and rules," etc and easily get decent information on the specific part of T.A. you want to learn at any given time.I've never really been a book reader, and so far I haven't read any books about the subject, so I can't be any help there. Everything I've learned, which I know is nothing compared to the knowledge that's out there, I've learned from YouTube and google search. The first person I started learning from was @dalinanderson(

I'm inclined to agree with Richard Heart when he said in an interview with IvanOnTech that he thinks T.A. works even better in the crypto markets than it does in other markets, though I don't have enough experience to have much say in the matter, nor do I agree with his analysis concluding that "the bull market is dead"(he says that at the 30:00 timestamp in the video) back then in February. Another thing I agree with him is that everything got a LOT more difficult to predict when wall street started getting in, which is why his trades started horribly failing and he is salty lately. The quote about TA working better in crypto is at the 33:50 timestamp in the video.

I noticed that @luiggih mentioned she has read books about technical analysis, so perhaps you might go ask her.

Wow thanks very much for the in-depth reply! Looking forward to learning more about it!