More than half of the current year (2018), but Mark Yusko, manager of a hedge fund, has not retreated from his expectations that the price of the Betcairn will reach a new high this year, and that the first rocket rise in the price of Bettquin will be in less than a decade of Time.

The price of the betcouin may reach $ 500,000 within six years

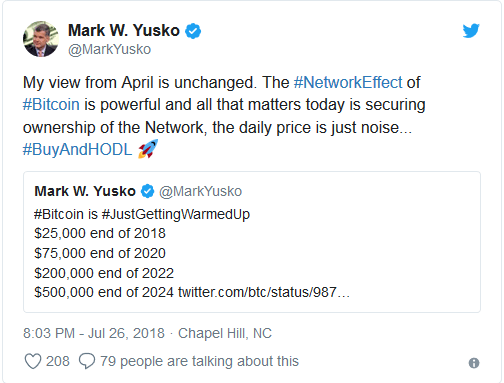

Mark Yusko, the founder of Morgan Creek Capital Management in North Carolina, wrote in a Twitter tweak that the price of the Betquin could be $ 25,000, as a possibility, at the end of the year. Initially, Yusko put this forecast in April, adding that he expected the price of the betcoin to reach $ 75,000 by 2020 and $ 200,000 by 2022, and eventually it would exceed $ 500,000 by the end of 2024.

Last October, Yusko predicted that the price of the Betquin could one day reach one million dollars for every single coin, although he said he did not expect the Pitcuin to reach this achievement in at least 10 years.

Such predictions put Yusko among the most optimistic people about Betquin, but he says his predictions are due to the power of the "network effect," the theory that the value of the telecommunications network increases with the number of users.

The price of the Betquin fell below $ 8,000 on Thursday after the Securities and Exchange Commission (SEC) rejected the second attempt by Winklevoss to include a Bitcoin ETF fund on an organized stock exchange.

Although the decision was not a comprehensive decision on all trading funds, the reason for the committee's decision casts doubt as to whether it will approve any other petrochemical funds in the near future.

Despite these downward pressures, the Betcairn managed to return to above $ 8,000, and the price of Bitquin was relatively stable at the end of the week at $ 8200.

Commenting on recent moves to the price of the Betcoin, Yusko said the daily volatility is "just a noise" because "all that matters is securing the ownership of the Betcoin network."

Earlier this year, Morgan Creek Capital began raising capital to launch a $ 250 million hedge fund. Anthony Pompliano, who runs Morgan Creek's digital asset business, said recently that he and his partners "never sold any investment" from one of their encrypted digital currency boxes, adding that the industry was a "long-term" game that would reward investors who knew Patiently.

Great Analaysis Buddy....

i am new in steemit Please Follow me and Support Me in the recent post