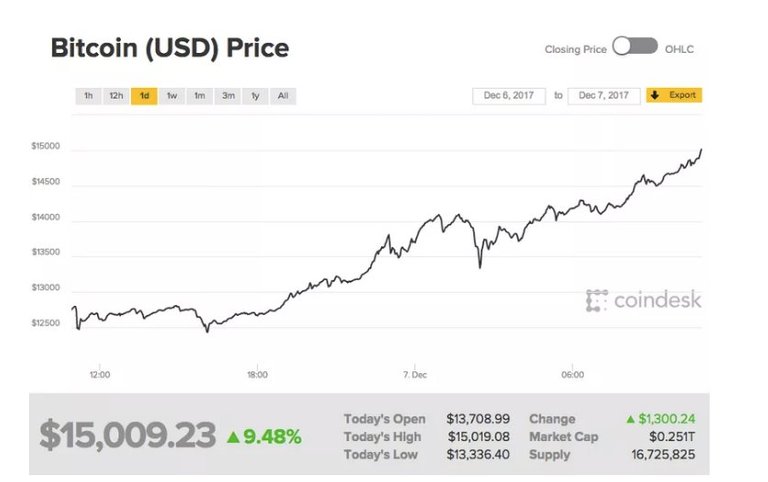

Bitcoin's esteem crossed the $15,000 edge out of the blue today, denoting another turning point in its confounding rising. As of late, the digital money has experienced an amazing increment in esteem; surging from generally $3,500 in mid-September to its present cost. Also, toward the begin of the year, a solitary Bitcoin was worth under $800.

What occurs next is impossible to say, and most examiners are joined just in their vulnerability over the digital currency's future. Bitcoin long back quit being helpful for really purchasing things (halfway due to its soaring worth and incompletely in light of painfully moderate exchange times), so the inquiries confronting theorists are: is this an air pocket? Also, assuming this is the case, when will it blast?

A few brokers figure we're drawing near, and are getting ready to short Bitcoin; that is, make wagers that its esteem will diminish later on. "[It's] one of the best shorting openings ever," digital currency Lou Kerner disclosed to Bloomberg not long ago. "You have a considerable measure of extremism, and many individuals, including me, who believe it's the best thing to ever occur ever. You have many individuals who believe it's an air pocket and a Ponzi conspire. It turns out them two can't be correct."

Despite the fact that the general pattern for Bitcoin's valuation is just up, the cryptographic money has been to a great degree unstable. On November 29th, for instance, its esteem fell 20 percent in under a hour and half; dropping from over $11,000 a tick above $9000. For genuine devotees, such blips are just transitory, however cynics alert that any dive could wind up being changeless. In the wake of intersection $15,000 prior today it's esteem immediately plunged down to around $14,800.

Bitcoin's soaring valuation has likewise carried with it another issue: vitality costs. It takes huge measures of energy to manage the Bitcoin arrange, and, as per a report from Ars Technica, it's assessed that the cryptographic money as of now devours as much power yearly as the entire of Denmark. Anticipating precisely how this utilization will rise or fall later on is troublesome (it relies upon things like the rate at which new bitcoins are mined and the quantity of exchanges), yet given that Bitcoin just presently has use as a theoretical resource class, it appears to be unsustainable.

In the interim, money related specialists are attempting to understand the wonder in general. One investigator cited by the Financial Times, Walter Zimmerman, proposes that the most ideal approach to take a gander at Bitcoin is as a ludicrous computer game without any limits. "Clients of different monetary forms discover utility in a steady esteem. Be that as it may, not here in Bitcoin world," composes Zimmerman. "The truth of Bitcoin is that clients are likewise players. Also, the goal of this amusement is the most astounding conceivable score." But how much higher would it be able to go?

Bitcoin has left Jupiter!