Hey traders and/or investors alike!

Have you ever wonder if adding another new crypto to your crypto-portfolio actually adds or reduces risk?

Do you remember last time when all your cryptos crashed together and you were in pain?

Is your crypto-portfolio diversified?

Here might be something that could help you manage risk and avoid concentrated positions. If you have studied statistics in school you might have heard about correlations.

No worries if you don't recall correlations. Here's in layman terms what correlation represents:

- Correlation describe the relationship between two variables/assets

- Correlation ranges from -1 to +1

- Closer correlation to +1 means the two assets have position correlation so and up move by one asset is likely matched by an up move by the other asset, and vice versa for down move

- Closer correlation to -1 means the two assets have inverse correlation so and up move by one asset is likely matched by a down move by the other asset, and vice versa

- Correlation of 0 means that's no statistical evidence that a correlation exists

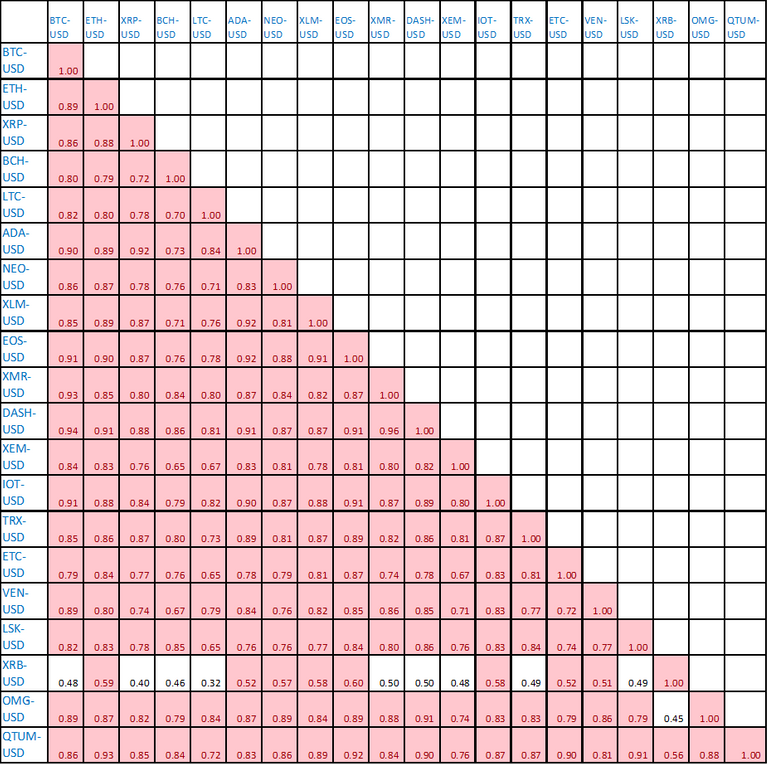

Here's a correlation matrix of the top 20 cryptos by market cap that could help you see clearly what cryptos are correlated.

(recent date range: 2018-01-25 to 2018-03-10; correlations calculated based on 30 daily returns)

I am sure you are not surprised by the large number of correlations very close to 1!!!

But keep in mind the these could change in the future and pay attention to those with low correlations for risk management and diversification purpose ;)

It would be prudent to avoid simultaneous positions with correlations very very close to 1 because in terms of risk these positions are statistically the same thing.

Hi, I just upvoted and followed you :)

My recent postFollow back so we can help each other succeed! @hatu