We all recently came across a deep correction of approx 70% from all time high. Honestly that was not uncommon for the godfathers who have been holding BTC since or close to its birth. Below is just a brief snapshot of some serious corrections BTC has gone through and came out strongly each time.

I have heard a lot of people saying "I wish I would have known about BTC during its initial stages in 2009/10", however how many of these people would have actually held BTC during its turmoils remains questionable.

Anyways past is past, "DO WE STILL HAVE AN OPPORTUNITY?" is the question that need to be answered....

We still seem to be in the mid adoption phase and I personally see a lot of potential for the entire crypto asset class to grow to atleast 3 trillion. But that wont be in a straight way up and will be accompanied with correction and panic moments. Which coins will be part of the future boom depends on its technical factors and/or mass adoption

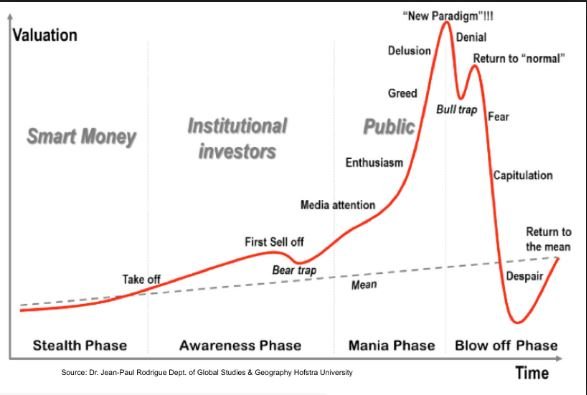

Every new asset/technology/product will go through a life cycle. The adoption phase is always best period for risk seeking investors to move in and capitalize on the opportunity.

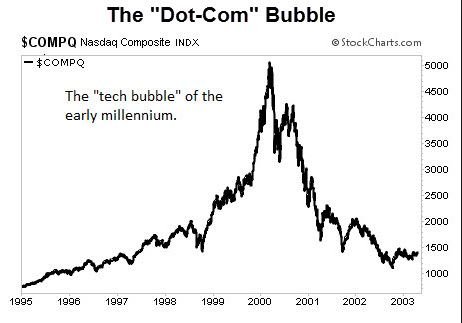

An example of the past includes the dot.com era where every company was trying to ride on the trend of internet and most of them failed to sustain for long. However its wrong to say that all investors lost their money, there were smart investors who knew either moved out at the right time or the other set who held on to fundamentally strong companies.

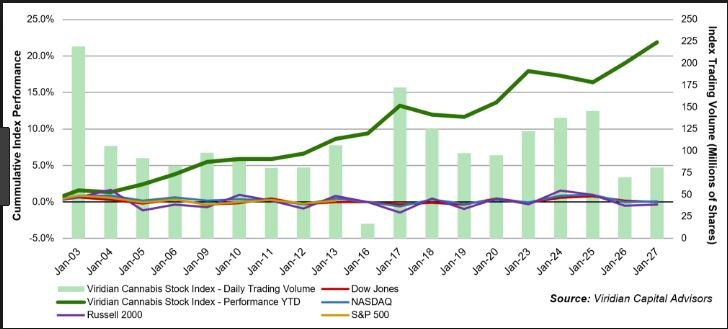

Current adoption phase example can be the Marijuana sector boom in the US and Canada which has given exorbitant returns to people atleast till now, future to be seen.

I have highlighted few positives and negatives based on my personal knowledge/skill/experience which could possibly drive the BTC prices either way

POSITIVES

Lead Runner: The acceptance of crypto by the regulators would go long way mainly for BTC inspite of its technical limitations followed by the other top 2.

Opening of more Futures market: News of NYSE listing BTC futures would cause a rally similar to CBOE and CME

ETF clearance: BTC ETF clearance by SEC will be another big positive for not just BTC but the entire crypto market.

Stock Market Deep Correction: When bears will control the stock market all the free and easy money or some part of it available could possibly flow into crypto currencies as there are lot of new investors sitting on the sidelines

NEGATIVES

Technical Issues: Technical limitations in BTC could be a big hindrance for its future as in long term. There are enough coins out in the market which are much most faster and effective when compared to BTC

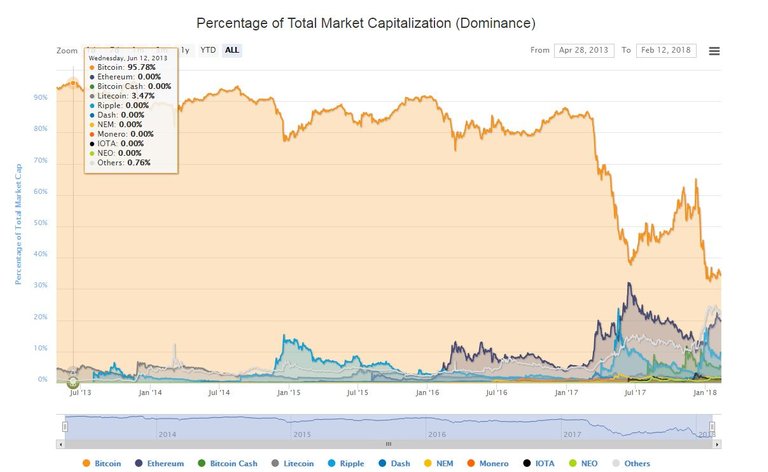

Reduction in Dominance: As the below chart suggest, BTC is losing its dominance in the overall market cap due to many reasons. However it still holds 35% which is still a long way for other runners to catch up.

Futures Market Movement: Future trend of BTC will possibly be determined by the institutional investors on the futures market of CME or CBOE which will be pure speculative play without having to hold the asset.

Past and Future Forks: Forking is not bad a all as long as the new technology or coin generated adds more value than the previous one. However will the original BTC still remain the dominant one is questionable.

All the above are my personal opinion and in no way any advice.

In my next article i plan to write/highlight where BTC may be heading based on Technical Analysis.

Thanks for going through my article....

What a good read! Can't wait to see your Technical Analysis.

Congratulations @investbuddy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP