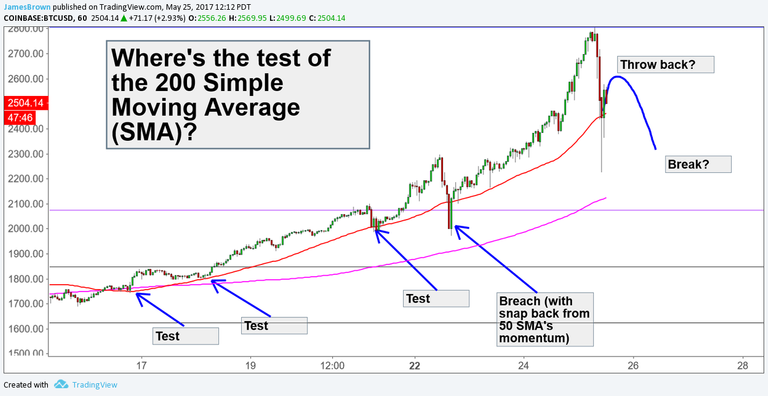

I think we're due for a test of the 200 daily simple moving average (DSMA). The 50 DSMA (red line on the hourly chart for BTCUSD, shown below) has been tested extensively and has held up well, but weakened on the last two tests (with momentary price breaches, leading to "throw backs"). This is generally my sign that the next test will be a failure.

The next major dynamic support could be the 100 DSMA (not shown on the chart), but more likely the 200 DSMA (pink line on chart).

Looking like the test may happen pretty soon. Have some odd price action happening lately with an intermediate higher high and currently matching the last two lows. We could be forming a head and shoulders top with the left shoulder and head already in (awaiting the formation of the right shoulder).

https://www.tradingview.com/x/wiIpGVzn/

If we forget about the wicks, it's forming a "mega-phone" pattern.

Always good to keep an eye on the SMAs.

It's possible that I'm wrong, but when you have an hourly chart as you have in your image, the SMAs for the hourly won't match the daily SMAs.

Here's my daily chart showing the current 200 SMA at ~1100 (the orange line):

https://www.tradingview.com/x/hTIKXsLn/

Would be happy to discuss more. I only have about a year of technical analysis under my belt at this point, and just started charting the cryptos, so I'm open to feedback.

Agree. Moving averages give us an idea about the short to long-term momentum within the market. For the hourly, I consider the 50 SMA to be the "short-term" moving average and the 200 SMA the long-term moving average. I always know to stay away from a trade if it's trading too far above the 50 SMA and I start to get a little suspicious if it goes too long without pulling in for a test of the 200. The SMAs also work great for signaling whether it's an opportune time to trade a breakout (from pattern or support/ resistance) or not.

You're right about the hourly and daily SMAs not matching. The number determines the "look-back" period, so the 200 SMA for the hourly accounts for the average of the last 200 hours while the daily accounts for the last 200 days.

Exactly. Thanks for the clarification. I think it helps those who may be newer to trading. I doubt we go right back to the 200 day SMA quickly, but could definitely see a bit of consolidation coming up allowing those SMAs to "catch up" a bit.

Happy trading!

Yes, in a strong bull market that would be the usual scenario for the 200 SMA test. We could form a symmetrical or ascending triangle (which bitcoin is famous for) allowing the 200 to catch up. The closer it gets, the more it supports a breakout of resistance.

Interesting, thanx!

You bet :)

Great analysis. I have been tracking btc via the U.S. exchange traded tracker GBTC. Altho there was no short term sell signal as of yet, the chart is showing as a short term confirmed top by my indicators. And there are lows below that need to get taken out down to 160.00. I think that would translate to a bitcoin price somewhere around $1500 or so. If this ends up being the case I might just buy lunch for the person who has the "guts" to say >>> "Buy the pullback!" at the right time. We might just see euphoria morph into outright panic...all in a 7 day trading period. But that's what happens when you actually "think" the market in bitcoin is different than any other market. It's all a matter of fear vs greed. And rarely do we see greed reach the euphoric levels we just saw in bitcoin. The GBTC chart. It can still save itself with a short term buy signal. But a short term sell signal at a lower high would be absolutely deadly. I will update the GBTC scenario at my blog here.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=gbtc&x=35&y=8&time=18&startdate=1%2F4%2F1999&enddate=2%2F18%2F2017&freq=7&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1024&lf2=2&lf3=8&type=2&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

Yes, I wouldn't be surprised at all it BTC goes down to test somewhere between $1,500.00 and 1,800.00. I'll be buying a bit if it reaches there, too (good value buys, IMO).

You meant to say "maybe" you'll buy then. There is also a chance you'll be too skeeerd to buy. No need to be tho. Just follow my updates.

Don't push the maybe, baby :P

I'm pretty fearless when it comes to trading the markets, meaning if I have a plan to buy a deep retrace, 99 times out of 100 I stick with it.

I appreciate your offer, though, and I'll give you a follow so I can check out what you got going on :)

LOL I apologize...sir. :-) I didn't realize who I was spewing at. Bingo! You are on my watchlist also. :-)

GOOD ONE!!!

great information...

Thank you.

u r welcome...

Nice analysis, I agree, adding you to my follow list this minute.

thanks

edit: ha, you were already there

Haha. Thanks :)