The current crypto bear market is a challenge for traders, especially for anyone who entered at the end of last year during the all time highs and is now nursing heavy losses.

We can’t control the market and price fluctuations, nor can we effectively predict where this bear market is likely to end. But we can control how we respond to the market, and use this time before the next bull run roars into action.

Napoleon Hill said that ‘in every failure lies the seed of an equal or greater opportunity’. This is definitely a belief shared by many successful traders. Here are a few ideas on how you can make the most out of the bear market, and use it as an opportunity to improve as a trader.

Step 1- Create 10x gains in your knowledge now, for 10x financial gains later

Any idiot can make money in a crypto bull market, the hard part is making money consistently and holding on to those gains.

The best traders don’t get stressed about each individual trade because they know the market is chaotic and unpredictable. Instead they focus on having overall discipline, consistency and quality analysis, because they know this will lead to greater financial gains over time.

This bear market is a great opportunity to deep dive into honing your crypto skills and knowledge, which just wouldn’t be possible during a bull market when the pressure's on to make dollar every day. Invest in yourself now, and reap the rewards when the trend changes.

Tips & Resources

I recommend a focused approach that zones in on the four pillars of successful trading -

- Emulating the psychology of successful traders

- Technical analysis (learning to read charts)

- Fundamental analysis (evaluating the merits of projects)

- Risk and capital management

Psychology - I highly recommend the book Trading In the Zone by Mark Douglas. This is a powerful blueprint for the mental processes of the best traders, showing how they stay calm and cool headed in both bear and bull markets. Available as an ebook

Technical Analysis - This is a topic that could fill unlimited bookshelves, but for an easy to understand guide to the fundamentals, I recommend CryptoCred’s YouTube Channel where he has covered the main building blocks - Support/Resistance, RSI and Volume.

Fundamental Analysis - There’s a good guide to this at Master The Crypto, but I also suggest the book One Up On Wall Street by Peter Lynch. This classic is targeted towards stocks and shares traders, but the core strategies can be easily applied to crypto.

Risk and Capital Management - I recommend CryptoGat’s video on risk management.

Spending just one hour a day developing skills in each of these areas, will put you ahead of 98% of the traders in this space, and will give you an edge when the bull market returns.

Step 2 - Research projects to buy when the market consolidates

Bear markets generally end with prices going a bit flat and moving sideways for a long time, before eventually rebounding and roaring back into life (usually when the majority of traders have given up and gone back to their job at McDonalds).

This ‘consolidation’ period is a great time to buy up some new positions. Then when the next bull market comes, you can essentially sit back and relax and simply sell off your holdings as the prices go up.

You just don’t have the luxury of time to carefully research and select positions in a raging bull market, this is a nice chance to slow down and discover tomorrow’s gems.

Tips & Resources

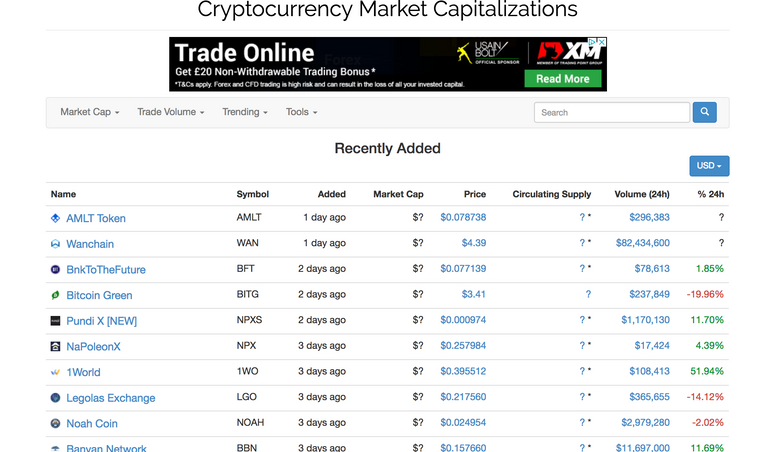

Go to Coinmarketcap, select ‘Trending’ and then filter by ‘Recently Added’. This is a great way to see what coins have recently entered the market, and might be worthy of research.

How I Research Low Cap Cryptocurrencies by Crypto Rand is a great reference.

Coincheckup can be used to gather useful stats and figures for coins that you’re in the process of researching, it collects price action, articles and analysis in one place.

Step 3 - Margin Trade Bitcoin's price movements

Margin trading is one of the few ways you can make money from Bitcoin and other cryptos dropping in value. You are essentially gambling some capital on the direction of the price action, and can even borrow capital from the exchange to add to your bet, for higher profits.

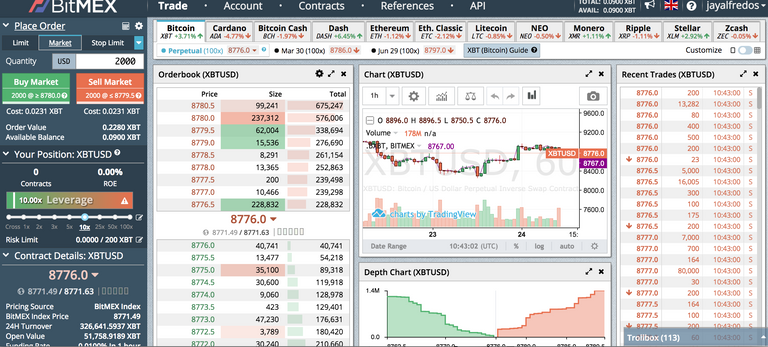

Bitmex is the website most people use to margin trade Bitcoin, this is a very good site and you can start margin trading with only a small amount of Bitcoin. However I would not suggest margin trading for most traders, unless you know technical analysis and can truly accept risk.

It’s very close to pure gambling and you can permanently lose all of your capital if you don’t manage risk correctly, or the prices goes against you too severely (aka ‘being liquidated’).

With that said, margin trading is great to study in a bear market because it will allow you to see what’s really going on in the markets. Fortunes are being made on Bitcoin’s price declines, and crashes can be a big payday for anyone who is ‘shorting’ (betting against) cryptocurrency.

Tips & Resources

If you do decide to margin trade, here are three tips for success.

Borrow small amounts of capital from the exchange, to lower your risk level. If you only use ‘low leverage’, Bitcoin’s price can fluctuate dramatically without you being forcibly ‘liquidated’. This allows you time and space to eventually lock in those profits.

Use TradingView to plan your margin trades, instead of the Bitmex chart. I usually add horizontal lines to the chart to plan the trade entry, the target profit area, the liquidation price, and a stop loss. Then it’s easy to see how much risk you’re taking on.

Be quick to cut your losses. Average traders focus on “being right”, excellent traders know and accept they often will be wrong, and are quick to limit their losses.

I highly recommend this guide by Edward Morra which is a really good, simple breakdown of margin trading.

Also these videos from Crypto Rampage will help you to set up and understand Bitmex.

Well that’s it guys. I hope you enjoyed this article and it was useful in looking at the bear market as an opportunity, not as a terrible misfortune! We will all get through these dark times and emerge stronger and better traders.

If you enjoyed this article please consider sharing on Twitter or smashing that upvote button, it’s a simple and quick way to help me out.

Thanks,

Jay Alfredos

Congratulations @jayalfredos! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @jayalfredos! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIt would be great to see you at the London Crypto Currency Show on 14th April! The following projects are coming to present:

Read their blog about the show:

Read their blog about the show:

Read their blog about the show:

Read their blog about the show: @utopian-io @esteemapp @stach @steempress

Also @allasyummyfood, @stephenkendal, @anarcotech & @starkerz will present. The event doors open at 09.30am and the Steem Project presentations start at 10.15am and finish at 11.30am.

There will be loads of cool steemians at our stand at the event all day where there will be presentations on the hour until 16.00. The after party starts at 17.00 at the Novotel Hammersmith.

See some blogs about the event HERE & HERE

Congratulations @jayalfredos! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!