On August 1, 2017, Bitcoin’s legacy blockchain was split, introducing Bitcoin Cash to the world. While Bitcoin Cash’s (BCH or BCC) potential is highly debated, its price movement since the split has caught a lot of attention.

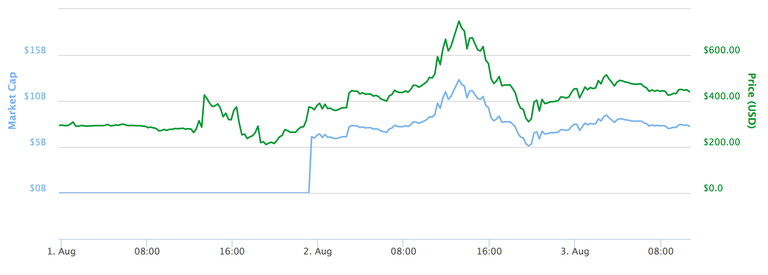

During its small stint on the exchange, Bitcoin Cash traded around $210 levels, then shot up to double its price to $440. It then saw highs of $747 before dropping again to $310. Its price was trading at $440 levels as of this writing. The impact of its arrival was evident by the redistribution in the overall market capitalization.

Bitcoin (BTC), while hovering steadily at $2,700 levels, lost some dominance. The split gave boosted Ethereum, which has maintained its price around $220 levels since the beginning of August. Bitcoin Cash replaced Ripple to become the third-largest cryptocurrency in terms of market capitalization. “Bitcoin Cash has performed well with a growing number of exchanges supporting this altcoin. At current prices, holders of Bitcoin essentially received a sort of 17% 'bonus' from this chain split, with Bitcoin price still holding steady,” said Bobby Ong, co-founder of CoinGecko.

Regina Lai, Overseas Commercial Director at sosobtc.com, agreed that Bitcoin Cash is gaining momentum. "From what we are seeing with our readers and the wider Chinese crypto community, I wouldn't be surprised if we see Bitcoin Cash become as valuable as Bitcoin," Lai told Investopedia.

The overall cryptocurrency market capitalization is $101.93 billion, out of which the top 10 digital currencies dominate 87.5%. Bitcoin currently has a market capitalization of $45.38 billion. Ether has $21.33 billion, Bitcoin Cash (BCH) is at $7.21 billion, and Ripple is at $6.67 billion.

Litecoin occupies the fifth spot, with $2.25 billion in market capitalization, while NEM (XEM), Ethereum Classic (ETC) and Dash (DASH) have 2.08 billion, $1.44 billion and $1.37 billion, respectively.

These eight cryptocurrencies have a market capitalization in billions totally, to $87.73 billion, or 86%. The other two cryptocurrencies in the top 10 are IOTA (MIOTA) and Monero (XMR). (See also: What's Bitcoin Cash And Where the Heck Did It Come From?)

In 2017, the price movement in Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), among others, has kept investors and traders actively involved with cryptocurrencies. However, the issue of Bitcoin’s block size, different upgrade solutions, failure to reach a consensus, and fear of a hard fork have been making headlines lately. The failure to reach a consensus resulted in a hard fork that has resulted in the creation of two versions of Bitcoin: one is supported by the majority and is adopting SegWit as a solution to the block size issue. The other is Bitcoin Cash. (See also: Bitcoin Crosses 50% of Overall Market Cap Ahead of Hard Fork)

All Bitcoin holders are receiving Bitcoin Cash in equal amounts following the split, and the decision to withhold such "distribution of Bitcoin Cash" has brought Coinbase, a prominent Bitcoin exchange, under fire. It published its clarification on the subject.

Interesting stuff! Personally, I think Bitcoin Cash will wear off. The limited block size was a real issue and unless Bitcoin Cash has its own solution, it is just a bad (or less good) version of Bitcoin. And as you say, the majority stays with Bitcoin. The fact that the price jumped to $700+ is pure speculation, if you ask me. People were hoping Bitcoin Cash would jump to Bitcoin levels, but over the long-run I expect them to realize this won't be the case.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.investopedia.com/news/bitcoin-cashs-price-movement-will-it-last/