Happy Sunday SteemIt Readers:

The following is NOT financial advice. This isn’t even financial meanderings in your direction. This is simply what I’m doing and odds are it isn’t even that smart.

Friday I tried using the methods in The 1 Hour Trade by Brian Anderson. It really didn't work for me. I'm pretty sure I don't really understand the method even though it seems simple. There are just too many good reviews on the book on Amazon for it to be the method. It's me--I may try it again later, but I think I'm a little gun shy now.

I didn't keep notes on the trades like I should have so I can't even go back and try to figure out what I did wrong. I'll try to do better. I tell you about this fiasco on Friday because you'll see a few new cryptos in my list today.

Yesterday nothing changed for me. I sold nothing, moved nothing. I watch BBQ Pitmasters and Smoked all day envying their mad grilling skills.

This morning I’m going to try to just jump right into my chart analysis.

Everyone comments on Bitcoin, so I guess I should too. I try not to worry about it because I do use it as my token of utility for trading. I’m not a Bitcoin evangelist. That said, it’s value does effect how much fiat money I can one day take out.

This is a daily chart of Bitcoin’s price action. It is showing bearish trends in all of the Ichimoku indicators. That said, if you’re into the small bumps since we crossed the Tenkan it is pretty likely it will make its way up the Kijun at $7197 IF it does it fast. If it doesn’t make it there by July 23rd it will hit a resistance at the bottom of the cloud first. By August 3rd that cloud resistance falls to where we’re at right now--$6745.

By the look of the cloud I would even argue that resistance will keep falling for a while. It could also stabilize. I never count on NASA, so I’ll never call for the moon in a bearish cycle unless the indicators are clear. All I know is it looks like a bumpy ride for Bitcoin for at least another 26 days until and unless some outside factor causes an abrupt change in price action. I think we all know that the big banks are trying to come into the space, but we have a saying in my neck of the woods—don’t count your chickens until they hatch.

Good news on BAT for me today. We broke through the cloud. The Stoch RSI is also climbing. If the trend continues I will probably sell it on Monday or Tuesday. Definitely a lot sooner than I thought. I may even jump out this afternoon before we hit that kumo twist tomorrow. I should be taking a little bit of profit in doing so.

Despite the downward price action BNB is still in a bullish trend. I also don’t mind holding onto it because it is another utility token for me. It’s a great way to pay reduced fees on the trading platform. That said, it is 9 am EST at the time of this writing. That means that today’s candle and volume aren’t accurate for the day. We’re already at Friday’s volume. In short, we have a real possibility of movement today. It may not be a lot of movement, but it just might be enough.

In other news, I saw on a YouTube channel the BNB burn is coming up on July 18th. Even if she jumps in the next few days I probably won’t sell my excess. I want to see what the reduction of the circulating supply will do to BNB.

QKC could not be at it’s top, BUT it’s high enough for me. Its RSI is high and it’s crossing the Tenkan. I could wait for the absolute top, but I’m not that greedy. I placed a sell order as I’m writing. I bought in two days ago at 0.00001204 BTC and the sell order went through for 0.00001388 BTC. That’s a 15.2% gain. I don’t own much of any of my cryptos, but I’ll take that gain any day of the week.

Ripple is still down. If I didn’t know that it has a ton of practical applications and isn’t going anywhere anytime soon I’d cut my losses and buy. As it is, I’ll just wait. You can’t see the end of the cloud, but I can on TradingView.

That kumo cloud is staying bearish for the next 26 days. In short, XRP just signed a lease in my portfolio. I refuse to just unload a crypto that could spike at any time due to outside forces. Yes, you could argue that could happen to any crypto—but let’s be honest, this one is the one getting attention from banks and governments for use in their systems. It kind of makes it more probable that it could happen in my head. I promise that its not all the XRP worshippers that I follow on twitter.

MFT is another one that I got and I’m selling. Could she go higher? Absolutely!! We just don’t have enough chart action to tell me. I’d rather get out, take my gains and not stress over it. I paid 0.00000235 BTC for it two days ago. I just sold it at 0.00000308 BTC. I will absolutely take my 31% gain and go home a happy camper.

I’m sure people much smarter than me know when I crypto is going to drop like a rock, but I’m not one of them. I’d much rather take my smaller gains and get out safely. That is just my line in the sand. It’s not wrong if yours is a lot farther out.

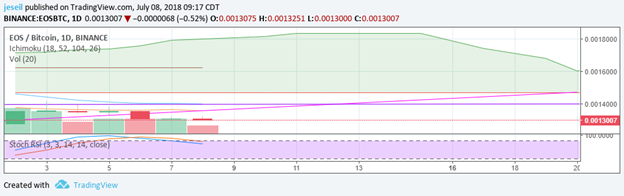

EOS is my last hold over from my stupid test this week. I bought it because of a volume spike in the 5 minute chart. I was trying out that new method…it didn’t end well. I ran right back the Ichimoku because I can understand it.

So, here I am, holding onto it. If I sold now I’d take a loss. I’m looking for a lot of sideways action as the cloud and TK are cancelling each other out. The cloud is bullish. The Tenkan is bearish. Who knows, luckily I don’t have much tied up in it if it decides to do a swan dive and get itself delisted.

So, it looks like I’ll be buying at least two new cryptos today. I work my way down the top volume stocks until I find what I’m looking for. What I’m looking for after a lot of thought and trial and error is a crypto in a bearish trend with a Stoch RSI below 20. I am not going to buy something I already have some of and I’m not going analyze everyone that I choose not to buy on this post. There are just too many because I’m getting picky.

Ethereum is not perfect for me, but it’s definitely good enough to take a chance. The price is not much higher than when the RSI had dipped. I know we’re not really suppose to buy in the cloud, but it’s been in the cloud for two days and is continuing to move in the same direction—towards the Tenkan.

I would have liked to have bought it in the end of June, but I don’t mind catching it now and riding it the rest of the way up. It could drop and hit the bottom of the cloud, but I look for it to chase the Tenkan. I plan to hold it until the Tenkan and Kijun cross and the RSI spike while the TK are bullish.

Let me clear, I am gambling. I really am. The RSI is spiking now, but the other indicators are not where I want them. I think it will keep going up, but there are no guarantees.

Bitcoin Diamond looked good at first glance, but when you go backwards it has basically been flat on the daily charts since it launched on Binance. I don’t know why it’s spiking, but I’m not chancing it. I know past performance is no indication of future performance, but it is a best guess.

I picked up a small amount of NEO. It’s actually in my sweet spot for everything but the Stoch RSI. I fully expect to hold this one for at least 30 days. The 26 day cloud continues to show bearish. I’m okay with that. For right now, the Tenkan can act as a support.

I’ll hold it until I can jump out above the cloud with a high Stoch RSI.

My final buy of the day was some Ontology. The Tenkan and Kijun are showing bearish, but the future kumo cloud is bullish. This one is kind of in my theoretical sweet spot. The Stoch RSI is low, it’s below a bearish Tenkan.

I’m looking at the cloud and thinking it doesn’t have much choice but to cross the cloud when it starts interacting with it on July 16th. I’ll be holding it at least a week or two, but hopefully it will get me a decent gain.

I was going to try to do this once a week, but this is one day's worth and it's WAY too long. I will have to do this every day I guess.

I am more to open to any of your suggestions. If you think I’m doing this wrong, feel free to tell me. I can’t promise I’ll heed your advice, but I will read it. All I ask is that you don’t lose your shit. This is my portfolio, not yours—so don’t expect me to freak over the same things you will.

The next big day of buys I’m looking at will be Tuesday or Wednesday. That’s when the Bitcoin I bought for this month clears Coinbase. Wish me luck. I need it!!

On a final note I want to provide a few thoughts on SteemIt. I love it so far. The vast majority of the articles are great and I absolutely love that I can support my favorite YouTube influencers when they post on here. That said, you need to be careful. I don't fully understand the platform in some respects.

People are posting stuff that a simple google search prove to be fiction. I'll give an example. The other day I saw a guy provide a quote from Bill Gates claiming he said Bitcoin was a great buy. I simple Google search shows Gates is still dead set against crypto. It was a good article, but for me, when you start making up quotes to reinforce your premise--it invalidates it all.

My problem is that people still upvoted it. They upvoted it because it was what they wanted to hear. They upvoted it without doing further research themselves. I'm just as guilty of this practice, but it worries me that people who are reading articles about crypto are not doing basic research.

It's their money to lose, but if enough people do that then it could effect the whole market. I'm not trying to be the hall monitor. People are totally allowed to post and say whatever they want. That said, I am allowed to worry. I just hope if you've made it this far on my post you can take that worry, not as an insult, but as my hope for you. I hope you do the research.

We can all be wrong, but there is a difference between being wrong because you're wrong and being wrong because you just made it up as you went along. I sincerely hope you make your financial decisions on more than a SteemIt post--especially if it's my SteemIt posts.

That was good @jeseil