MORNING STAR / EVENING STAR

What does it look like?

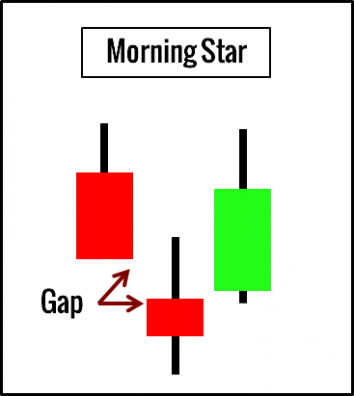

Both star patterns are three-bar patterns.

In candle-speak, a star refers to a candlestick with a small body that does not overlap with the preceding candle body. Since the candle bodies do not overlap, forming a star will always involve a gap. Thus, it is uncommon to find Morning Stars and Evening Stars in intraday charts.

A Morning Star comprises (in sequence):

A long bearish candlestick

A star below it (either bullish or bearish)

A bullish candlestick that closes within the body of the first candlestick

An Evening Star comprises (in sequence):

A long bullish candlestick

A star above it (either bullish or bearish)

A bearish candlestick that closes within the body of the first candlestick

This pattern is similar to the three-bar reversal.

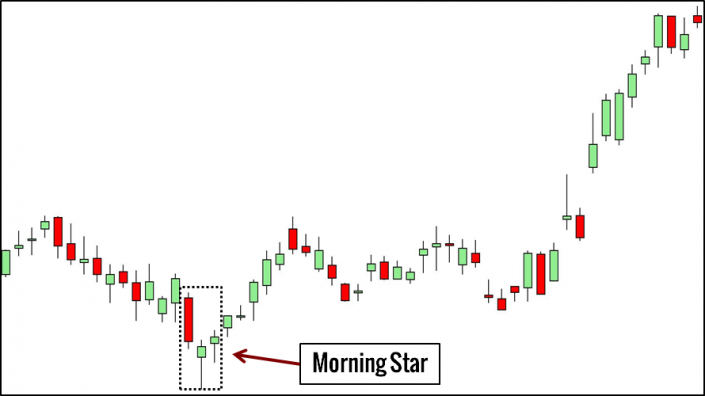

Morning Star Example

What does it mean?

The first candlestick in the Morning Star pattern shows the bears in control. The star hints at a transition to a bullish market. Finally, the strength of the last candlestick confirms the bullishness.

The Evening Star expresses the same logic. The first candlestick shows the bulls in control. Uncertainty sets in with the star candle. The last candlestick confirms the bearishness.

How do we trade it?

We apply both patterns to catch reversals as well as continuations.

Buy above the last bar of the Morning Star formation

Sell below the last bar of the Evening Star formation

Morning Star Trading Example