Be sure to click on the image to view full screen!

Highly recommended reading for all, nice summary of different narratives that (co-)exist(ed) in bitcoiners' minds. Do you have a personal journey to share?

https://medium.com/@nic__carter/visions-of-bitcoin-4b7b7cbcd24c

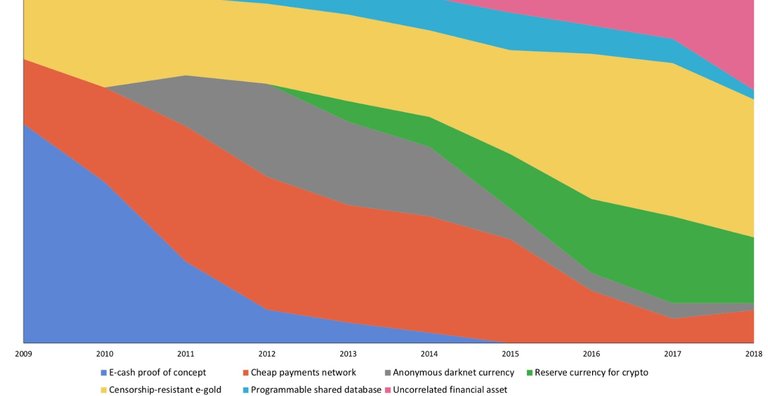

2. Cheap p2p payments network: an extremely popular and pervasive narrative. Some believe this is what Satoshi had in mind — a straightforward currency for peer to peer internet transactions. A decentralized Paypal or Venmo, if you will. Since microtransactions are a key component of internet commerce, proponents of this view generally believe that low fees and convenience are an essential characteristic of such a currency.

3. Censorship-resistant digital gold: the counterpoint to the p2p payments narrative, this is the view that Bitcoin primarily represents an untamperable, uninflatable, largely unseizable, intergenerational wealth store which cannot be interfered with by banks or the State. Proponents of this view de-emphasize Bitcoin’s use for everyday transactions, arguing that security, predictability, and conservatism in development are more important. We’re callously lumping in sound money believers into this camp.

4. Private and anonymous darknet currency: the view that Bitcoin is useful for anonymous online transactions, in particular to facilitate black market online commerce. This is not necessarily mutually exclusive with the e-gold position, as many proponents of the digital gold view believe that fungibility and privacy are important attributes. This was a popular narrative before the chain analysis companies had success de-anonymizing Bitcoin users.

5. Reserve currency for the cryptocurrency industry: this is the view that Bitcoin serves an essential purpose as the native currency for the cryptocurrency/cryptoasset industry more generally. This is a view espoused by traders for whom BTC is the numeraire — the currency in which the prices of other assets are quoted. Additionally, traders, businesses, and distributed networks that hold reserves in BTC de-facto endorse this view.

6. Programmable shared database: this is a slightly more niche view, and generally involves the understanding that Bitcoin can embed arbitrary data, not just currency transactions. Individuals holding this view tend to see Bitcoin as a programmable, expressive protocol, which can facilitate broader use-cases. In 2015–16, it was popular to express the notion that Bitcoin would eventually absorb a diverse set of functionalities through sidechains. Projects like Namecoin, Blockstack, DeOS, Rootstock, and some of the timestamping services rely on this view of the protocol.

7. Uncorrelated financial asset: this is a view of Bitcoin that treats it strictly like a financial asset and finds its most important feature to be its return distribution. In particular, its tendency to have a low or nonexistent correlation to all manner of indexes, currencies, or commodities makes it an attractive portfolio diversifier. Proponents of the view are generally not too concerned about owning spot Bitcoin; they are interested in exposure to the asset. Put another way, they want to buy Bitcoin-flavored risk, not necessarily Bitcoin itself. As Bitcoin has become more financialized, this conception has gained steam.

In the chart below, we’ve weighted these various narratives according to their popularity at the time."

Dclicked.

Thanks!

vote and dclicked

Thanks!

Dclicked!

Thanks!

Congratulations @jomeszaros! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: