Geopolitical turmoil erupts and bitcoin is again acting like a safe haven

Recent turmoil between the United States and Iran is giving bitcoin and oil a major boost.

After breaking the $7k support recently and getting as low as $6,800, prices bounced over $500 to get back over $7,300 in fairly short order.

This happened right around the time news was breaking that the United States had carried out a hit on top Iranian military commander Qasem Soleimani.

As you might have guessed, Iran vowed to retaliate and risk on assets suddenly started to plunge while risk off assets started to catch a bid.

With bitcoin being being treated like it was one of them again.

So, which one is it?

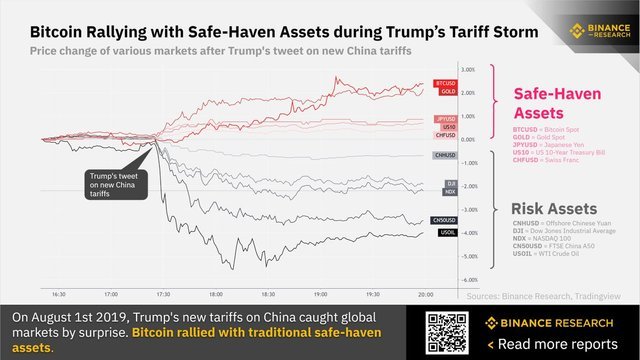

Earlier this year bitcoin saw strong gains around the time that the China trade war was reaching fever pitch.

However, shortly after more trade war drama popped up and bitcoin didn't budge.

Much to the surprise of everyone.

(Source: https://steemit.com/bitcoin/@jrcornel/bitcoin-rallying-along-with-safe-haven-assets)

Shortly after that many were speculating that it was starting to trade like a risk-on asset again...

Except we saw the stock market continue to make high after high while bitcoin continued to drift lower and lower.

Bitcoin has truly lived up to its name as an uncorrelated asset this past year.

Will that continue or is bitcoin finally going to pick a side, especially as more institutions get involved?

I wish I knew, it would make trading it a lot more predictable.

Stay informed my friends.

-Doc

I was watching the tape after the news out of Iraq, BTC initially went down, gold immediately went up. It took crypto's about two hours to rise. IMHO, people are buying crypto, trying to front-run the risk-on trade hoping to sell into the momentum......Time will tell depending on the news and geopolitical events that unfold these next few hours and days.

The bitcoin market tends to not be quite as efficient as other markets that are more institutionalized, which is my guess for why there was a delay.

Good point, but the crypto market is a 24-7 market, including a market of open access of all individuals and potentially any nation. It has the potential to be more efficient, or in effect, less influenced by paper shorts, like in the stock markets.

Yep, I agree, but we are not there yet. It needs to become more institutionalized to be more efficient is my guess.

I am currently short, but I don't think we will get below 6,000 in 2020. I think Bitcoin will remain weak until mid-January, then it could go up again.

What platform are you shorting through?

Bitmex

Monthly EMA40 is slightly below 6000 USD currently, so it would require someone to find a serious bug in Bitcoin for it to crash a lot below 6000 USD... Other option is very unlikely, but some malicious trader with enough coins would need to cash out a lot of coins.

Yea, given the overall backdrop for bitcoin right now, being short doesn't sound very exciting to me.

No it’s not. It’s literally in same range as last month. Call me when we hit 10K baby

It’s under $7500

How the hell is that a store of value? It’s down from 2017 $19,500 high and $13K 2018 high. This move is nothing

Thanks for this information.

You got it.