Bitcoin volatility is at the lowest level seen in over 2 years, but that may be good thing.

The price of bitcoin has been going sideways for some time now, in fact, volatility is approaching historically low levels.

Currently the 30 day volatility in bitcoin is the lowest it has been since mid 2016.

That means that bitcoin has not been this stable at any point in over 2 years.

Cool, so what does this lack of volatility mean?

I am glad you asked!

Just saying that prices are stable doesn't really do us a lot of good unless we can glean some possible implications from the price action.

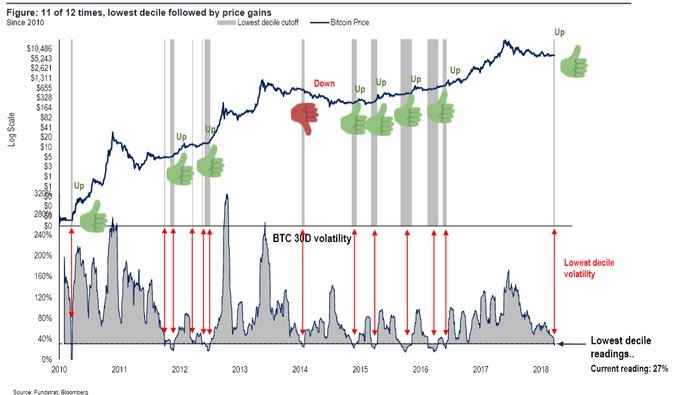

Luckily for us, our friends at Fundstrat Global Advisors have put together a chart showing us exactly that:

(Source: ~~~ embed:1053292065247891457) twitter metadata:ZnVuZHN0cmF0fHxodHRwczovL3R3aXR0ZXIuY29tL2Z1bmRzdHJhdC9zdGF0dXMvMTA1MzI5MjA2NTI0Nzg5MTQ1Nyl8 ~~~

As you can see, since 2010, the last 8 times bitcoin had this little volatility or lower, the price went up shortly after 7 times!

Yes, you read that right...

That means, periods of low volatility have been followed by large up-moves in 7 out of the last 8 times this has occurred!

Unfortunately for us, the one time when it didn't work out was in the bear market of 2014 which is what this more recent bear market often gets compared to.

Other than that though, I like our odds of a move higher being the next thing in store for bitcoin.

Stay informed my friends.

Image Source:

https://news.bitcoin.com/bitcoin-volatility-match-fiat-two-years/

Follow me: @jrcornel

Measured in USD, rather than in BTC gives a very skewed indication.

https://news.bitcoin.com/bitcoin-volatility-match-fiat-two-years/

For the volatility measured in USD to go up, one of the following, or both should happen:

Not sure what you are trying to say here. It seems pretty straight forward to me, in 7 out of the last 8 times volatility was this low, bitcoin rallied significantly afterwards...

I might have realized what is different this time and how individual commodity prices are rigged:

Large institutions such as hedge funds may buy or sell Bitcoin at an arbitrage, according to its futures contract prices that are rigged by the unlimited ability of sovereign money creation by players that are backed by central banks.

Was the odd 1 out of 7 the previous low in volatility?

Did it happen after the inception of the Bitcoin future contracts?

Also, now, when USDT is finally starting to be exposed as worse fractional reserve banking than the precious metals cartel complains about, more people will realize what was the main drive in the 2017 rally.

And fundamentally, Bitcoin is bad.

I saw your recent thread about how cheap you present it to be, but this is not what I read from a real person that wanted to rescue some digital reserves into USD.

Such fees make it bad for transfers of value and for store of value.

I loved its concept initially, but its POW is something that should not be bared.

I am not against POW in general, I am only against POW for the mere sake of security.

Other systems found a way to employ POW for good causes as a necessary "side effect" of the POW for security.

This waste is Satoshi's worst decision that I currently know about.

flagged for bid bot abuse @steemflagrewards

Steem Flag Rewards mention comment has been approved! Thank you for reporting this abuse, @themarkymark.

You bought votes to increase the rewards of your post above the value of its content. This post was submitted via our Discord Community channel. Check us out on the following link!

SFR Discord

Follow up flag for bid bot abuse @steemflagrewards

Follow up flag for bid bot abuse @steemflagrewards

follow on flag for bid bot abuse @steemflagrewards

Your balance is below $0.3. Your account is running low and should be replenished. You have roughly 10 more @dustsweeper votes. Check out the Dustsweeper FAQ here: https://steemit.com/dustsweeper/@dustsweeper/dustsweeper-faq

This comment has received a 28.74 % upvote from @steemdiffuser thanks to: @stimialiti.

Bids above 0.05 SBD may get additional upvotes from our trail members.

Get Upvotes, Join Our Trail, or Delegate Some SP

You got a 60.00% upvote from @sleeplesswhale courtesy of @atempt!

flagged for bid bot abuse @steemflagrewards

Steem Flag Rewards mention comment has been approved! Thank you for reporting this abuse, @themarkymark.

You bought votes to increase the rewards of your post above the value of its content. This post was submitted via our Discord Community channel. Check us out on the following link!

SFR Discord

follow on flag for bid bot abuse @steemflagrewards

You got a 100.00% upvote from @luckyvotes courtesy of @atempt!

This comment has received a 62.50 % upvote from @steemdiffuser thanks to: @atempt.

Bids above 0.05 SBD may get additional upvotes from our trail members.

Get Upvotes, Join Our Trail, or Delegate Some SP

You got a 30.90% upvote from @sleeplesswhale courtesy of @stimialiti!

Can I get an Amen for a breakout? 🙏

Amen amen amen.

It will moon!

Gracias por el dato @jrcornel bastante interesante…

Sorry, I do not understand what you are saying here. I speak and read in English only.

I agree that stability of the price of BTC could highly be followed by a huge pump in prices.

This will benefit long time hodlers more than daily traders.

After every all time high, there is always a huge dump And then a bigger pump to a new all time high.

The next all time high will happen for sure but will take some time,, but will result in massive gains for hodlers.

Keep it up.

Daily traders trade on volatility and with leverage. Bitcoin prices did go up and down 1000 dollars in a day last year. No difference for the hodler, since price was roughly the same at the end of the day,but massive opportunity/risk for the day traders.

Correct. The people who have been holding for much of the bear market would like very much to see an increase in prices in the near future. They have seen enough red for the time being.

Indeed

Daily traders trade on volatility and with leverage. Bitcoin prices did go up and down 1000 dollars in a day last year. No difference for the hodler, since price was roughly the same at the end of the day,but massive opportunity/risk for the day traders.

Daily traders trade on volatility and with leverage. Bitcoin prices did go up and down 1000 dollars in a day last year. No difference for the hodler, since price was roughly the same at the end of the day,but massive opportunity/risk for the day traders.

I think of it of a demand/supply balance where it seems as thought price is equaling the value in the assets. However, I still think that most of the demand and thus value is speculation which could change the balance quickly if fundamentals fail.

That is exactly what it is. The demand and supply finally are in balance for a period of time. Though, some new development or news release often changes that balance rather quickly.

Volume of traders in the market is extremely low. They are waiting for bitcoin to break out of the descending triangle it has been in since the start of the year. Nobody knows what it will do, so everyone is waiting.

There is likely a lot of truth to that. Everyone is waiting for bitcoin to pick a direction before piling in one way or the other.

Volume of traders in the market is extremely low. They are waiting for bitcoin to break out of the descending triangle it has been in since the start of the year. Nobody knows what it will do, so everyone is waiting.

I expect it to go lower, we are 80-90% correlated to the 2013-2014 bear market. But a v-shape recovery can be expected. Be ready to buy the dip, the real last dip.

I could see that. A plunge down to about $5k. Is that what you are expecting?

Currently thinking about buying more... I think it will go up soon.

That is what makes a market :)

It goes higher.

Posted using Partiko Android

When and how high?

By end of Q4 we will see 10K.

Posted using Partiko Android

I could see that as well. Don't think we break $10k for a while yet though.

My no-coin acquaintances keep gloating that it's a shame the bubble has burst. I remind them that the bubble has popped before and always subsequently inflated bigger. I say that we've seen a gentle lapping wave and a tsunami is coming. I ask 'did you feel that minor tremor because a magnitude 10 earthquake is on its way?' $200 billion market cap? 100x that.

I agree 100%. Those same friends will be the ones finally willing to buy on this next peak, probably around $30-$40k BTC. Then they will also endure the next bear market that follows that peak. Why not just buy now when everyone hates it?!

I am getting more of the 2014 feeling. A lot of people lost pretty big, and I think it is going to take some time before new money enters. Or institutional money enters...then that would be a game changer. Either way, now is not the time to sell. Slowly accumulate and hold. It will eventually go back up to previous highs and even higher.

My thoughts exactly. Unfortunately this recent bear market looks an awful lot like 2014, which took about a year and a half to play out. If things play out similar here we may still have 6-8 months before we start seeing bullish price action again.

what is your prediction for bitcoin next year ?? @jrcornel