The Bakkt Bitcoin Futures contracts continue to gain traction

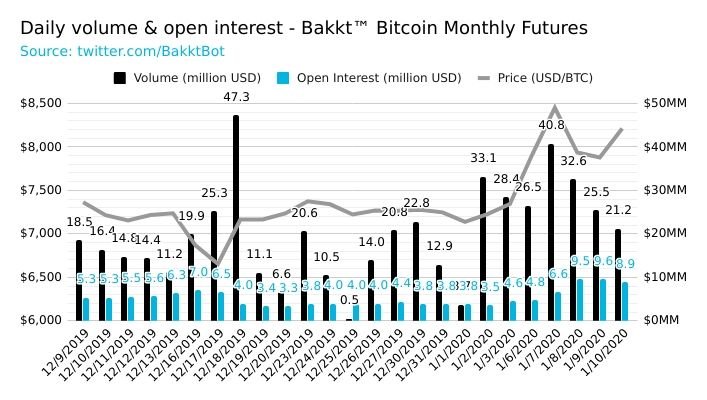

Bakkt's bitcoin futures products continue to show more volume and more open interest as time goes on.

After a slow start, Bakkt is finally starting to do close to the volumes that many had expected initially.

On December 18th, Bakkt saw over $47 million in dollar volume traded, the current all time high in dollar volume.

More recently Bakkt saw $41 million in dollar volume trade on January 7th, marking the second highest total ever.

These numbers still aren't a ton compared to what the CME bitcoin futures do on a daily basis, but the trend appears to be 'up and to the right' as time moves on.

Check it out:

(Source: ~~~ embed:1207665664586063872) twitter metadata:QmFra3RCb3R8fGh0dHBzOi8vdHdpdHRlci5jb20vQmFra3RCb3Qvc3RhdHVzLzEyMDc2NjU2NjQ1ODYwNjM4NzIpfA== ~~~

High volumes happened yet again on an "up-day"

Historically, some of the highest volume days on the Bakkt bitcoin futures products had occurred on days when the price of bitcoin was headed lower.

This sort of trend lead some to believe that perhaps these new institutions that were using Bakkt for bitcoin exposure were perhaps doing more harm than good.

Using the Bakkt product as a way to bet against bitcoin.

However, these latest volume figures, as well as the previous all time high, helps put those fears to rest as they both occurred on days when bitcoin was up a significant amount.

They both happened on "up days".

Overall, Bitcoin futures are really catching on...

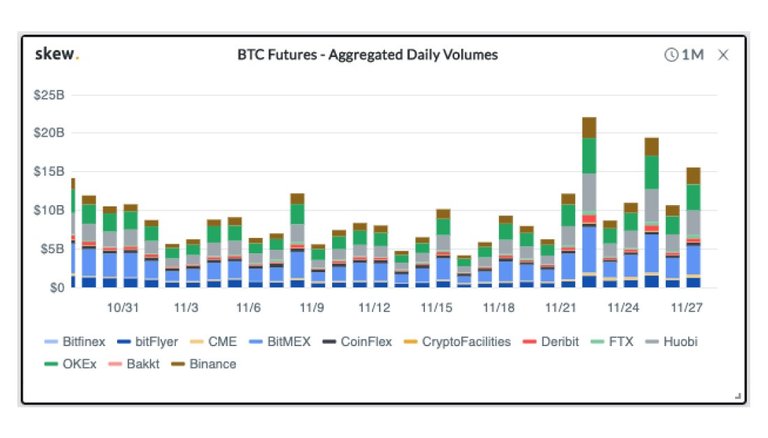

The total bitcoin futures volumes are starting to climb over $10 billion in daily dollar volume.

With 3 of the largest days ever occurring in the past several months:

(Source: ~~~ embed:1200018870410629123) twitter metadata:c2tld2RvdGNvbXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9za2V3ZG90Y29tL3N0YXR1cy8xMjAwMDE4ODcwNDEwNjI5MTIzKXw= ~~~

This is starting to mirror other more traditional assets classes where derivative trading eventually becomes larger than spot market trading.

This is a very interesting development and something to keep an eye on.

It's even more interesting as one would assume the derivative trading numbers may be slightly harder to "fake" than some of the spot market trading numbers that many find suspect...

Which could mean that the derivative trading markets already dominates the spot trading markets.

Stay informed my friends.

-Doc

Yay high volume futures trading. The real Satoshi's vision.

Posted using Partiko Android

It doesn't matter what Satoshi's vision was, he was but one man (or one group), bitcoin was never going to be 'allowed' to replace governments and their currencies all at once anyways, getting more money involved in bitcoin is a good thing overall and further's adoption more so than just keeping bitcoin an underground currency mostly only used by tax evaders, money launders, and anarchists.

Futures trading is not adoption. This kind of "adoption" is no reason to celebrate by any metric other than price.

These futures products are physically settled, meaning that actual bitcoin changes hands. It offers a regulated way for institutions to gain exposure to bitcoin, and in my opinion getting institutions involved in the space is a good thing for all of us.

Excellent information ... Thank you for sharing ... @tipu curate

Thank you for the tip!

Upvoted 👌 (Mana: 20/25 - need recharge?)

this 2020 started well for the blockchain world

Yep, hopefully it continues.

It's good to see that crypto derivatives are catching on to institutions. With end-2019's strong performance, I think 2020 will be an even better year for institutional demand into crypto, and now since futures options are coming onto the market soon, with potential for an ETF to come along, too :-)

Yep, I agree. Especially if we see some positive price action, that will encourage more and more to dip their toes in.