Will Bitcoin be part of the Everything Bubble?

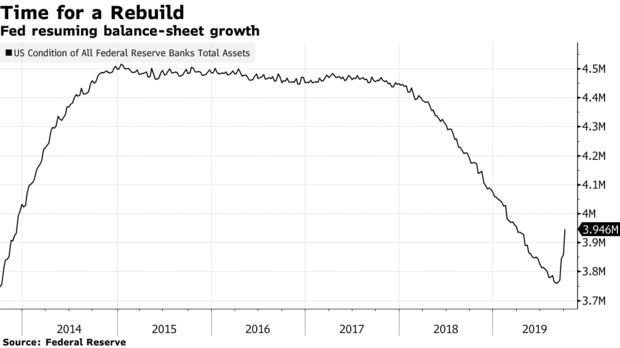

In the last month, the FED has added roughly $210 billion to their balance sheet.

A number that is larger than the entire market cap of bitcoin by the way, which stands just under $150 billion currently.

They are quick not to call this latest round of balance sheet expansion quantitative easing, but I am not sure what you call it exactly as it looks an awful lot like the same thing.

The result is a FED balance sheet that is now approaching $4T:

(Source: https://steemit.com/bitcoin/@jrcornel/btc-bounces-as-fed-expands-balance-sheet)

The perfect storm for asset prices?

Many investors and analysts around the world are suspecting that as moves like this one continue to happen, asset prices will continue to move higher.

Since assets across the board are likely to rise, the current and expected bubble is being referred to as the "Everything Bubble".

To make matters worse, many countries around the world are doing this exact same thing.

It has become the norm for central bank monetary policy.

Which means this bubble could be worse than anything the world has ever seen before as economies and assets are becoming more and more intertwined and connected.

Will bitcoin go along for the ride?

My guess is yes.

As it stands now, bitcoin's use cases are relatively small, similar to that of gold.

The majority of the money in bitcoin is in it due to its store of value properties or its speculative properties, which ironically don't usually go hand in hand.

If assets across the board inflate, I would expect the price of bitcoin to do the same.

Due to the price moves we saw in 2017, everyone is keeping a close eye on bitcoin to see if it can catch some momentum again, at which point they will be quick to jump in as they know how explosive the gains can be.

Bitcoin is considered to be very far right on the risky asset spectrum by most managers.

However, what happens when the bubble pops?

Will that tank the price of bitcoin?

Perhaps, or perhaps not.

I think that depends on how bad the prick is that pops the bubble, and I think it matters how far down the road it happens.

If the prick is due to central banks losing control and many countries experiencing run away inflation, I don't think bitcoin goes down much in that scenario.

I think it would be seen as the Schmuck Insurance many out there claim that it is.

However, if we have more of a run of the mill garden variety pullback/recession, then I think you could see bitcoin prices pulling back in that environment right along with most other asset classes.

There are several moving parts to all of this so it is difficult to say with absolute certainty how assets will respond, but the most likely outcome with continued money printing is increasing asset prices.

And I am thinking that will likely include bitcoin.

Stay informed my friends.

-Doc

very likely.

In 2015-2016 industry went into a mini-recession, followed by the ECB pumping over a Trillion Euro into the wild. Then, in 2017 crypto had so much life breathed into it that everyone was dreaming of lambos. 2019 is now matching the 2015-2016 decline with a very similar trajectory, and now its the Federal Reserves turn to shovel fuel into the furnace.

I believe this time though we'll see the inflation move to safety at a much faster pace, because 2016 was not a reset by any stretch, and everyone has one eye on the exits this time.

Perhaps. Though I think they have a lot more fire power to throw at this still before recession actually hits. Interest rates have a lot of room before zero (or negative) and "non-QE" could still turn into official QE.

I'm not going to be surprised if Bitcoin gobbles up the entire legacy economy over the next decade. It's entire purpose is to act as neutral economic ground to soften the blow of catastrophes like this. Bitcoin was literally built for this upcoming crash, and was born in response to the last one.

Bitcoin is immune to long-term manipulation. Bitcoin is not a store of value, it is a generator of value. The establishment can only manipulate it in the short-term because it's gaining value so quickly.

The precious metals market is much easier to control because gold and silver don't actually gain any value over time. They just store the value. Pump/dumps, futures markets, and all the other tricks they use don't work nearly as well on an asset that is doubling in value every year.

Bitcoin is going to be the only viable ship these rats can swim to.

You said it yourself liquidity is the killer app in this situation.

Yep, very good points. Especially when you use my own against me. :)

You have great relevant content but can you explain me why after voting nonstop for @Slowwalker and his alts you can't get enough vote back on your post to make it up the trending?

You know it'd be efficient to start by flagging people who actually post content they care about to try breaking the oldstone - wisdomandjusting - slowwalker vote trading? I hope you find better use of your SP before I get real fed up.

What do you mean by this?

I mean the circle you vote for don't seems to care about the content they post, they care much about the reward so it'd be more efficient for me to flag you because you care about both.

Well, curangel had asked me to stop voting for them and so I did, and yet they kept downvoting me anyways even after I stopped... so if you would like to upvote some of my posts (as you said you deem them to be worthwhile content), I'd be glad to stop voting for them. :)

@tipu curate 2

Upvoted 👌 (Mana: 10/20)