In finance, and even more so in crypto, the killer app is liquidity

Liquidity is extremely important in finance, it basically is a measure of how easy an investor can get in or or out of an investment.

Something many smaller investors don't really concern themselves about, however, it's something that is very important to institutional and larger investors.

Think about why bitcoin is the coin of choice so far for most large investors. Going beyond the name brand, the longevity compared to others, the scarcity, the decentralization compared to others etc etc etc...

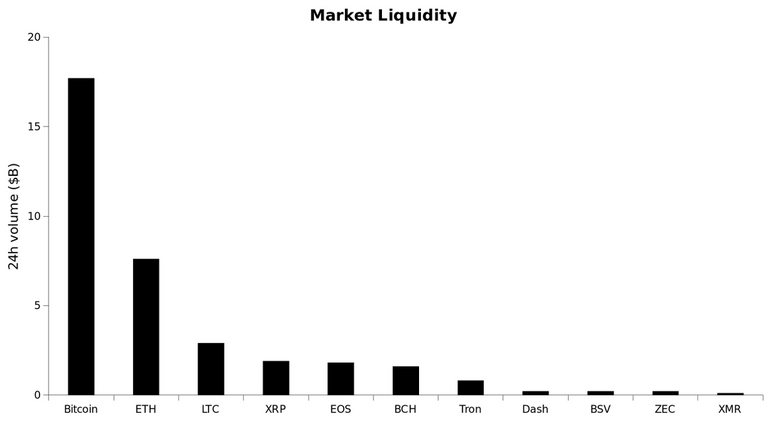

Bitcoin has far and away the most liquidity:

(Source: ~~~ embed:1181298109596520448) twitter metadata:MTAwdHJpbGxpb25VU0R8fGh0dHBzOi8vdHdpdHRlci5jb20vMTAwdHJpbGxpb25VU0Qvc3RhdHVzLzExODEyOTgxMDk1OTY1MjA0NDgpfA== ~~~

And guess what, liquidity tends to attract liquidity!

Those numbers above are from coinmarketcap.com and likely include a lot of 'fake' volume.

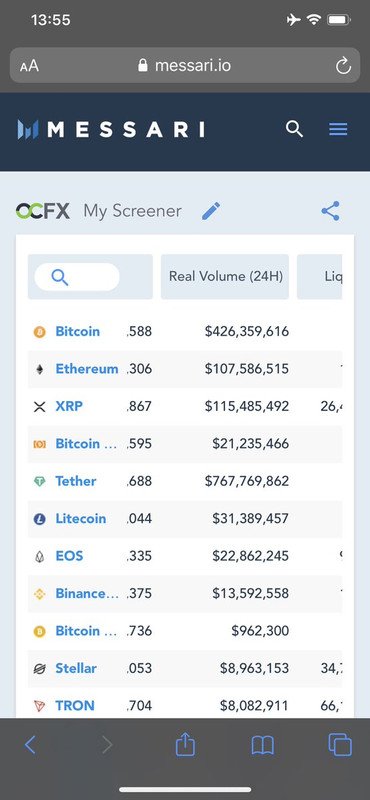

However, even trying to account for a lot of the wash trading, bitcoin is still far and away the king:

(Source: ~~~ embed:1181312654238834688) twitter metadata:RVJjcnlwdG83NHx8aHR0cHM6Ly90d2l0dGVyLmNvbS9FUmNyeXB0bzc0L3N0YXR1cy8xMTgxMzEyNjU0MjM4ODM0Njg4KXw= ~~~

EOS and LTC, coins that many believe are in the Top 5 best coins on the planet, don't even have 10% of the liquidity/volume of bitcoin.

As you can imagine it gets much worse the further down the list you go.

Which only makes it harder and harder to attract large investment.

Think about how that relates to Steem for a second...

It was just announced that steem will be delisted from Poloniex in about a month. There was no reason given but most likely it had to do with a lack of volume/liquidity.

Poloniex likely was losing money by keeping a steem market open if no one was using it.

Unfortunately, the sliding volume is something that is being seen at most exchanges in steem's case.

It kind of becomes one of those things where, since the volume is low no large investors will invest and the volume stays low because no large investors will invest.

Without a large increase in popularity, it is very hard to break out of that cycle.

Many people think that bitcoin's killer app has something to do with its core functionalities, but I would argue its killer feature is mostly its name brand and liquidity. :)

Stay informed my friends.

-Doc

For currency the real killer app is being able to buy what you need with it. I don't care what the liquidity of my dollar is because I'm never going to leave it for another currency. I can buy whatever I need with my dollar.

Posted using Partiko Android

Not much of a gold-bug?

Not a big fan, no. If I wanted to keep value over centuries, maybe. However, TIPS are better at protecting against inflation. In the case of societal collapse better investment items are alcohol, livestock, and even books. I just don't see where gold is the best fit in a portfolio.

Posted using Partiko Android

Interesting. So it seems a bit screwy that you get taxed on the automatic inflation adjusted value of your TIPS if the value goes up. Do you get a tax credit if it goes down?

https://www.investopedia.com/terms/t/tips.asp

...and how liquid is this type of bond? If there's a large-scale market panic, can I convert it to cash without having to wait a week or more?

If I buy some gold coins and keep them in my pocket, the value can go to the moon and I don't have to pay tax on it unless I convert it to cash.

With negative inflation the value never gets adjusted down.

There is a secondary market where you can sell before maturity.

If you are looking for growth to keep up with inflation that isn't taxed then municipal bonds would be better.

Personally I buy Series I US savings bonds for inflation protection.

Posted using Partiko Android

What if this happens?

You use your honeymoon money to pay the accounts.

Just kidding. The savings bonds are backed by the full faith and credit of the us government. They have the power to tax the richest single country economy in the world to pay me back. If SHTF then I'd rather have liquor, livestock, or books.

Posted using Partiko Android

Good points. Given that it makes sense why bitcoin's biggest use case is.... speculation. Store of value sure, but beating the pants off inflation seems to be main attraction, in most years anyways. 2018 must be thrown out the window of course. :)

True, though I think in Bitcoin's case it is much more a crypto-asset as opposed to a cryptocurrency. I think most of these things are viewed that way currently, actually.

I’m staring at that EOS price! 🚀🌝

Posted using Partiko iOS

I am not sure how I feel about EOS. From everything I have read on it, it sounds like it has several issues that are going to make it very difficult for it to become Web 3.0, and it's currently priced like it is going to do big things.

Compared to 99% of shitcoins out there, EOS works at least lol. 😂

Posted using Partiko iOS

Doesn't require rocket science to fork another coin or use forknote generator to make a "new" coin and then make simple configuration or search/replace error and end up with coin that has sync or wallet issues... It has been made really easy.

Real coins go beyond the initial build to add features and improve existing code.

You like the $3 price?

@tipu curate

Just a question @jrcornel that doesn't have to do with the theme of the post. Have you looked to steem-engine tokens and their market cap?? It's just me or some caps are a little bit mmmmm..... big?

Is this rare? Or I'm just having a paranoia?

It doesn't make sense... having low market cap of steem and seeing those large market caps there, perhaps those aren't the real market caps? don't know. Could you put some light or reasoning to that? Thanks.

Can you give me a specific one you are talking about?

Here are the top ones

Yea, those market caps make no sense. I don't follow it closely enough to know why those are showing those numbers, but I do know they are not 'real'.