2017 became year of ICO. This innovative form of financing representing release of new digital tokens for fund raising on development of projects has already turned into the powerful industry which cost has exceeded 2 billion dollars in 9 months of this year. This figure has already exceeded the volume of traditional venture financing of all startups in branch of cryptocurrencies and a blockchain for last year.

One of the reasons of so high popularity of this method of financing that till summer of this year of ICO practically were regulated in any way and anywhere. Anyone with in the slightest degree decent technical knowledge could create own digital token and tie it to the existing business or even the idea of a startup. However now everything changes.

On July 25 the U.S. Securities and Exchange Commission (SEC) became the first financial body which has issued the statement concerning ICO regulation. Since then several countries have followed her example.

USA

On July 25 the U.S. Securities and Exchange Commission (SEC) has published the statement in which the risks connected with investment into primary placements of tokens have been covered and is declared that the digital tokens having characteristics of securities will fall under federal laws of the USA on securities.

It means that any startup starting ICO has to or to be ready to standard control of SEC, or will have to prove that his tokens aren't securities.

It is expected that in Russia and other European countries the rules regulating release and sale of tokens will be published soon.

Canada

The regulator of stock exchanges of Canada (CSA) and the financial regulator of the country has declared on August 24 this year that the law on securities can be from now on applied also to ICO if the new released tokens can be classified as securities. If they fall under this category, then the company issuer of tokens has to request standard recommendations about sale of tokens.

Any company which plans to attract the capital through ICO has to define whether the released tokens are securities. The organization also has to address to the local body of regulation of securities to discuss possible approaches for compliance with laws about securities" — it is said in the statement.

China

The government of China has given the industry an unpleasant surprise in an early autumn – seven regulators of the country have issued a joint statement in which was declared that ICO are recognized as an illegal method of fund raising and are forbidden to carrying out in the territory of the country. China became the first country which has imposed a total ban on primary placement of tokens – the government has stated that ICO can be connected with the roguish enterprises.

On ICO ban legislators haven't stopped. Soon after that the government has forbidden work of all cryptocurrency exchanges of China. Many, however, are sure that similar tough policy of China concerning cryptocurrencies – only a temporary measure. It is rumored that the Chinese government develops regulatory measures for the industry now and that the exchanges will open again soon, and the ban on carrying out ICO will also be withdrawn in the near future. However, there is also information and on fast start of the Chinese state cryptocurrency which won't be need uncontrollable to the government competitors.

South Korea

South Korea has followed the example of China and too has given cryptocurrency community an unpleasant surprise, having forbidden all ICO. On September 29 the South Korean commission on financial services declared that all types of sales of digital tokens will be forbidden as this type of financial activity needs to be traced and controlled carefully.

As well as in a case with China it is possible to assume that this ban will be withdrawn after regulators develop the corresponding standards.

Hong Kong

Unlike other China, Hong Kong — the free economic zone in which there is own regulation — has published more humane rules concerning ICO. The Securities Commission and to futures (SFC) has issued on September 5 the statement in which it is said that the digital tokens falling under definition of securities are regulated by the legislation on securities of Hong Kong and SFC.

"Stocks and debt obligations are considered as securities", according to the Provision on securities and futures (SFO). Therefore, if recently released digital tokens have characteristics of securities, then their turn demands approval of regulators.

Gibraltar

On September 22 the Commission on financial services of Gibraltar has published the statement in which it is said that since January, 2018 new standards will regulate the companies working in Gibraltar and using technology of a blockchain for "storage or transfer of the values belonging to others".

Besides, the financial regulator has noted that sales of tokens can be also subject to standard control in the future, having said that he "considers creation of the additional regulatory base covering advance and sale of the tokens connected with technology of the distributed register".

According to the financial regulator, primary placements of tokens so far aren't regulated in the territory of Gibraltar in any way.

Singapore

The central bank and the financial regulator of Singapore (MAS) has published the following statement:

"Sale and release of digital tokens in Singapore will be regulated by MAS in case they represent the products falling under the Law on securities and futures. This clearing from MAS is caused by the number of primary placements of tokens which has increased recently in Singapore for the purpose of fund raising".

In other words, by analogy with Canada, Hong Kong and the USA, sale of new digital tokens will be regulated by MAS if they are stocks of the company.

Switzerland

The financial regulator of Switzerland, Body for supervision of the financial market (FINMA) have published the statement in which it was said that the regulator plans to investigate all ICO passing in the territory of the country and will define whether certain ICO types can fall under the existing regulation.

Switzerland – one of the countries which have most a kind feeling to cryptocurrencies in the world. In her territory so-called Kriptodolina settles down.

Lithuania

The Central Bank of Lithuania has also made the statement concerning ICO. According to a dokumente, the probability that the authorities will consider some tokens as securities is high and to regulate them as appropriate. However the regulator specifies that each ICO needs to be considered separately, from the point of view of characteristics of the released token, and only then to apply to him the corresponding regulation.

About creation of separate regulations you will also lock ICO of the speech doesn't go yet.

Great Britain

Management of financial supervision of Great Britain (FCA), rather friendly treats the industry of the fintekh and doesn't consider digital currency as threat for a financial system of the country. Moreover, in a financial technical-sandbox of FCA work several blokcheynovykh of startups which develop financial decisions on the basis of cryptocurrencies with assistance of the regulator.

The positive spirit of FCA affects also concerning ICO. In the statement the regulator warns about the risks connected with investments into tokens and recommends to investigate carefully ICO before investing in him. Certainly, about any bans there is no speech.

"You have to invest in ICO only if you are the skilled investor confident in quality of the ICO project (for example, the business plan, technology, people) and are ready to lose all the investments" — FCA in the recent prevention has stated.

Isle of Man

The Isle of Man – the independent island which is near the coast of Great Britain known for the liberal relation to financial regulation. It was reflected and in the new regulatory base for ICO the purpose of they are to open doors for the blokcheynovykh of startups which want to work at the island and to start ICO taking into account the rules AML and KYC.

Though the regulatory base hasn't been officially published yet, the unit manager of the fintekh and digital development of the Ministry of Economic Development of the Isle of Man, Brian Donegan has confirmed that she is in development and will be soon finished and published.

Follow, Resteem and VOTE UP @keks blogger of https://steemit.com and always I hope for your help. |

|---|

I book marked your article. Great information, save me some time to do research. You deserve my vote.

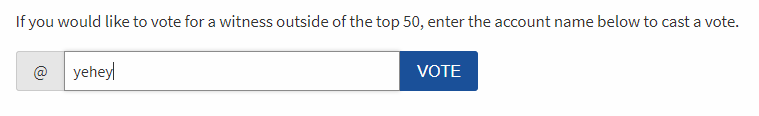

Please VOTE @yehey for Witness, go to https://steemit.com/~witnesses and vote for yehey.

Follow me @Yehey,

Thank you.

Thank you for updating us on the state of regulation. There is quite a lot here I did not know

Great post!

Great post, thank you

I hope new funds would go to the market not only with new ICOs and similar projects but to Steem capitalization. That's why platform needs new design badly