Already in 2016, an interesting article about cryptocurrencies appeared on the official website of the IMF. The authors conclude that Bitcoin and the technology of the distributed registry restore the basic advantage of cash - limiting the trust necessary to make transactions. The electronic money market, built over the decades, has departed far from this idea. Not only that, every transaction has at least one intermediary, and usually more. These are banks, but also, for example, card operators, payments and other companies. Only on various transactional commissions, banks earn an incredible sum of 1.7 trillion (1700 billion) dollars in the world, which accounts for 40% of their revenues.

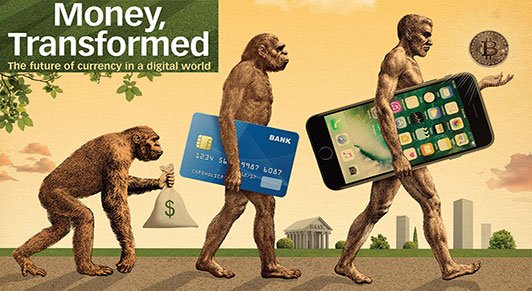

The International Monetary Fund has for a long time seen the potential of cryptocurrencies and the technology behind it, ideally composing the current or digital world. Of course, he also sees threats of even anonymity, but virtually every new technology creates new threats and this is inevitable. Suggesting banks to invest in cryptocurrency technology proves that the IMF sees the future in this. However, the IMF omitted one important issue. The main and one of the most important advantages of cryptocurrencies is ... the elimination of the intermediary and thus the banks. In the cryptocurrency era, banks are no longer needed (at least for the transfer function). Everyone can have their bank on the phone / computer.

Tell me what you thing about it in comment.