This is a play on the libertarian refrain to “Audit the Fed” as a call for a transparent accounting of how much US dollars are being printed, when, and why, and what is backing such printing. Some would think “oh not another article lamenting the printing of tethers.” No. I try not to write on a topic related to valuation unless I derive and process numbers to make a case either way. And many have already written an ample bit about tethers and the doubt behind whether they are being backed by actual dollars or being printed from nothing.

What Are Tethers?

Tethers are positioned as a blockchain currency stand-in for the US dollars, backed 1 to 1 by US dollars. Unlike blockchain based cryptocurrencies that are minted based on some mathematically deterministic supply formula, the tether is supposed to be printed in exchange for every US dollar taken in to back the tether.

Source: https://tether.to

Without any proof that indeed each tether is backed by dollars as purported, this potentially creates a money printing scenario. Unlike with fiat where money printing happens on the supply side, this printing potential occurs on the demand side. And unlike supply side printing, it results in greater deflationary pressure on the price of cryptocurrencies. And if this is occurring it is just as dangerous or even more so, potentially.

So we decided to engage in a mathematical analysis of bitcoins demand to see if we will see the evidence of unfeasible demand side printing. (As mentioned in my prior articles, the blockchain is a fundamental mathematical analyst’s dream because the numbers are all freely available on the blockchain to extract and analyze for trends. And math can sometimes tell the stories and provide the evidence for what sometimes a hunch or common sense might have been telling us.

Some Prior Tether Warnings

The writings of Bitfinexed has provided some of the most extensive analysis and articles regarding Tethers, including:

- Unconvincing evidence of the existence of an actual bank that is dealing with Tethers sufficient to be banking up to the USD 2 billion of tethers that should be backing the 2 billion tethers (USDTs on many exchanges) in existence

- The lack of an independent audit of such backing (tether has an internal memorandum on their site cited as proof but is not an audit and the firm that produced the memo was terminated from completing a full audit.)

- The firing of the prior independent auditor that was supposed to present independent proof as mentioned above.

herehere), as well as several Youtube videos. Those draw from some of the above odd facts as well as the credulity of that much printing of tethers to have been truly backed by actual dollars in deposit. So below we attempt a look at this issue on the evidence of an analysis of the demand side. I actually also looked at Steem and also see fellow Steemian articles on tethers including by @jerrybanfield () and @cryptoverse (

Demand Side Analysis of the Bitcoin Network

In prior work, models of the demand side of bitcoins as a function of the unique daily addresses (DUA) on the network was presented. And noted the discrepancies that sometimes point to bubbles in the value of the assets. Recently, as noted in that article, there has been significant and persistent deviation is due to artificial demand, especially after watching the current tepid recovery. Particularly, where there is actually currently now no return of demand by new users coming into the network at the growing rate that characterized the network over the prior 9 years.

Here is the Tether supply and market cap charts from coinmarketcap that several of the above articles already deemed unlikely to be sustained by a real audit:

Tether Supply and Market Cap Have Gone Up to 2.2 billion Tethers the Past Few Months

Source: https://coinmarketcap.com/

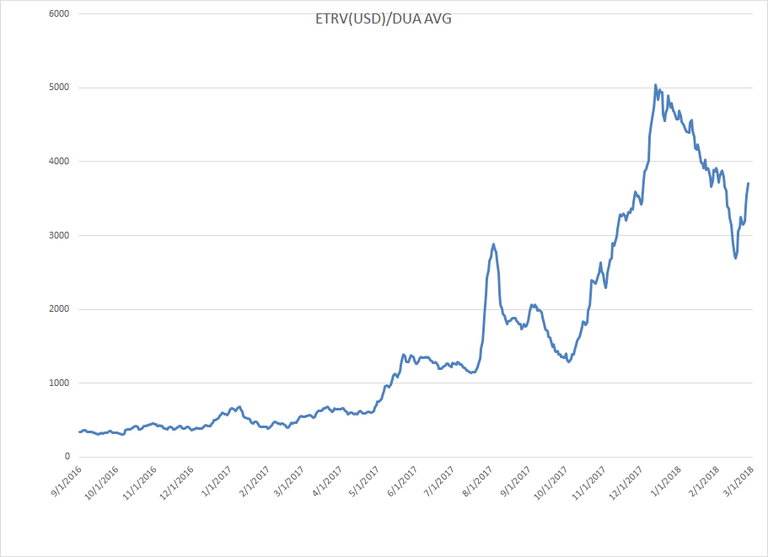

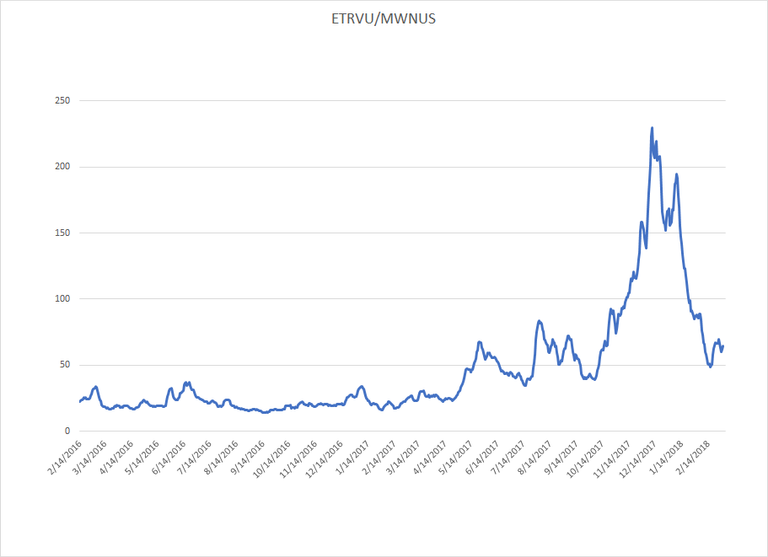

We examined several blockchain variables and honed in on two metrices – the ratio of the estimated transaction volume per day and the number of users based on all wallet addresses, and the ratio of estimated daily transaction volume to daily unique addresses. These two metrices have potential for revealing possibly unrealistic or artificial transaction volumes.

7-day averaged Estimated Transaction Volume USD/Daily Unique Addresses

Source: https://blockchain.info/charts

7-day averaged Estimated Transaction Volume USD/Wallet Number of Users

Source: https://blockchain.info/charts

What those chart simply show is that from some time between April and May 2017, the average trading being done on exchanges regardless of whether USD or USDT was being used suddenly doubled and nearly tripled, respectively, compared to new addresses being opened and total number of accounts on the blockchain. And without any commensurate rise in BTC values during that time. So essentially on average bitcoin traders began trading roughly doubled what they used to from that month. There are several assumptions that can make this feasible and there are possible factors that may have influenced this; but bottom line is that this would be quite unlikely for such a non-transient shift.

What Should the Community Demand Next?

The entire cryptocurrency community would benefit from real transparency on this issue. This would be good for everyone including operators of tethers as well, if indeed the printed tethers can be proven backed by actual dollars, as expected. The community was supposed to be about transparency and mathematically deterministic supply (and demand was never supposed to be printed in the first place.) Demanding for full transparency on tethers would do a lot in fostering a healthy market.

What If Tethers Can Not be Audited Fully

What if a full transparent audit can not be achieved on time as tether organization seems to have expressed in discontinuing the prior auditor’s activities? Or what if a full audit would result in a market crash? If tethers were operating on a fractional reserve basis, then one possible path to closing the gap would be to possibly continue to lift up the market, sell at the top, which would be followed by a drop; and repeat. This is speculative but Bitfinexed published what seems to be compelling demonstrations on a micro-level for possibility of market making at points, here. If true might take some time depending on how deep the reserve is, but either way the possibility of this results in an even riskier market than it would already be.

References:

https://hackernoon.com/the-curious-tale-of-tethers-6b0031eead87

https://hackernoon.com/meet-spoofy-how-a-single-entity-dominates-the-price-of-bitcoin-39c711d28eb4

https://medium.com/@bitfinexed/the-so-called-tether-audit-that-isnt-an-audit-at-all-5a40cfcc2a75

https://www.coindesk.com/big-fail-tether-might-still-cryptos-ticking-time-bomb/

https://hackernoon.com/what-will-happen-when-the-shit-hits-the-fan-with-tether-f59f92fd8dca

https://np.reddit.com/r/Bitcoin/comments/6719bj/tether_announcement_about_their_banking_problems/

https://steemit.com/bitfinex/@jerrybanfield/bitfinex-tether-cryptocurrency-crash

https://steemit.com/cryptocurrency/@cryptovestor/the-massive-tether-ticking-time-bomb

Other Recent Articles

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only.

It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs.

This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

Follow and Resteem if you like articles such as this, so as to get it to more viewers.

https://www.sciencedirect.com/science/article/pii/S1567422317300480

on one hand, I hate regulation, OTOH, I wish order for cryptocurrency..

You got a 28.78% upvote from @passive courtesy of @kenraphael!

We really have to check whether it is back with real US dollar

I don't think they have the money

If you didn't you could read BitMex Tether analysis:

Because of their first competitor TrueUSD (TUSD) maybe they will be forced to proceed with a legit audit. https://news.bitcoin.com/bitmex-research-tether-not-a-ponzi-but-susceptible-to-shutdown/

Thanks for that link. They did seem to partially defend tethers, while of course selling their alternative. Here is the main thrust of their "defense" of whether its fully backed or not:

"Calculating Bitfinex to have been making $10 million in exchange fees a day at the height of bitcoin mania, Bitmex opines that Tether likely has plenty of assets, either directly, or indirectly via Bitfinex, should the need arise. The report then extensively deals with rumors that Tether is seeking to set up banking operations in Puerto Rico, where regulators take a more hands-off approach. It’s possible, opine the report’s authors, that all of the fiat currency backing tethers is stored in the Puerto Rican banking system. While far from perfect, this arrangement – if true – shoots down the allegation that Tether is a Ponzi scheme with nothing backing it."

That is the kind of speculation that is really unnecessary, unfortunate, and what a clean audit would completely take care of. People are putting their hard earned cash into assets where the conjecture is based on rumors and likelihood of whether it is backed or not, when that was the promise.

This technology was supposed to be a better system, more trustless and more transparent. They should make this simple so people don't need to be opining on whether it is backed or not.

I agree with you. As long as all USDT situation will no be cleared there would be always a "shady" atmosphere on it and on BTC Tether-driven value.

Exactly with this ecosystem being so transparent why cant we get more transparency from Tether?

It is very hard to determine the legitimacy of many cryptocurrencies but hopefully that can change so investors are enabled greater protection. Thank you for the interesting post!

If you put people in a position where they can print money, and are never checked, eventually they will...

_ Unknown

I think this might not be generally true of everyone but I thought it was an interesting quote.

Very good quote and so true

Well-done @ kenrapheal your post is well detailed

The Tether situation is worrying, there is one thing that makes it slightly better is that most people expect them not to have the dollar backing, thus if this turns out to be true the reaction by the market should be less than it would be if people believed Tether to be 100% backed. Black Swans events are extremely dangerous to financial markets, I would call Tether a 'Grey Swan'.

I think it would be better only when the audit process is independent, unbiased and uninfluenced.

What like the SEC is trying to do with exchanges and ico's? I think self governance by the community its the best way to go as letting various government institute getting involved can cause a problem further down the line...

True.

Looks to me like Tether is a scam

run away...run, run..runaway

it is bizarre that no governmental invention has happened yet

I really don't believe the govt can and should just be intervening in any and every issue without taking time to study and understand the issues as well as depending on the scale and size of the issue. Right now based on recent reports, it appears the US regulators have communicated with tethers since December 2017 requesting information, so that part is unfolding.

We shall see, my spidey scenes are tingling on this one.

The biggest problem for crypto prices right now (and has been for the last few months) is that there always seems to be "boogie men" hanging over the markets head... BTW I'm not saying I don't believe Tether could be a big problem, or regulation by governments and other fraud/ manipulation being uncovered.

I do believe in them things and that's why I think it so hard for investors to gain enough confidence to put a longer term bull run together right now. Just too much bad news/ possible bad future events.

this is a very valid argument. with thther in a precarious position concerning its legitmacy an liquidity the market is skeptical. This is why there is a need for atleast one crypto that is supported by a national government so that people can cash out easier.

I stand by the belief that full decentralization will create issues of even worse inequality because the system would be easily manipulated by whales with no accountability.

I think there needs to be accountability in these systems to improve user faith and create stability.

Any way you flip it there is a need for a currency that is low volatility, accepted as legit by governments and has accountability so people may alleviate the fears that hold the market down.

I know this opens up a whole nother can of worms but it will be a step in the right direction.

I do not think it is necessary to have crypto backed by national governments, but it would be great if a system could be made in which whales have less power.

I don’t know much about mining, but perhaps mining could be more regulated to adjust for the price going up or down, make the changes more soft? Not for the coins that have started already of course, but for a new one?

I would prefer instead of Tether even the Petro... I think it is the fault of the people who buy Tether if they wake up one day with nothing... I could not sleep one day holding Tether...

Here an article of how I would see it working with the Petro.. People could switch from Bitcoin to the Petro while Bitcoin tanks...

https://steemit.com/petro/@mexbit/venezuela-s-options-how-the-petro-could-make-that-country-sanction-resistent

Tether printed millions of dollars overnight during the last crypto crash in january. They said it was to mitigate ill effects of the crash.

It was at that moment I knew it was a scam no better than the fed.

Interesting, I’ve been using tether to protect against a market down turn such as the one happening now since it holds its value at $1 basically garentees profits at a certain value until the markets reverse.

I intend to do a post on Tether when I have a good amount of time because 99.9% of people do not understand how it works, why it works and most importantly why this audit hysteria is of zero concern. If and when you truly understand Tether, you will think its the most brilliant concept that you wish you thought of. I am not sure when I will break it down by you can follow me @alakazam. If you are truly concerned I highly recommend you ignore the FUD and read the white paper 3 times. I've been in this game a long time and not much impresses me, but Tether is beyond brilliant. So brilliant 99.9% of people can't understand it. Furthermore, CFTC served Bitfinex with a subpoena with regards to USDT ( 12/2017) and Tether is still around so I am pretty sure all is good in the hood.

This post has received gratitude of 5.03% from @appreciator courtesy of @kenraphael!

If you believe this post is spam or abuse, please report it to our DiscordYou got a 4.94% upvote from @buildawhale courtesy of @kenraphael! #abuse channel.

If you want to support our Curation Digest or our Spam & Abuse prevention efforts, please vote @themarkymark as witness.

You got a 6.17% upvote from @postpromoter courtesy of @kenraphael!

Want to promote your posts too? Check out the Steem Bot Tracker websitevote for @yabapmatt for witness! for more info. If you would like to support the development of @postpromoter and the bot tracker please

Thank you for the tutorials.

True, Thank you for the tutorials

You got a 21.20% upvote from @upmewhale courtesy of @kenraphael! Earn 90% daily earning payout by delegating SP to @upmewhale.

14.89% @pushup from @kenraphael

Sneaky Ninja Attack! You have been defended with a 12.98% vote... I was summoned by @kenraphael! I have done their bidding and now I will vanish...Whoosh

There's a difference between being backed by an asset and being pegged to an asset. I think Tether is just pegged to the USD.

I totally agree I think Tether will be a torn in crypto's side until we know for sure how they are running their businesd model.

Blast any Steemit post using SteemBlast.com

How Do I Blast My Post?

Go to your Steemit Post URL

2. Erase

itin the address3. Type

blastand GoGet Blasted Instantly – Blasted posts are 100% upvoted every 2.4hrs, Blast your post to Win.

Your Post Has Been Blasted on @SteemBlast.com!

This post was resteemed by @steemvote and received a 11.62% Upvote