I am writing this in response to a comment made by Crypto.888, in a post made by Ivan Labrie on Tradingview.

As I do not have a Pro Tradingview subscription, nor do I see myself using the Pro anytime soon, I've decided to put up some thoughts adding into Ivan's analysis.

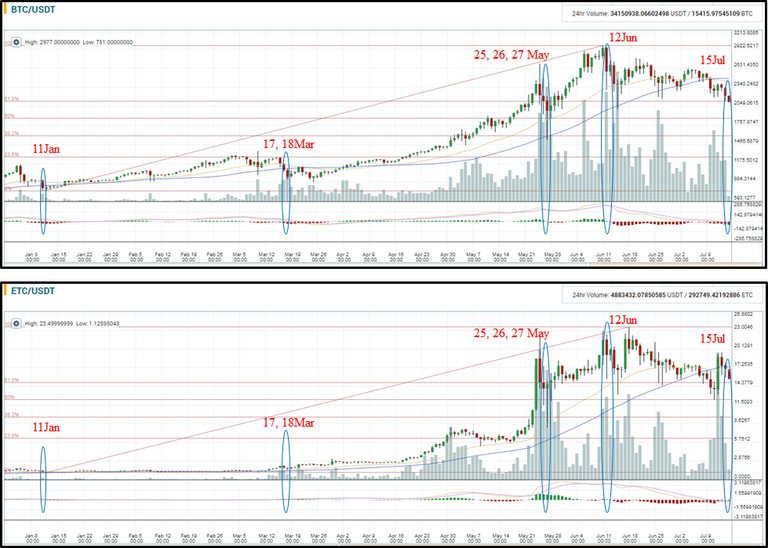

In case you are wondering what this is about, TL:DR --> There is a nice correlation between the BTC/USDT trend and the ETC/USDT trend on the Poloniex exchange. This might give you a better understanding of the track record performance of ETC since the beginning of 2017. Enjoy!

@kesterwong: https://www.tradingview.com/x/jzWgH1gd/

The idea is that despite correlation, performance of $ETC is better when bullish, and less worse or better when bearish. Thus, the $ETCXBT chart is in an uptrend, and shines when $BTC drops. So, you can margin long $ETCXBT as a means to shorting $XBT.

Of course Ivan, I would not easily buy into believing that the bullish performance would/could outperform the bullish performance of ETC, especially for a relatively undervalued coin that has recently been released in at least three major exchanges in China, and then there's the Emerald wallet.

Congratulations @kesterwong! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!