The world has gone completely startup crazy over the last several years. Spurred by soaring tech stock prices (a byproduct of the U.S. stock market bubble) and the frothy Fed-driven economic environment, countless entrepreneurs and VCs are looking to launch the next Facebook or Google. Following in the footsteps of the dot-com companies in the late-1990s, startups that actually turn a profit are the rare exceptions. Unfortunately, today’s tech startup bubble is going to end just like the dot-com bubble did: scores of startups are going to fold and founders, VCs, and investors are going to lose their shirts. In this piece, I wanted to show a collection of recent news headlines (all from Business Insider) that capture the zeitgeist of the tech startup bubble – please remember these when the bubble bursts and everyone says “what were we thinking?!

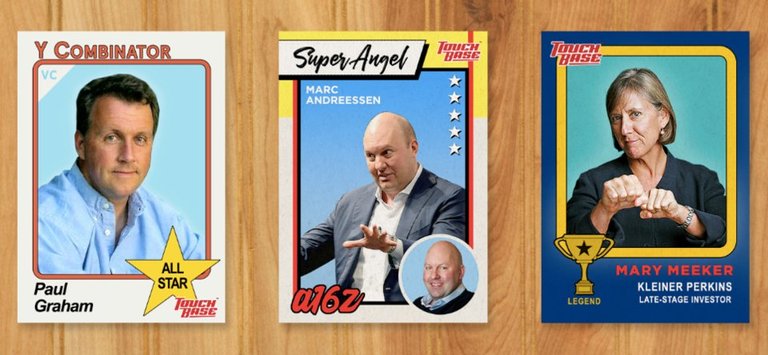

A San Francisco based company has made trading cards of Silicon Valley's top VCs because, well, it's Silicon Valley

TouchBase has released collectible trading cards featuring Silicon Valley's top investors and advisors.

Cards include notable investors like Y Combinator co-founder Paul Graham and Andreessen Horowitz co-founder Marc Andreessen.

The cards include stats for each investor, like their total number of investments and number of exits.

A pack of five cards goes for $59.99.

Ever think you'd hear someone say: "I'll trade you a Paul Graham for a Marc Andreessen?"

A San Francisco company is hoping that the tech industry's biggest VC dealmakers have attained the same kind of celebrity status that has driven kids to trade baseball cards for generations.

New collectible trading cards, created by a company called TouchBase, feature Silicon Valley's top investors and advisors, including Y Combinator co-founder Paul Graham, Andreessen Horowitz co-founder Marc Andreessen, Benchmark general partner Bill Gurley, and Mary Meeker, formerly a partner at Kleiner Perkins.

Read more: Famed tech investor Mary Meeker is looking to raise about $1.25 billion for a new growth fund

The cards include stats for each investor, like their total number of investments and number of exits.

They're also not cheap. A pack of five cards goes for $59.99.

But, as TouchBase mentions on their website, "the VCs featured have had multiple exits, but are on their way to more. This makes their cards highly collectible."

Some of the rarest VC cards include Don Valentine (Sequoia, an investor in Atari), Mike Markkula (Angel, an investor in Apple), and Jenny Lee (GGV, an investor in Alibaba). A recent Boing Boing report showed one lucky collector scored a Sam Altman in their pack.

A TouchBase spokesperson wouldn't confirm how many different VC cards exist today, but said it's "always creating new series." In fact, on the company's website, visitors can suggest new investors or founders that they'd like to see added to the collection.

To view the entire collection, TouchBase is offering a limited number of private showings in their San Francisco office.

Packs will start shipping in November — right in time for the holidays.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.businessinsider.com/trading-cards-of-silicon-valleys-top-vcs-2018-11