A moment day of misfortunes all through digital currency markets is allowing would-be brokers to purchase that may not be rehashed.

Bitcoin dipped under $10,000 on Cointelegraph's value list Wednesday, Jan. 17. Around the same time, Ethereum (ETH) went beneath $900, denoting a value slide of more than 30% for the two resources this week.

Group and industry figures have responded with blended feelings to the downturn, which imitates conduct found in January in the course of recent years.

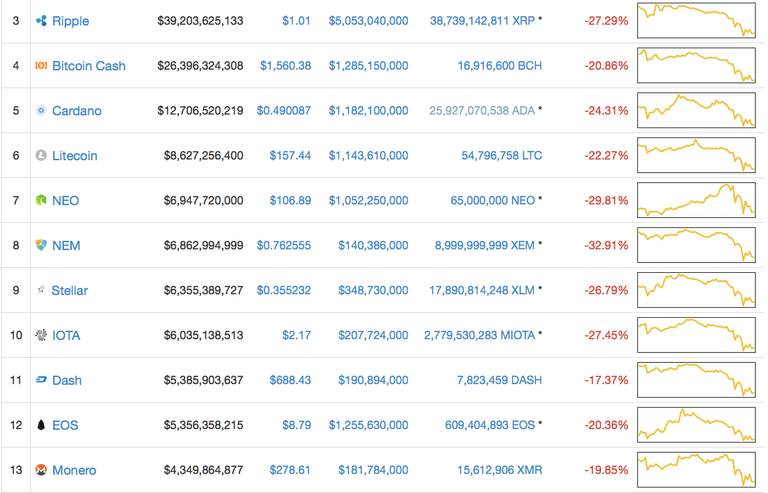

Crosswise over major altcoin markets, resources are additionally right now being exchanged at soak rebates versus only seven days prior, when many were all the while beating unsurpassed highs in USD.

The slide against fiat is fuelling a fresh round of mainstream media speculation Wednesday, meanwhile, with various publications hinting at the possibility of Bitcoin’s alleged ‘bubble’ having burst.

“Did Bitcoin just burst?” Bloomberg writes citing analysts who compare current price performance to historical commodity bubbles.

A curious U-turn in the industry came from highly-critical CNBC. Even as prices had fallen 20% Tuesday, the network came out with a piece explaining why Bitcoin “skeptics” were “wrong” to suggest it has no value.

“Many people think that bitcoin is a bubble, and that's predicted on the concept that bitcoin has no value. But there's reason to believe that that just isn't true,” CNBC’s article concludes.

“By definition, bitcoin is scarce. And the cryptocurrency may have utility as a superior way to store and exchange wealth.”

Ripple is the future.