The famous actor Steven Seagal got pwned by SEC today for "unlawfully touting" a bitcoin-wannabe called Bitcoiin2Gen which right now is pretty much worth zero.

I did not even hear about it, i assume this one targetted really new people into crypto and the actor was a good one to target those.

The SEC's indictment shows that Seagal did not disclose that in exchange for promoting B2G tokens he was promised $ 250,000 in cash and $ 750,000 in B2G tokens. The actor was to encourage the public through social media entries not to "miss" ICO Bitcoiin2Gen. In addition, he was also announced as the ambassador of the Bitcoiin2Gen brand. Bitcoiin2Gen's press release contained phrases indicating that Seagal supported the ICO "wholeheartedly."

While he did not admit to the case he did say he will pay the fine of $314,000 over two separate charges. In addition, Seagal agreed not to promote any securities, digital or otherwise, for 3 years.

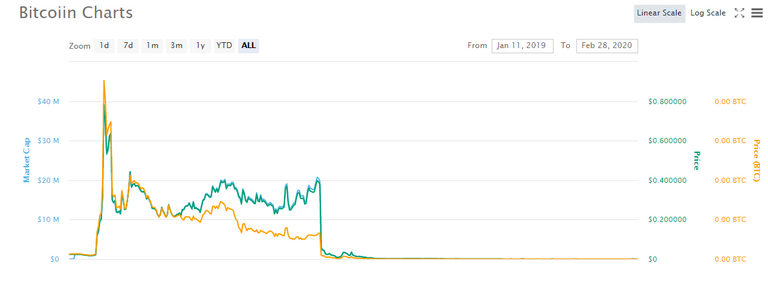

Bitcoiin2Gen claimed that bitcoiin was a "superior or more advanced version" of the original bitcoin, however, after bitcoiin soared to a price of $0.76 per bitcoiin token in the midst of late 2017 cryptocurrency gold rush, the price crashed to almost zero last year.

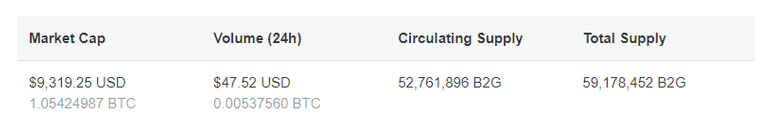

At its peak bitcoiin had a total market value of almost $40 million now worth 10k but with the volume we can say its worth zero.

Still not a bad deal..

- make 1 million USD

- pay 315k USD. fine

- ???

- Profit.

REAL WAYS TO MAKE PASSIVE INCOME FROM CRYPTOCURRENCY - DOWNLOAD FREE EBOOK NOW

Join My Official Discord Crypto/Steemit Group - https://discord.gg/Ma3VCxj

Follow, Resteem and VOTE UP @kingscrown creator of Bitcoin and Ethereum Loans with unique newsletter and hidden tips for subscribers! |

|

|---|

They should have fined him for most of his movies. Thats the real crime he's commited.

LOL :D

I don't know if it was a matter of fraud, but it sounds of it. But if it wasn't a fraud case, he probably could have asserted a first amendment defense. That the regulation was compelled speech, and not narrowly tailored. I'm not a tax guy, but it is possible the IRS knew also further demonstrating the regulation wasn't narrowly tailored. He probably still could in an overbreadth attack (maybe 5th amendment grounds if he was desperate) if it was a fraud case, but since the coin went [essentially] to 0 then it wouldn't be the best case to raise such challenges.

Since much of his payment ended up being in that crypto, he may not have gained from it.If he did cash in and it is still listed on exchanges, he could silently try to give it new life for sh__s, giggles, and experimentation on market psychology. Would a controlled .1% to 1% daily gain a day on a dead-but tradable-coin for a few months lead to a bigger movements than him speaking?

yea who knows

Hi @kingscrown!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 7.260 which ranks you at #66 across all Steem accounts.

Your rank has improved 2 places in the last three days (old rank 68).

In our last Algorithmic Curation Round, consisting of 88 contributions, your post is ranked at #1. Congratulations!

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server