Bitcoin had a good run and its price tripled within just a month and a half - from $6K in mid-November to over $18K right before this dip ensued. Opinions vary about “who is who” in this market - many people still believe that Bitcoin and crypto-currencies in general, are dominated by speculators with big money (akin to a hedge fund billionaire Mr. Novogratz) who talk up the price to attract as many ordinary investors as possible and then shave off the profits from all-time highs. This is not true.

This market is dominated by long term investors and many of them also trade cryptos on a daily basis. If you take a look at the ones who are active on Trading View, you will see a lot of average investors who build their long positions in Bitcoin over time and also trade a portion of their investments to make money by selling into highs and buying the dips. And this is exactly what you are seeing, the market was selling into all time highs to take profits.

Unlike stock markets where you have government actors (e.g. Federal Reserve) and corporate buy backs that prop up stock prices acting as buyers of last resort when the market crashes or takes a large dip, Bitcoin has no such actors. This means that in the case of Bitcoin, we are seeing genuine market forces in play when the price goes up or down, in which all market participants weigh in on the fair value of the asset. So, when some people see this big dip as the end of Bitcoin and its intrinsic instability, the smart investor will actually see an efficient market at work. Also, since we now have Bitcoin futures, those usually intensify the downswings thanks to to short selling.

While this price correction may take us to much lower lows, you will be seeing those long term investors to actually add to their long positions by buying this dip at every point. You need to watch out for a reversal if you are trying to time your buying correctly. But first, what are some factors behind this current dip?

Long weekend consolidations in a broad sell-off across all cryptos

South Korean factor

All time highs being sold

Traders “calling” the dip

Usually, investors like to take profits and consolidate their long positions as they go into long weekends. So this Christmas weekend is no exception. Traders had waited for this correction for too long and freshly baked Bitcoin futures made it all too possible. Healthy market dynamics always calls for a price correction at some point. Dips happened before and they will happen in the futures. And in the case of Bitcoin, these are in thousands of dollars and very volatile at this time.

This also coincides with some negative news coming out of South Korea. But that’s a minor factor. The recent 300% runup in price was fueled by a lot of new money pouring into Bitcoin from every corner of the Internet. Some of that money was definitely speculative in nature - entering trades for short term gain - far from everyone believes in the bright future of Bitcoin! This creates fertile soil for speculative pumps and dumps, as I mentioned in my previous blog post on here.

The effect of Bitcoin futures

The futures markets (both CBOE and CME) do not yet have a lot of sway over the real price of Bitcoin. Bitcoin futures allow traders to set bets on future price movements of Bitcoin. If futures traders think Bitcoin is about to go down, they will short sell it. And while there are some patters that we can look for in those markets that may predict how real prices will behave, those are not always reliable. Traders who trade real Bitcoin will of course try to spot those patterns and adjust their positions accordingly. At the same time, no pattern can be a good indicator of when the dip starts and ends. You must follow the open market closely for those signals. So, let’s take a look at the spot price on a daily chart below.

The price is currently sitting on December’s support at $14,600 and then you can notice the last candle that looks like a “hammer” which at the support level may indicate a bullish reversal of the downtrend. I won’t be surprised to see a large green candle tomorrow as a confirmation of the reversal. We do not know if that happens but the conditions are in place as the long tail of the candle indicates that selling pressure was not enough to hold the price below the support level.

Bitcoin spot price - daily chart in USD.

Now, again, nobody knows unless we see a confirmation of the reversal within a few days. Traders who trade Bitcoin futures will of course look at all this dynamics but even they will be having a very hard time assessing the next price move. Bitcoin has gained a lot of popularity and attracted many new investors who have just recently opened Coinbase accounts.

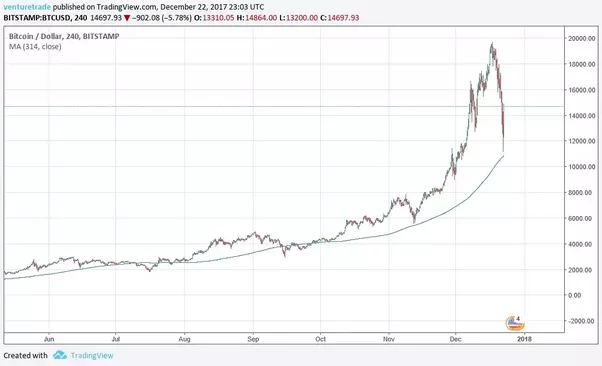

At the same time this dip was long overdue. Bitcoin has been hovering way above the 314 (Pi) moving average cycle as you can see below.

Bitcoin spot price - 4-hour chart and Pi curve.

Overall, this correction looks like a short lived one for now and we may start seeing a more modest growth in the following few days. If the price drops below the Pi- moving average, we may see this dip to continue further down. Last time it approached the Pi curve in mid November, it bounced in a V-shaped reversal. So keep watching. And if you want to learn more about chart analysis, check out my older posts in this blog.

Hello my name is @imadha, I am new to this channel, I invite you to follow me in this community and generate a good friendship, see you soon

I found your post and decided to help you get noticed.

I will pay a resteeming service to resteem your post,

and I'll give you my stamp of automatic approval!

Curious?

introduction post

Check out the great posts I already resteemed.Resteemed by @resteembot! Good Luck! The resteem was payed by @greetbot The @resteembot's Get more from @resteembot with the #resteembotsentme initiative