In an essay published on Kana and Katana last month, a research platform run by Ikigai Asset Management, Xapo CEO Wences Casares said that bitcoin may be worth more than $1 million in 7 to 10 years.

“In my (subjective) opinion those chances of succeeding are at least 50%. If Bitcoin does succeed, 1 Bitcoin may be worth more than $1 million in 7 to 10 years. That is 250 times what it is worth today (at the time of writing the price of Bitcoin is ~ $4,000),” Casares wrote.

According to Casares, a director at PayPal, investing in an emerging asset like bitcoin poses risks and it would be irresponsible for an investor to invest anything more that can be lost. But, he emphasized that it would be almost as irresponsible to not have any exposure to BTC at all.

HOW WOULD BITCOIN SUCCEED?

A strong argument can be made that bitcoin has already succeeded. It has been operating for 10 years as a purely decentralized network of miners, node operators, users, and developers that sustain the Bitcoin blockchain protocol as a whole.Casares said that if bitcoin succeeds, it would not replace reserve currencies like the U.S. dollar but rather operate on top of or alongside reserve currencies as an alternative.

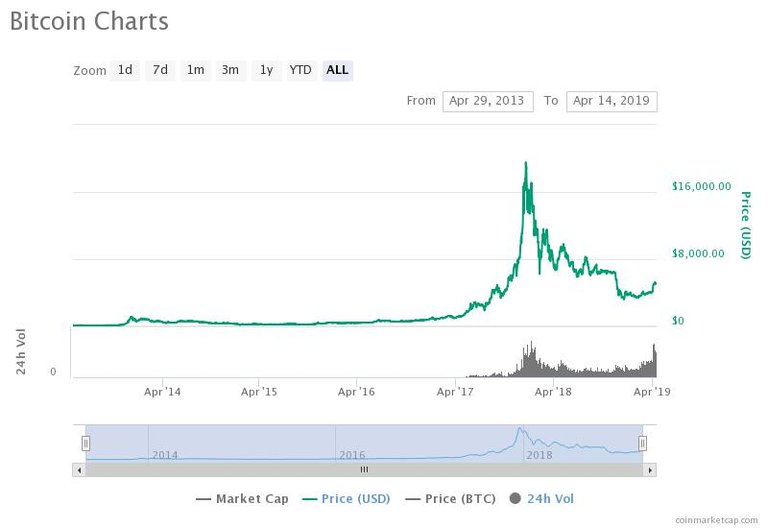

Although bitcoin experienced an 80% correction in 2018, it is still up substantially in the past several years (source: coinmarketcap.com)

“If Bitcoin succeeds it will most likely not replace any national currency. It may be a supranational currency that exists on top of all national currencies. If Bitcoin succeeds it may be a global non-political standard of value and settlement,” he said.

In regions with inefficient and expensive financial services like the Philippines, for instance, one in every ten adults are said to be utilizing cryptocurrencies such as bitcoin through exchanges and remittance applications.In consideration of the relatively high level of adoption of bitcoin globally and the rapidly rising awareness of cryptocurrencies as an emerging asset class, Casares noted that a $10 million portfolio should invest up to 1 percent in BTC.Casares explained:

I suggest that a $10 million portfolio should invest at most $100,000 in Bitcoin (up to 1% but not more as the risk of losing this investment is high). If Bitcoin fails, this portfolio will lose at most $100,000 or 1% of its value over 3 to 5 years, which most portfolios can bear. But if Bitcoin succeeds, in 7 to 10 years those $100,000 may be worth more than $25 million, more than twice the value of the entire initial portfolio.

He further added that with more than 60 million holders moving over $1 billion per day globally using bitcoin, the dominant cryptocurrency has a solid chance of succeding.

“But after 10 years of working well without interruption, with more than 60 million holders, adding more than 1 million new holders per month and moving more than $1 billion per day worldwide, it has a good chance of succeeding,” Casares added.

$1 MILLION

The $1 million bitcoin price projection of Casares comes from his observation that the bitcoin price can often be calculated by $7,000 multiplied by the number of bitcoin holders.Casares said that if the number of BTC holders increases over the long run, which would suggest an increase in the adoption of the cryptocurrency as an alternative currency, it may result in the rise in the value of the asset.

“I have noticed over time that the price of Bitcoin fluctuates around ~ $7,000 x how many people own bitcoins. So if that constant maintains and if 3 billion people ever own Bitcoin it would be worth ~ $21 trillion (~ $7,000 x 3 billion) or $1 million per Bitcoin,” he explained.

With the efforts of both existing companies in the cryptocurrency sector and newly entering financial institutions, the cryptocurrency market has shown crucial signs of maturation and growth in recent months in various areas including compliance, security, transparency, and institutionalization.Although it remains uncertain whether bitcoin could achieve a multi-trillion market cap, industry executives remain optimistic in the long-term outlook of the cryptocurrency.

Joseph Young

Hong Kong-Based Finance and Cryptocurrency Analyst. Contributing regularly to CCN and Hacked. Providing unique insights into the crypto and fintech space since 2012.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.ccn.com/one-bitcoin-could-exceed-1-million-in-7-10-years-paypal-director