By Dmytro Brovkin

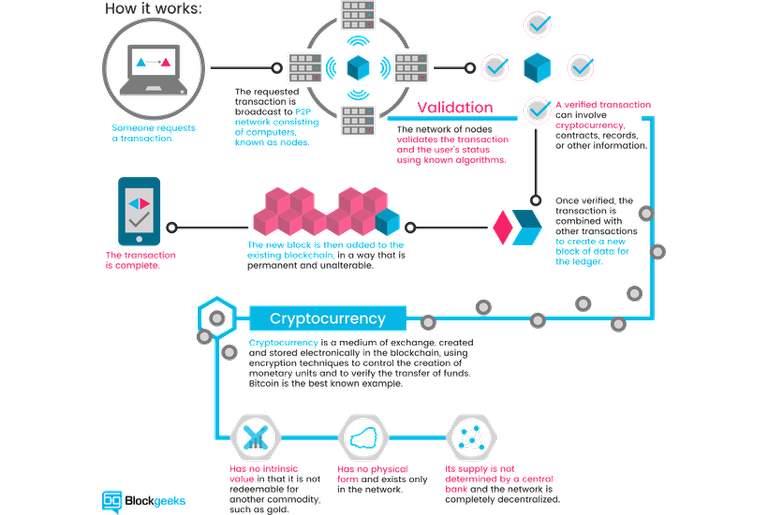

Bitcoin is the first decentralized currency in the world and it attracts more and more attention over the last couple of years. Bitcoin functions with the help of blockchain technology, which itself bases on the chain of transactions blocks. The information about those transactions updates at all devices in the world simultaneously.

The experts predict blockchain big and bright future — the technology that ensures that the authenticity of transactions can only be confirmed by the parties involved, without any middlemen or regulating parties, can confirm land and diamonds property rights and organize the communication of “smart” electronic devices.

Despite the fact that not long time ago Bitcoin was beating all anti-records and the wide use of it in the worldwide trading is still in the distant future, blockchain is gaining more and more attention from biggest banks, techno-corporations, governments and venture investors. It was in November 2015 that the combined investments in blockchain projects and Bitcoin have passed the 1$ billion mark.

Although in its early days blockchain was only attractive as a base for stable functioning of every cryptocurrency, today’s researches and new technologies tell us a completely different story: this database can be used almost everywhere, there are social networks, helpful projects of all sorts and even bank services functioning with help of block data keeping system.

It surely isn’t the limit, blockchain’s future looks bright and huge. And that future is something that a lot of people could be afraid of: blockchain can easily replace a lot of bureaucracy system workers, who are only needed to work with databases. At current rate soon comes the day when we won’t even need the people for maintaining the databases and keeping track of statistics — distributed database will be capable of maintaining itself.

So, now we know a little more about what exactly blockchain is. Now let’s get a little bit more information about Bitcoins.

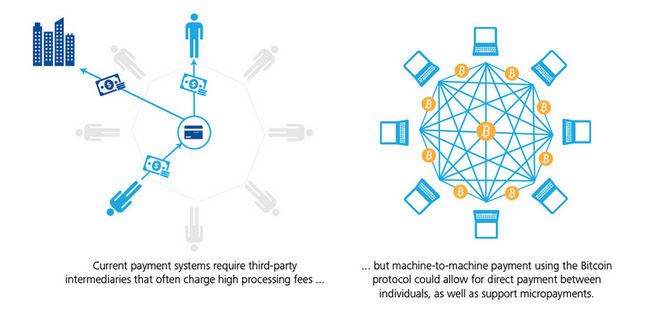

The algorithm’s developer is Satoshi Nakamoto, he has suggested the electronic payment system which bases on mathematical calculations. The point of his idea was to execute the coin exchange without any sort of centralized power, electronically, more or less instantly and with tiniest delays.

What is Bitcoin in a couple of phrases? It’s a tough task, but we tried: Bitcoin is a new generation of decentralized digital currency that only works in Internet. Nobody controls it, emission of the currency is executed through the work of millions of computers all around the world, using the program made for calculating of mathematical algorithms. That’s the point of Bitcoin.

You can also buy anything you want in Internet using Bitcoins just like you would use dollars or euros, and it trades on the stock market just as any other currency does. But the main important difference is that Bitcoin is decentralized, unlike all the other kinds of money. No organization in the whole world controls Bitcoin. Some are confused by this, because this also means that no bank can control your money.

Considering the actuality and popularity Bitcoin and blockchain, a lot of developers are asking how to develop blockchain app. First of all, let’s look at the pros of cryptocurrency wallet apps.

Transactions made easy

You often should go through hell and back to open a bank account for your company in a bank and facilitate transactions — sometimes to just get rejected without any reasoning. It isn’t a problem for Bitcoin, you’ll need 5 minutes of your time to make a Bitcoin wallet, set everything up and start using it. No questions, no additional fees.

In some countries (for example Japan and a couple of places in Europe) you can already buy something using Bitcoin — no matter if it’s a cup of coffee or a house. It’s very comfortable for all parties involved, cause the money are arriving in a matter of seconds with minimal commission charges, and the most important feature is that you don’t need a middleman for your deal: no banks and no brokers are involved, which makes transaction a lot easier.

Bitcoin really is an international currency, it’s the same anywhere you go, and it’s undoubtedly a good thing. For example, you can pay for your goods in Europe, USA or wherever else you want using only one account and not thinking about current exchange rate. Sending Bitcoin abroad is as easy, as getting it to your neighbour. No middleman-banks, who could leave you waiting for up to three working days, no excessive commissions for international transactions, no restrictions of transaction amount.

Absolutely decentralized

This currency isn’t printed and supported by the national banks, so therefore it doesn’t play on their rules. Banks can print as much money as they want to cover the holes in state budget, but it would lead to huge inflation. Bitcoin right now is free of that pressure and immense control that make a life of fiduciary money holders harder and harder.

The states are looking for further restrictions of cash circulation; meanwhile keeping your money in the bank means excessive “transparency” of every single one of your transactions to supervisory authorities, high commission charges and in some cases even restrictions of your capability to cash out on your bank deposit. At the same time, Bitcoin maintaining is free and transactions aren’t restricted by any of state and bank presets. All of that makes Bitcoin so decentralized.

That said, no control and full anonymity of the transactions make it easy target for terrorists, drug dealers and so on. That’s one of the biggest problems in making Bitcoin a legal currency, and as for now, it isn’t sorted out yet.

Unmatched safety level

Another big advantage of Bitcoin is its level of wallets and transactions security that is miles ahead of similar services of other ways to keep and transfer your money. Bitcoin-transactions are secured by the cryptography of the highest level. No one can take the money off you or make transactions from your account. As long as you take all the needed steps to secure your wallet, Bitcoin gives you full control of your money and high level of protection from different ways of scamming.

All the new entries in this base are simultaneously synchronized with all of its copies on all of the users computers. The smart algorithms of finding a consensus are working. To steal something, the thief would need to change the data of at least a half of all users, and that’s practically impossible, given how big the network is.

If you are too worried about hackers getting your data that’s been stored online, you can use another way called “cold keeping”. Bitcoin-wallets of this type are storing closed keys offline, so it’s impossible to steal them through Internet.

It’s probably the best to keep the most part of your Bitcoin budget “cold” and just transfer the needed amount to the separate address, which does have the Internet connection. So, even if you lose your phone or wipe that address off your PC, you only can lose a tiny amount of coins.

Full anonymity

The network is decentralized, so everything is absolutely anonymous. You can only track last transactions, but who got the Bitcoins and what did he do for it is impossible to define even for special services. This advantage has one obvious disadvantage: it’s illegal use of Bitcoins.

Bitcoin is fully anonymous and at the same time absolutely transparent. You can create endless amount of Bitcoin addresses without opening your name, phone number or any other personal info. But Bitcoin keeps the full history of transactions that took place every now and then, it’s called a chain of sequentially connected blocks, or blockchain that we already discussed. Blockchain knows everything.

So, if there’s a publicly used Bitcoin address, everyone can check how many Bitcoins does one have. But if one didn’t tell that this address belongs to him, no one will know his identity. Usually, if someone wants to keep everything as anonymous as possible, one Bitcoin address is used for one transaction only.

Good for stock market trading

The rocket rise of the digital currencies couldn’t stay unnoticed by professional traders, who of course decided to try to make profit. The cryptocurrencies stock markets are appearing with immense speed, Bitcoin quotations can be seen on Bloomberg, Yahoo Finances and Thomson Reuters Eikon terminals, the foundations based on digital currencies are being started and supported, Bitcoin index was put into stock market platforms ETF.

Cryptocurrencies stock markets are functioning like the standard stock markets. Experienced trader will only need to spend a little time on getting to know the unknown features to start working in the new conditions, and a beginner would risk almost as much as playing lottery. To adapt faster and avoid getting loads of losses and damages, the crypto-trading newbies should learn and understand a couple of simple and not too complicated strategies that work on every stock market that exists.

So, how to make a Bitcoin wallet app?

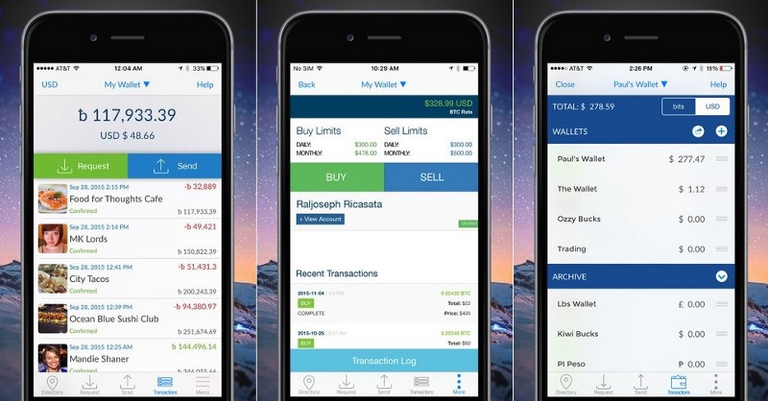

You’ll need a Bitcoin wallet to have an easy access to your Bitcoins. It can look almost whatever you want it to look like — simple sheet of paper, super technological software with loads of security functions on the Flash-medium and so on. The main function of the Bitcoin wallet is to keep secret digital keys that give you access to the Bitcoin address and obviously your money.

It’s clear that it’s very important to provide its security and make it as unbeatable as possible. Moreover, the backups are a must in this case. Technically Bitcoins aren’t even kept anywhere, Bitcoin wallets only contain secret digital keys that are needed to access public Bitcoin addresses and give you a possibility to “sign” transactions. This is exactly the information that is being kept with the help of Bitcoin wallet.

There’s a lot of forms of wallets, but they can all be divided into four categories: for PC, mobile, online and offline Bitcoin wallets. We are obviously more interested in mobile wallets.

PC wallets are quite good, but not exactly very comfortable, especially when you are outside and want to pay for something on the shop. In this case the mobile apps with wallets come to the rescue. They work like an app in your smartphone and give you the possibility to pay directly from your phone, it’s made possible by keeping the closed keys to your Bitcoin addresses right in the app. In some cases you can even use the non-contact NFC technology and pay just by touching reader, not giving anyone any of your data.

The common feature of all of those mobile wallets is that they aren’t fully functioning Bitcoin clients, so that they don’t need to download the whole blockchain, which continually gets bigger and reaches the size of multiple gigabytes. It would lead to the huge mobile traffic and our mobile operators would happily send us an equally huge receipt for it. Anyway, most mobile phones simply don’t have enough memory on board to keep the whole blockchain.

Instead of that, mobile clients are often developed with the help of such system as simplified payment verification (SPV). They download a very little amount of blocks from chain and just relay on other, reliable units of Bitcoin-network to confirm the correctness of existing data.

Bitcoin as a payment method

We hope that in the nearest future cryptocurrencies will spread around the world much wider that they are now, and people will stop seeing them as something exotic and unusual. Moreover, today they already are one of the safest (if not the safest) type of digital money.

Bitcoin nowadays is a modern digital currency that is already pretty good suited for the transactions in the web. More and more shops are taking Bitcoins as one of the options for the payment. Simplicity and convenience of opening the bank account are attracting more and more attention to this currency. And, what’s notable, it’s people from all around the world. In many Asian and African countries the Bitcoin network replaces the expensive and difficult bank maintenance.

In the most forward-minded countries the POS-terminals for Bitcoin-transactios are already getting used in the shops, just as ATMs for cryptocurrencies and hardware-powered Bitcoin wallets are. There’s a true start-up boom going on at the Bitcoin market. It’s turned out that blockchain technology can not only be used for financial calculations, but also for distributed keeping of a data of different actives. There are tens of thousands of other cryptocurrencies already, some of them are based on Bitcoin, some are absolutely independent.

The main reason why Bitcoin and other cryptocurrencies rise that fast is the big players joining the market. Investors and their foundations, international corporations, billionaires and even some governments have made it clear that they will support and start using some of those currencies and blockchain technology as a whole — it gives investors and cryptocurrency holders a huge confidence boost. The market isn’t taking Bitcoin as a joke, it’s a financial asset that is volatile, maybe hard to understand and even harder to explain, but absolutely real and functioning.

And last (but not least), if you want to get expert’s help or consultation about Bitcoin and blockchain technologies, feel absolutely free to contact us, we’ll be more than happy to answer all of your questions regarding cryptocurrencies. Use your chance to become successful!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/swlh/how-to-develop-a-blockchain-application-185bf8b7e7eb